The news arrived, as it always does, via a push notification that caused my phone to buzz with the urgency of a trapped hornet. A billion dollars of “open interest” in something called XRP. It sounded less like a financial instrument and more like a new show on Netflix that everyone will be talking about for a week and then completely forget. Another one of these invisible coins had elbowed its way into the crypto country club, placing it alongside Bitcoin and Ethereum, which, as far as I can tell, are just digital Beanie Babies for men who wear zip-up hoodies to shareholder meetings.

Our Heroes at the Chicago Mercantile Exchange Weigh In 🙄

The CME Group, which I imagine is run by a very serious man named Glenn who has never once laughed at a knock-knock joke, announced that their entire crypto… portfolio?.. bundle?.. menagerie?.. had surpassed thirty billion dollars. A sum so large it’s impossible to visualize unless you picture it as the number of times I’ve checked my own meager bank account this year. The real star of this deeply boring show was XRP, which apparently sprinted to the billion-dollar mark with the frantic, desperate speed of a man who just realized he left his child at a Buc-ee’s.

This “surge” is apparently due to “institutions” wanting “trusted access.” This is code for rich people, who have finally decided that the unregulated casino of cryptocurrency wasn’t quite formal enough for their tastes. They needed a casino with a dress code and a sad-looking salad bar. So now they can gamble on the future price of a thing that doesn’t exist, but in a way that is supervised by the CFTC, which I assume is another serious man named Glenn.

The Price Itself Is Having a Bad Day at the DMV

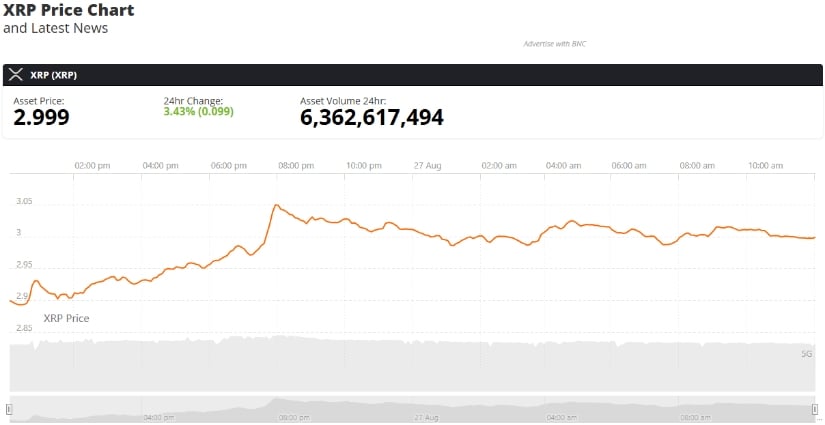

And here’s the wonderfully absurd part. While all these institutions were piling a billion dollars into bets about XRP, the actual price of XRP was doing its best impression of a soufflé in a slamming door. It fell. It rose. It “battled to stay above $3,” which sounds less like a financial analysis and more like a synopsis for a gladiator movie. One minute it’s at $2.96, the next it’s tumbling to a “critical support” level of $2.84, a phrase that suggests the token was huddled in a bunker, waiting for the artillery to stop.

It’s down for the day, down for the week, and nearly 20% below its peak, which presumably happened on a day when the collective delusion was slightly stronger. All these charts with “Bollinger Bands” and “RSI” are just fancy ways of saying, “Nobody has any idea what will happen next, but if you draw these wiggly lines, it looks like you do.”

They’re Making Credit Cards Now, Because Why Not

Not content with just existing as a volatile speculative asset, Ripple Labs is now getting into the credit card game with Gemini. An XRP credit card. I try to imagine the conversation at the dinner table. “What did you buy today, honey?” “Oh, just some groceries, and I put it on the XRP card.” The silence that follows is the true sound of the future.

This is all happening, of course, against the soothing backdrop of a relentless lawsuit with the SEC, which is the financial equivalent of trying to host a elegant garden party while your house is actively on fire.

