My dear, the world of Bitcoin is aflutter once again! Marathon Digital Holdings, that intrepid miner, has whisked away a cool $87 million worth of Bitcoin to the arms of institutional darlings like Two Prime, BitGo, and Galaxy Digital. How utterly thrilling, and yet, how dreadfully ominous!

As Bitcoin pirouettes around $64,800 after a rather dramatic tumble, one can’t help but wonder: are the miners preparing for a grand exit? Or merely a spot of treasury rebalancing? The timing, my loves, is simply divine-or should I say, suspiciously convenient.

Marathon’s Bitcoin Waltz: A Prelude to Selling?

On the 6th of February, Marathon Digital Holdings executed a most audacious maneuver, transferring 1,318 BTC (valued at nearly $87 million) to those institutional titans. Such a move, I must say, is the financial equivalent of a raised eyebrow-a signal, perhaps, of impending sales, collateral shenanigans, or a mere treasury tweak.

The Bitcoin mining firm #MARA transferred 1,318 $BTC($86.89M) to Two Prime, BitGo, and Galaxy Digital in the past 10 hours.

– Lookonchain (@lookonchain) February 6, 2026

All this, mind you, transpired within a mere 10-hour window, while Bitcoin was languishing in the mid-$60,000 range. How delightfully dramatic!

Marathon’s Treasury: Still a Fortress of Bitcoin

Fear not, darlings, for Marathon still clutches a staggering 52,850 BTC, worth a cool $3.42 billion. They’re hardly fleeing the scene-merely adjusting their jewels, as it were. But oh, the timing! Bitcoin’s already down 10% in 24 hours, and the market’s as fragile as a debutante’s ego.

When miners start shuffling their coins during a downturn, one can’t help but anticipate a spot of turbulence. Volatility, my dears, is the name of the game.

Miners and Whales: A Selling Symphony

Ah, but it’s not just Marathon causing a stir! Bitcoin miners, poor darlings, are feeling the pinch. With mining costs soaring above $87,000 and Bitcoin trading at a mere $65,402, many are selling at a loss. CryptoQuant tells us miner reserves have dwindled to 1.806 million BTC-a clear sign of distress.

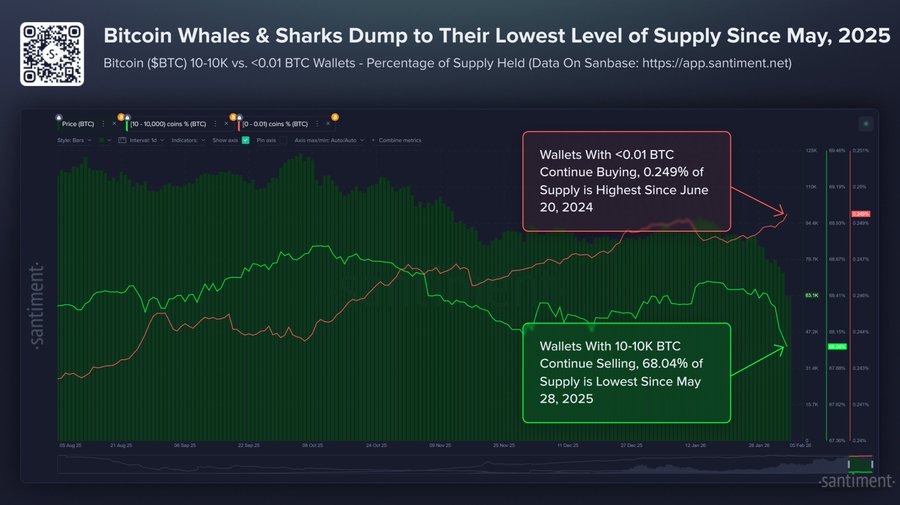

And let’s not forget the whales, those grande dames of the crypto world. Santiment reveals they’re trimming their positions too. Wallets holding 10 to 10,000 BTC now control just 68.04% of the supply-a nine-month low. They’ve offloaded 81,068 BTC in the past eight days alone. How utterly reckless!

So, my darling readers, as we sip our martinis and watch the crypto drama unfold, one must ask: Is this the beginning of a sell-off, or merely a tempest in a teacup? Only time will tell. Ta-ta for now!

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- XRP: A Most Disappointing Turn of Events! 📉

- XRP’s Wild Ride: To the Moon or Just a Bit Bouncy? 🚀

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- Pi Coin Rally Heats Up as Every Group Buys In – But a Risk Lurks Below $0.29

- Harvard’s Shocking $117M Bitcoin Bet: Is This the Future of Investing? 🤯💰

2026-02-06 08:46