Welcome, dear reader, to the US Crypto News Morning Briefing-your daily dose of cryptocurrency chaos served with a side of existential dread and a sprinkle of emojis. ☕️🌍

Grab your coffee (or perhaps something stronger, depending on how the markets are treating you today) because the world’s largest sovereign wealth fund has just made a move that could either be genius or the financial equivalent of trying to microwave a metal fork. ⚡️🍴

Crypto News of the Day: Norway’s $1.6 Trillion Behemoth Takes a Giant Leap into Bitcoin 🪙

Yes, you read that correctly. Norway’s sovereign wealth fund-managed by the ever-so-serious-sounding Norges Bank Investment Management (NBIM)-has increased its Bitcoin exposure by a whopping 83%. That’s right, an 83% leap into the wild, untamed jungle of cryptocurrency. 🦍💰

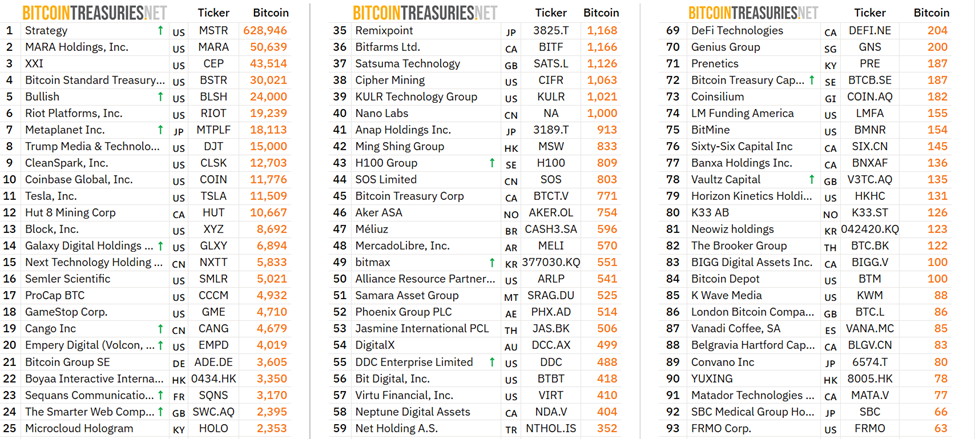

In Q2 of 2025, NBIM’s Bitcoin-equivalent holdings soared from 6,200 to 11,400 BTC. Most of this is held indirectly through shares of MicroStrategy (MSTR), the company that seems to have forgotten it’s technically a business and not just a Bitcoin fan club. Oh, and they also bought a tiny position in Japan’s Metaplanet, equivalent to 200 BTC. Because why not? 🌏✨

“I just ran my usual 13F filing spreadsheet for the BTC ETFs, MSTR, and Metaplanet… The most interesting detail, by far, this time was Norges Bank Investment Management’s buying of MSTR and Metaplanet,” said Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, in a statement. Translation: “Wow, even the boring people are getting into Bitcoin now.” 😅📊

Now, before you start imagining NBIM executives wearing neon sunglasses and dancing to EDM at a crypto conference, let’s remember that this is still a sovereign wealth fund. These are the folks who think long-term, like “how do we ensure Norway’s future generations don’t starve when the oil runs out?” So, while their Bitcoin allocation is a tiny fraction of their $1.6 trillion portfolio, it’s clearly a strategic hedge against things like currency debasement and geopolitical risks. Or maybe they just lost a bet. Who knows? 🎲🌐

This move isn’t happening in isolation. Sovereign wealth funds and pension managers worldwide are quietly tiptoeing into Bitcoin, like teenagers sneaking into a forbidden party. If this trend continues, Bitcoin might just become the financial equivalent of avocado toast-everywhere, unavoidable, and slightly overhyped. 🥑🍞

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of August 14 | Pre-Market Overview |

| Strategy (MSTR) | $372.94 | $373.23 (+0.078%) |

| Coinbase Global (COIN) | $324.89 | $325.00 (+0.034%) |

| Galaxy Digital Holdings (GLXY) | $28.57 | $28.84 (+0.95%) |

| MARA Holdings (MARA) | $15.75 | $15.77 (+0.12%) |

| Riot Platforms (RIOT) | $12.25 | $12.20 (-0.41%) |

| Core Scientific (CORZ) | $13.84 | $13.62 (-1.55%) |

So there you have it-a morning briefing that’s equal parts alarming, amusing, and utterly baffling. Stay tuned for more adventures in the cryptoverse, where the only constant is change, and the only certainty is that someone, somewhere, is probably losing their private key right now. 🔑🤷♂️

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- Vitalik Buterin Pushes Gas Futures Idea for Ethereum

- RENDER PREDICTION. RENDER cryptocurrency

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- Will Ethereum’s $5K Destiny Unravel as Whales Assert Themselves? 🐋💰

- Why Cardano’s Next Move Might Make You Say ‘Wow’ or ‘Oh No’

- Meme Coins: September’s Silent Revolution? 🤑

2025-08-15 16:35