Well, butter my biscuit and call me confused-Kanye West, the man who once declared himself a god, has now anointed himself the high priest of memecoins. In a move that surprised absolutely no one, Ye (or whatever he’s calling himself this week) launched his very own cryptocurrency, YZY, on the Solana blockchain. Because what the world needs more of is a volatile digital token backed by the financial acumen of a man who once wore a “White Lives Matter” shirt to fashion week. 🌈🤡

YZY: The Rollercoaster That Only Goes Down

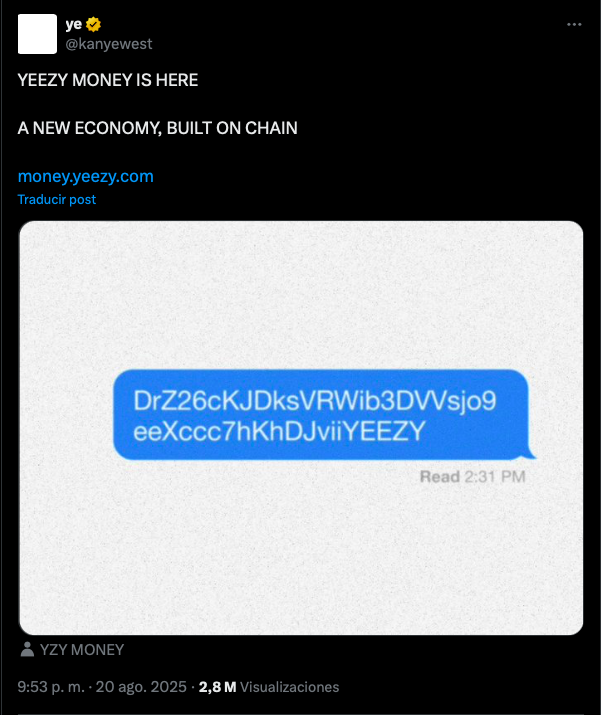

On a fateful Wednesday night, Ye took to his X account (formerly Twitter, but who’s keeping track?) to announce the arrival of “YEEZY MONEY.” He posted a picture of the contract address with the caption, “YEEZY MONEY IS HERE. A NEW ECONOMY, BUILT ON CHAIN.” Because nothing says “financial stability” like a meme-based currency launched by a man who once tried to run for president. 🏛️💸

The token initially skyrocketed to a market cap of $3.1 billion, which is roughly the amount of money Kanye owes in legal fees and divorce settlements. But, like a fart in a crowded elevator, the excitement didn’t last. Within hours, YZY plummeted 65%, leaving investors with the financial equivalent of a participation trophy. 🎢💨

The crypto community, ever vigilant and slightly masochistic, quickly spotted red flags. Allegations of insider trading? Check. A lawsuit waiver that reads like a mafia protection racket? Double check. The official website includes a clause stating that by buying the token, you agree not to sue the “Covered Parties” (read: Kanye and his buddies) for anything. One investor aptly noted, “if you’re buying this ur literally giving them permission to rug you without consequences.” 🧨📜

But fear not! Investors can opt out of this financial straitjacket by sending a written notice within 30 days. Because nothing says “trust us” like a waiver that requires a certified letter and a sacrifice to the gods of bureaucracy. 📬🙄

Insiders: The Real Winners (As Usual)

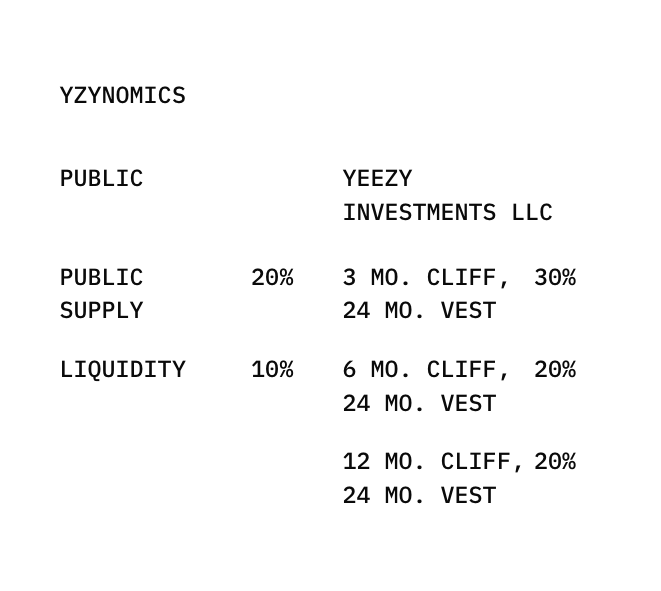

Conor Grogan, director at Coinbase, estimated that 94% of the token supply was owned by insiders. Shocking, I know. It’s almost as if Kanye and his team planned this whole thing while sipping champagne in a marble-clad boardroom. One wallet alone held 87% of the tokens before distributing them like party favors at a toddler’s birthday. 🎁🤑

According to the “YZYNOMICS” (yes, that’s a real thing), 20% of the tokens were for public supply, 10% for liquidity, and 70% for Yeezy Investments LLC. Because nothing says “fair distribution” like giving the majority to the guy who once claimed he was $53 million in debt. 📊💰

On-chain analytics firm Bubblemaps confirmed that the distribution matched Kanye’s website, but warned that the “public supply” could be sold at any time. Lookonchain added that only YZY was added to the liquidity pool, with no USDC, meaning the developers could pull the rug at any moment. Because nothing screams “trust” like a liquidity pool that’s essentially a black hole. 🕳️🚀

Meanwhile, Kanye added 30 million YZY (worth $34 million) to the liquidity pool with a price range of $3.17-$4.49. Once the price hits $3.17, he’ll start earning fees while selling YZY for USDC. If it reaches $4.49, all 30 million tokens will be dumped. It’s like a game of financial Jenga, but everyone loses. 🧱💥

Investors: Seeing Red (And Not the Good Kind)

On-chain researcher Defioasis revealed that most wallets holding YZY are in the red. Out of 56,050 addresses, 60% are losing money. One poor soul lost over $1 million, while another is down half a million. It’s like a charity event, but instead of helping the needy, you’re lining Kanye’s pockets. 🤡💸

Only 1.31% of wallets had profits exceeding $10,000, and among those, just five had over $1 million. One of them? An insider, of course. Because in Kanye’s crypto circus, the clowns are the only ones laughing. 🎪😂

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- ETH PREDICTION. ETH cryptocurrency

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- XRP Staking: A Tale of Tension and Tokens 🚀

- SHIB Price Drama: Will Shiba Inu Rise from the Ashes or Plummet into Oblivion?

2025-08-22 07:32