Oh, the M2 global money supply, a most fickle mistress, whose whims have long been mirrored by the price of LINK! 🧙♂️💸 Behold, the chart shared by the enigmatic analyst Bull Bear Spot (@m2globalmoney) reveals a structural similarity to previous parabolic phases—like a drunken nobleman stumbling through a ballroom. 🕺

At the time of writing, LINK is trading at $18.39, with a 1.16% daily gain—though one might argue it’s merely the ghost of bullish momentum whispering in the ears of traders. 🦄 The model, a most cunning alchemist, suggests that if the current structure holds, global capital flows could drive LINK toward the $60 region, where dreams are as plentiful as socks in a laundromat. 🧵

Chainlink Mirrors M2 Liquidity Trend in Bullish Formation

The visual overlay of Chainlink price against the M2 global liquidity curve shows a strong historical correlation, with each major LINK rally coinciding with surges in global money supply. The yellow trendline—used by Bull Bear Spot to represent M2 growth—shows a rising trajectory beginning near the $6–$9 accumulation zone and extending sharply upward through the current price range. A tale of liquidity-fueled expansion, where the price dances to the tune of global capital flows! 🐍

This divergence indicates that Chainlink may be entering a liquidity-fueled expansion phase, with the price structure echoing early-cycle behavior from previous bull markets. A most peculiar phenomenon, akin to a peasant suddenly acquiring a crown! 👑

From a technical standpoint, LINK has recently completed a multi-month rounding base and is now forming higher highs and higher lows—a hallmark of emerging bullish trends. The chart’s structure, combined with this liquidity model, suggests that a breakout above the $20 psychological level would confirm the beginning of an acceleration phase. A most thrilling prospect, like a fox chasing a hare through a snowstorm! 🐺

Analysts using macro overlays see the alignment between the current pattern and past cycles as supportive of long-term upside, with key milestones projected at $32, $44, and $60 if liquidity dynamics remain favorable. A prophecy as clear as a mud pie, yet no one dares to question it! 🧙♂️

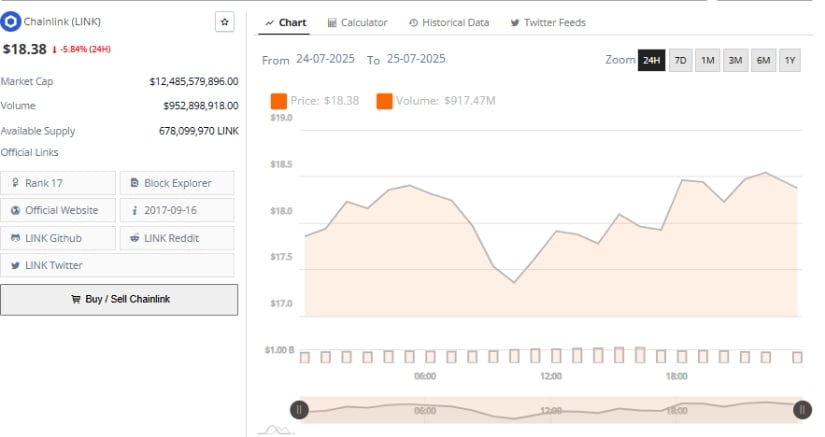

Intraday Volatility Signals Accumulation Zone Near $18

The 24-hour chart for LINK shows a turbulent session characterized by sharp swings. The price opened near $17.60, surged above $18.40, and then sharply dropped back to $17.50 mid-morning, likely driven by short-term profit-taking. A dance of chaos, yet the higher lows suggest accumulation at intraday dips. A most curious ballet of greed and fear! 🕺

This trough was followed by a gradual recovery throughout the day, with LINK reclaiming the $18.30–$18.40 level by session close. Despite ending the day with a 5.84% loss, the sequence of higher lows suggests accumulation at intraday dips. A tale of resilience, like a stubborn mule in a desert! 🐴

Volume for the session totaled $917.47 million, reflecting high liquidity, although the lack of major spikes during the recovery phase hints at cautious optimism rather than aggressive buying. A most timid celebration, like a mouse nibbling a cake! 🐭

With a market cap of $12.48 billion and a circulating supply of 678 million LINK, the token remains one of the most actively traded mid-to-large-cap assets. Resistance at $18.80 continues to be a short-term ceiling. A most stubborn wall, like a drunkard refusing to fall! 🧍♂️

Indicators Point to Strength as $19.53 Becomes Pivotal

On the daily timeframe, LINK has recently tested and briefly reclaimed the $19.53 resistance—now acting as a pivotal level. A gatekeeper of destiny, much like a tsar’s advisor with a penchant for riddles! 🧙♂️

Maintaining support above this threshold is seen as essential for continuation toward higher resistance zones, notably $22.00 and $26.40. The chart shows a well-formed uptrend with clean breakout attempts, aligning with bullish momentum signals across multiple indicators. A most promising omen, like a crow cawing at dawn! 🦉

The MACD line at 1.37 remains above the signal line at 1.16, and the histogram reads a positive 0.22, indicating that bullish momentum is intact, though not yet accelerating. Meanwhile, the Chaikin Money Flow (CMF) stands at +0.20, a strong signal of continued capital inflow. A most curious dance of numbers, like a jester juggling apples! 🍎

If LINK maintains this support while volume builds, the breakout above $20 could trigger a sharp rally, validating the $60 target proposed by the M2 liquidity overlay. Consolidation below $19.50 may delay this move, but the broader structure remains technically sound. A tale of patience, like a farmer waiting for the harvest! 🌾

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Is Dogwifhat’s $1.15 Dream Still Alive? 🐶💰

- Bitcoin Signals Recession…” but then contrast with the data. Also, mention the potential upside. Let me check character count. “Bitcoin Signals Recession, But Data Says Otherwise – Bullish Opportunity Ahead?” That’s 78 characters. Maybe shorten “Bullish

- Tether’s U.S. Debut: Trump’s GENIUS Act & a Stablecoin Saga 🤖💸

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

2025-07-25 21:24