Well, well, well, ladies and gentlemen! While the illustrious gold has been doing a fine job of twinkling through 2025, a rather intriguing turn of events has caught the eye of the financial world: silver, that humble little metal, might just steal the show. Yes, you heard it correctly, silver is predicted to soar past $50 per ounce by the year’s end. Why, you ask? Well, the forces of industrial demand and a healthy dose of economic jitters are behind this meteoric rise.

Silver Bulls Roar: $50 Target in Sight as 2025 Precious Metal Trends Heat Up

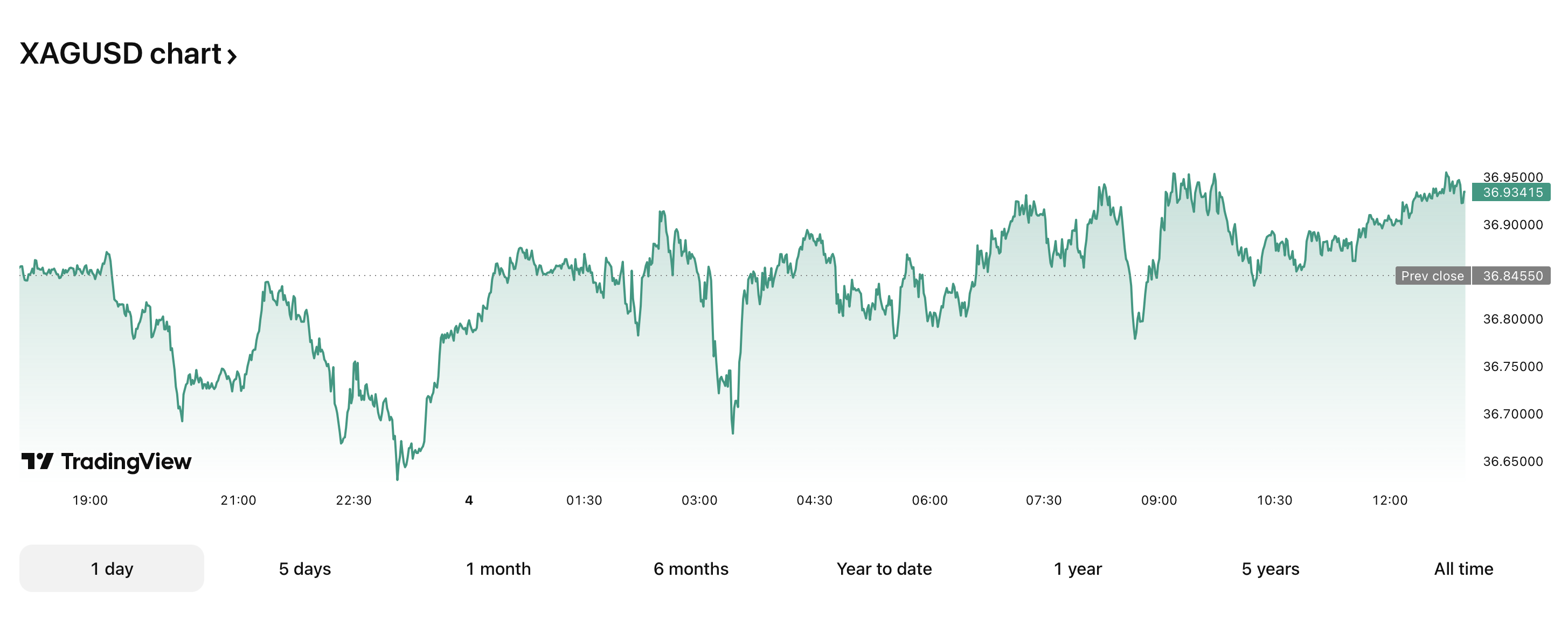

Currently, silver is happily trading between $36 and $37 per ounce in early July 2025, according to the latest numbers from the ever-reliable JM Bullion, Tradingeconomics, and Tradingview. For those of you who follow the shiny stuff, this range looks less like a leisurely stroll and more like the calm before a mighty storm of profits.

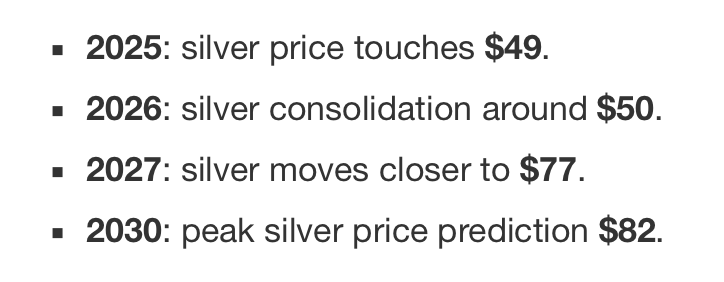

This weekend, the boldest of predictions came from none other than Investinghaven. Yes, they’ve put their crystal ball to work and are calling for a potential target of $48.20 to $50.25 per ounce by December 2025. That’s a nearly 40% jump, my friends, which could land silver right back at the top of its all-time high. Fancy that! 💥

And don’t just take Investinghaven’s word for it! Other financial bigwigs are also putting silver on their radar, though some are taking a more conservative approach. Coinpriceforecast, for example, pegs silver at $42.78 by year’s end, while Just2Trade is a tad more cautious at $42.44 per ounce.

For those of you with a love for all things measured and prudent, a slew of predictions hovers around the $40 mark. Citigroup, Saxo Bank, and the ever-astute Alan Hibbard from Goldsilver are all forecasting a more tempered rise. Meanwhile, Priceprediction.net is the party pooper, expecting a modest $38.87 by December.

The spread, from a humble $38.87 to a boisterous $50.25, just goes to show the wonderful unpredictability of the market. But still, the general consensus is this: upward momentum seems all but assured. 🤞

Why the optimism, you ask? Simple—industrial demand is going through the roof, especially from solar panel manufacturers and electric vehicle producers, who are keen on snapping up silver as if it were the last biscuit at a tea party.

To add a little more fuel to the silver fire, tight supply conditions and a good dose of economic uncertainty are making investors turn their heads toward silver as a safe-haven asset. Inflation and global political unrest are just the cherry on top for those looking to hedge their bets.

Investinghaven’s predictions aren’t based on mere whimsy—they rely on years of market research, blending technical analysis with real-world supply-and-demand trends. The result? A forecast that has the potential to make even the most hardened market skeptic raise an eyebrow. 👀

Silver, you see, has a bit of a reputation for holding strong when the going gets tough. Just look back to 2020, when it rallied a staggering 47% amid global chaos. Could history repeat itself as military tensions flare? Time will tell.

So, while the $50.25 forecast is the highest on the board, the general mood seems to be one of excitement. Silver appears to be headed for greener pastures as we wrap up 2025, with real-world demand and economic pressures likely pushing it to new heights. Who knew the humble little metal could cause such a stir?

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- 🚀 BNB Soars to the Moon While Crypto Market Faceplants! 🌕💸

- XRP Staking: A Tale of Tension and Tokens 🚀

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

2025-07-06 22:58