The Eternal, Hopeful Dream of an ETF

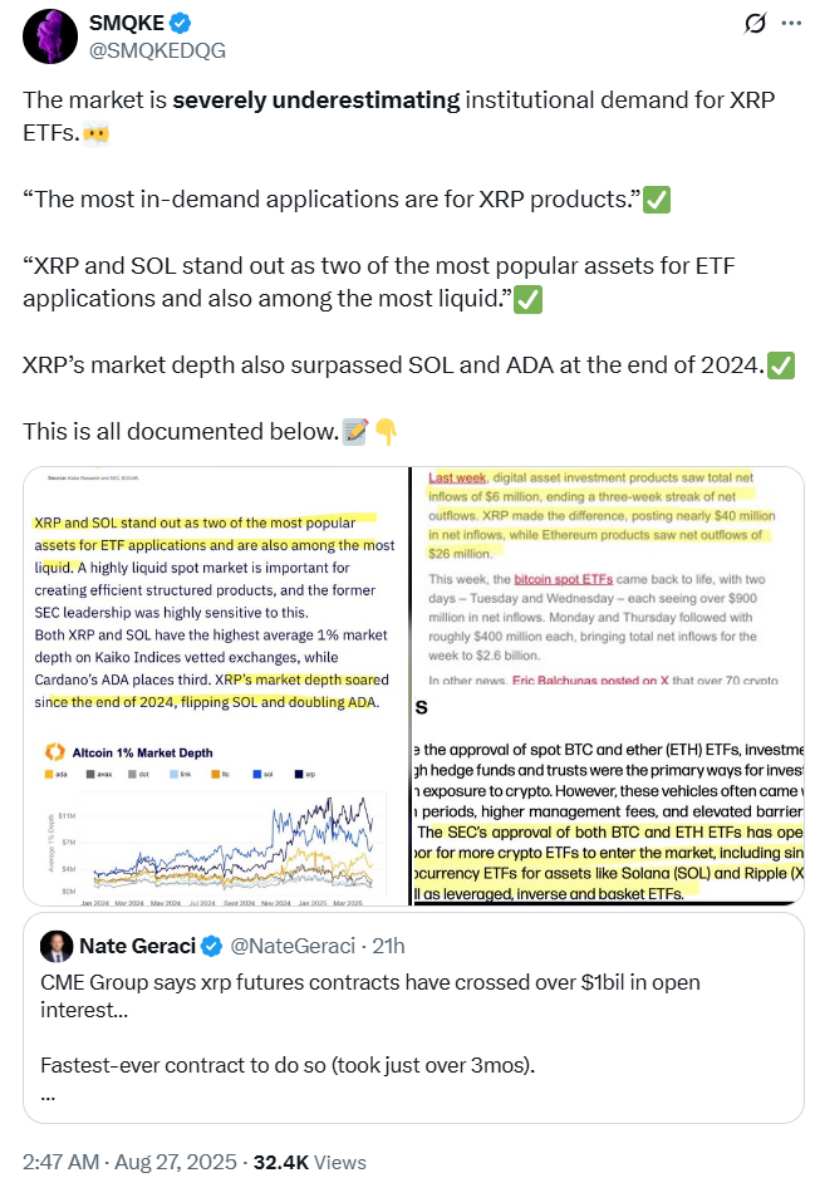

And now, the pièce de résistance: the Spot XRP ETF. This is the holy grail, the sparkling unicorn that everyone is chasing. It’s the fund that would allow people to invest in the thing without actually having to understand the thing, which is the American way.

Some guy named Nate Geraci, who is presumably the president of a firm with a name that sounds like a prescription medication, says the demand is “underestimated.” He bases this on the fact that people are already throwing nearly $800 million at futures-based ETFs, which is like betting on the future of a bet. It’s betting-ception.

So, What’s Next? 🤷♂️

Will XRP go up? Will it go down? The only thing that’s certain is that a lot of people with more money than sense are now very interested in its answer. The “long-term trajectory could remain bullish,” which is analyst-speak for “we really hope it goes up because we’ve put a lot of money into this digital ghost.”

All eyes are on the magical $3.10 level, a number that has as much inherent meaning as my high school GPA. If it breaks through, they say it could surge to $3.70. If it doesn’t, it might fall back to the price of a decent sandwich. Place your bets. Just make sure you do it on the proper exchange, under the watchful eye of a man named Glenn.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Bitcoin Signals Recession…” but then contrast with the data. Also, mention the potential upside. Let me check character count. “Bitcoin Signals Recession, But Data Says Otherwise – Bullish Opportunity Ahead?” That’s 78 characters. Maybe shorten “Bullish

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- TAO PREDICTION. TAO cryptocurrency

- Silver Rate Forecast

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

2025-08-27 23:29