What One Must Ponder:

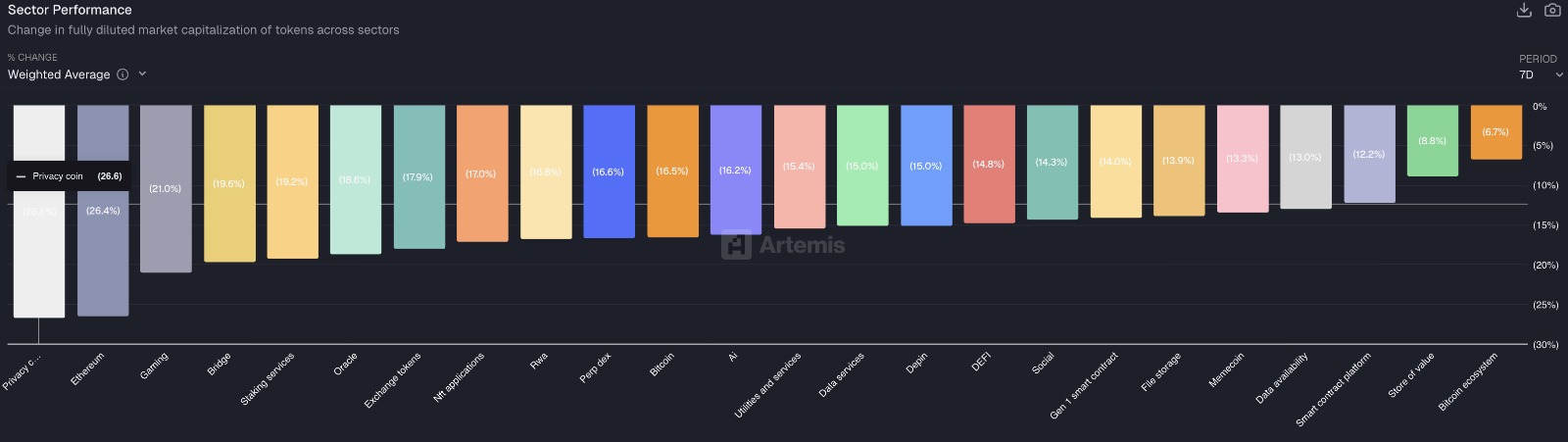

- Monero and ZCash have become the heralds of a 25% decline in their sector, all thanks to a most oppressive regulatory atmosphere and the relentless hand of exchange delistings.

- Traders seem to be abandoning their once-beloved privacy assets for the tantalizing allure of transparent, high-volatility tokens that boast rather grandiose community tales.

- Meanwhile, our dear Maxi Doge has gallantly raised over $4.57 million, attracting the attention of those great whales of the market, capturing liquidity much like a skilled fisherman snags the biggest catch.

- Unlike its more passive counterparts, $MAXI injects a bit of zest into the trading experience with competitions that would even inspire the laziest of souls to engage in spirited endeavors.

Ah, the privacy coin sector finds itself in a crisis of existential proportions!

The venerable giants, ZCash ($ZEC) and Monero ($XMR), are leading a rather unfortunate correction, erasing nearly a quarter of their segment’s value as they navigate through turbulent waters. As the broader market flounders, these privacy assets have decided to embark on a downward spiral, choked by an increasingly strict regulatory noose and a liquidity situation resembling a dried-up well.

Recent maneuvers by major centralized exchanges to unceremoniously delist privacy tokens within the EU have sent traders fleeing to what they perceive as safer shores. The very notion of ‘untraceable money’ finds itself at odds with global AML compliance, thus compelling institutional investors to make their hasty exits. However, let us not overlook the irony: privacy coins were conceived to resist censorship, yet they now find themselves in a strangling embrace from the very centralized exchanges that once cradled them.

This flight of capital has created a vacuum of liquidity. Traders forsaking the privacy sector are not necessarily retreating into stablecoins; instead, they seek high-beta assets that offer transparency and exhilarating potential for profit. The narrative has deftly shifted from ‘hiding wealth’ to ‘multiplying wealth.’

This notable rotation is funnelling volume into the high-leverage culture tokens like Maxi Doge ($MAXI), which seems to have captured the market’s imagination.

Maxi Doge: The “Leverage King” Strikes Back

As ZCash struggles to carve out its relevance in this unforgiving world of compliance, Maxi Doge boldly embraces the current market mindset: aggressive conviction is the name of the game.

Positioned proudly as the ‘Leverage King,’ $MAXI is far from just another canine derivative. Nay, it is a utility token crafted specifically for those daring souls who thrive on high-octane trading. This project distinguishes itself by gamifying the entire experience. Instead of languishing in passive privacy, Maxi Doge demands spirited participation through holder-only trading competitions.

Such innovation addresses a real quandary for retail traders, often lacking the capital needed to make substantial gains. By fostering a ‘gym-bro’ culture around the mantra ‘never skip a pump,’ the project taps into the adrenaline rush that accompanies 100x leverage trading, enveloping it in a vibrant community ecosystem.

This transformation from technological obscurity to culturally resonant transparency is manifesting on-chain. The wise and savvy capital is casting its vote with palpable enthusiasm.

Whales appear convinced that the ‘lift, trade, repeat’ narrative will race ahead of the languishing privacy sector.

For further enlightenment regarding Maxi Doge, kindly delve deeper.

Presale Data: A Shifting Landscape of Retail Sentiment

The stark contrast between the bleeding privacy sector and the inflows towards Maxi Doge underscores a rather simple truth: liquidity dances to the tune of narrative.

As Monero grapples with regulatory delistings, $MAXI has secured a commendable influx of early-stage capital, demonstrating the market’s voracious appetite for its ‘meme-first, utility-second’ hybrid model.

According to the official presale page, Maxi Doge has impressively raised $4.5 million thus far. This figure signifies a genuine interest in high-risk, high-reward environments.

With tokens priced at a mere $0.0002802, early adopters are seizing the opportunity before the token graces public exchanges.

The project’s tokenomics are crafted to sustain this momentum. A dynamic APY staking mechanism bestows daily rewards from a 5% allocation pool, encouraging holders to lock their supply for up to one year. This effectively reduces circulating supply while simultaneously expanding the community.

Furthermore, the Maxi Fund treasury bolsters the ecosystem by providing essential liquidity for partnerships and future listings upon various exchanges.

In a market wherein ZCash is losing its utility to compliance conundrums, $MAXI extends a clearly marked path for speculation and engaging interaction.

Do consider purchasing your $MAXI here.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- DeFi’s Wild Ride: From Yield Fever to Utility Sanity 🤠💰

- Whizz-Pang: The 75/25 Crypto ETF Circus Hits the S&P

- BTC’s $93k Gamble: A Bull Cycle’s Last Dance 🐆💸

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

2026-02-05 17:29