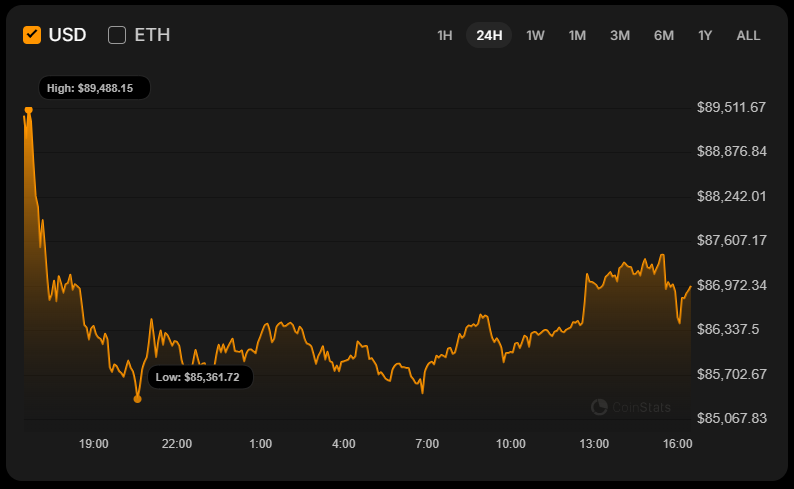

Bitcoin’s Wild Ride: Will it Soar or Crash? The $85k-$100k Mystery Unveiled!

In a thrilling twist that would make even the most seasoned roller coaster enthusiast proud, Bitcoin’s derivatives market is signaling a stable and broad range of prices-no massive moonshot or dramatic crash in sight. 🚀