Oh, London! Once the dazzling belle of the financial ball, now finds herself slumped in the corner like an overcooked Yorkshire pudding. Her IPO market has hit a 30-year low, while across the pond, New York dances gleefully to the tune of crypto and AI listings.

Ah, how the mighty have fallen-or rather, shuffled off to sip tea in obscurity. The global capital stage has been rearranged, with new-economy sectors opting for Broadway over Buckingham Palace. Truly, it’s a tale of two cities: one thriving on innovation, the other reminiscing about its glory days like an aging aristocrat clinging to their monocle. 👑📉

A Historic Low That’s Not Quite “Keep Calm and Carry On”

According to Barchart (who must be having a field day), London raised a paltry £160 million ($215 million) across five deals in H1 2025. Yes, you read that correctly-five deals. This is the lowest figure since Britpop ruled the airwaves and people still used landlines. 🎤📞

London Has Fallen

London’s IPO market plunges to its worst level in AT LEAST 30 years

– Barchart (@Barchart) August 22, 2025

Indeed, the city’s star has dimmed so significantly that even Big Ben seems to chime less enthusiastically. Deal volumes? Collapsed. Valuations? Practically nonexistent. It’s enough to make one wonder if Brexit was less of a fresh start and more of a self-inflicted exile from prosperity. 🚪💸

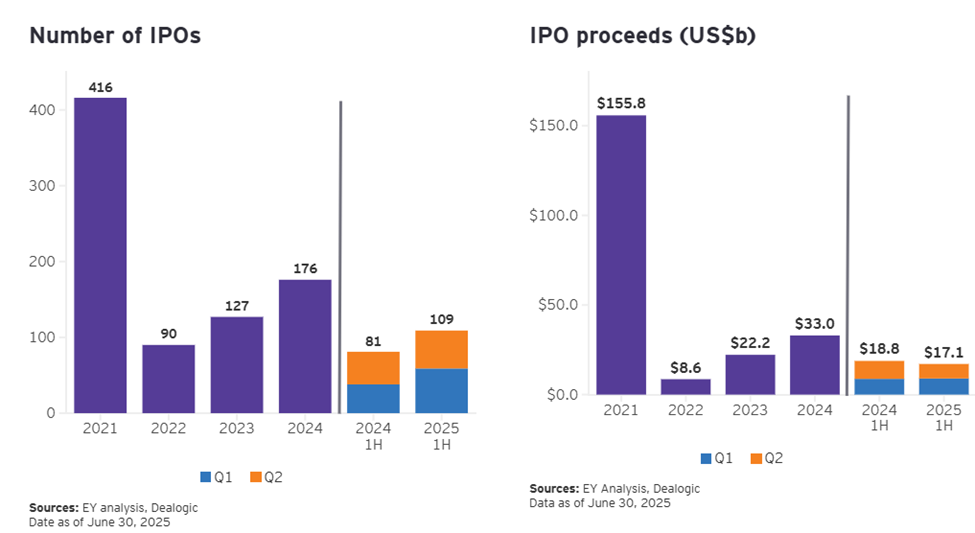

Meanwhile, American exchanges are throwing confetti at $28.3 billion raised through 156 listings in the same period. London’s numbers look positively Dickensian by comparison. Oliver Twist could’ve asked for more gruel and still outperformed this performance. 🥣📉

And let us not forget June’s parade of IPO triumphs. Nine companies raised over $50 million each, including some real headline-grabbers. Circle Internet Group, darling of the stablecoin world, saw its stock price soar 336%. If only British trains ran half as fast. 🚄💫

“Circle’s stock price has quadrupled its initial offer-an extraordinary moment,” said Anil Oncu, CEO of Bitpace. One might say it’s the financial equivalent of finding Narnia in your wardrobe. ✨📚

Crypto and Capital: A Match Made in Manhattan

The divergence between London’s stagnation and America’s exuberance reveals deeper truths about global finance. Since Brexit, London has struggled to maintain relevance, while New York struts around like Gatsby at his own party. 🎉🎩

“Half of the top 10 IPOs in Q2 took place in June,” noted EY’s Rachel Gerring. Clearly, Wall Street knows how to save the best for last-even amidst tariffs and geopolitical drama worthy of a Shakespearean tragedy. 🎭⚔️

As Asian crypto firms eye US markets and European startups pack their bags for greener pastures, London risks becoming the forgotten cousin at the family reunion. Unless drastic reforms are made, the city may find itself relegated to hosting museum exhibits about its former greatness. 🖼️🕰️

In conclusion, dear reader, the moral of this story is simple: adapt or perish. For every Circle or Bullish making waves in New York, there’s a London firm quietly wondering where it all went wrong. Let us hope they find inspiration before the curtain falls entirely. 🎭💔

Read More

- Brent Oil Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Cronos Rises as Crypto Markets Crumble! 💸📉

- HBAR: $32 Million Hangs in the Balance! 😲

- DOGE PREDICTION. DOGE cryptocurrency

2025-08-22 18:40