Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead. 🌟

Grab a coffee, dear reader, and let us delve into the labyrinthine corridors of global finance, where the US is venturing into the murky waters of stablecoins, amidst a grandiose attempt at monetary engineering to weaken the dollar. Max Keiser, ever the sage of the digital realm, perceives Bitcoin playing a rather unconventional role in this drama.

Crypto News of the Day: Bitcoin, the Knight in Shining Armor, or the Harbinger of Fiat’s Demise?

The bone of contention, rate cuts, continues to gnaw at the heart of the US, with Fed chair Jerome Powell steadfastly resisting the tempestuous political pressure from President Trump, as reported in a recent US Crypto News publication.

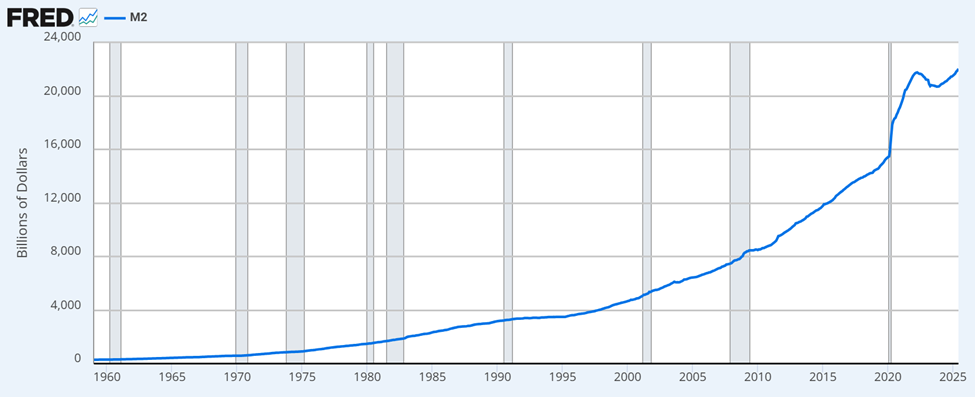

While Powell remains a pillar of resistance against the pressure to cut interest rates, the M2 money supply is expanding, albeit at a pace that leaves much to be desired.

Bitcoin’s patriarch, Max Keiser, opines that a sufficiently rapid expansion of the M2 money supply could serve to debase the dollar, a scenario that aligns perfectly with Trump’s aspirations for bolstering exports. 🚀

According to Keiser, the President is leveraging stablecoins to double the M2 money supply, a move that he foresees as a harbinger of economic transformation.

“Your USD purchasing power is about to get cut in half,” he declared in a recent post, a prophecy as ominous as it is intriguing. 😱

In a development that echoes the sentiments expressed in a recent US Crypto News publication, Keiser noted that issuers of stablecoins are amassing Bitcoin at an unprecedented rate.

BeInCrypto reached out to Max Keiser for deeper insights. In his characteristic eloquence, the Bitcoin visionary posited that Bitcoin has transcended its status as a mere speculative asset. It now stands as a formidable hedge against the specter of sovereign default and the impending collapse of the fiat system.

“Bitcoin has always been the equivalent of a CDS (Credit Default Swap) on the 400 trillion, global, fiat money Ponzi scheme that is now imploding as demand for securities like US Treasuries continues to radically shrink,” Keiser confided to BeInCrypto.

Keiser further suggests that Trump’s enthusiasm for stablecoins will face a stern test, as the demand for treasuries, which the President anticipates will surge due to stablecoins, fails to materialize. 🤷♂️

Chart of the Day

Byte-Sized Alpha

Crypto Equities Pre-Market Overview

| Company | At the Close of July 28 | Pre-Market Overview |

| Strategy (MSTR) | $403.80 | $408.50 (+1.16%) |

| Coinbase Global (COIN) | $379.49 | $381.40 (+0.505) |

| Galaxy Digital Holdings (GLXY) | $29.60 | $30.05 (+1.52%) |

| MARA Holdings (MARA) | $17.16 | $17.34 (+1.05%) |

| Riot Platforms (RIOT) | $14.51 | $14.57 (+0.41%) |

| Core Scientific (CORZ) | $13.75 | $13.75 (+0.036%) |

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- TAO PREDICTION. TAO cryptocurrency

- Silver Rate Forecast

- XRP Staking: A Tale of Tension and Tokens 🚀

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- Larry David on Pakistan & Kyrgyzstan’s Crypto Love Affair 🤦♂️

- Bitcoin’s Dramatic Fall Puts Strategy’s Holdings in Crisis Mode! What Happens Next?

2025-07-29 17:44