Yesterday, Ethereum slipped again below two thousand dollars, a drop small enough to be a slip of a thumb, yet large enough to cause a ripple in the heart of the crypto market. The atmosphere, much like a quiet Moscow evening, became defensive: no one dared to set the hedge to a steep high, but that does not mean market participants were sober. The retreat was unhurried, a patient shuffle, as the price drooped there quietly while orders faded almost as if the trader’s ledger was tired.

The underlying weariness had been told in whispers long before the price fell. Spot demand has stalled at resistance. Large holders, those silent protagonists of the blockchain theatre, began moving their coins to exchanges, as if an actor steps off the stage prematurely to take a coffee break. Derivative positions drifted towards the wing of the bearish dream. When Ethereum finally broke below support, it should have felt like a weather report: “breeze down here.” It was, but the market had already sighed ready for that announcement.

Large Holder Deposit Raises Sell‑Side Liquidity

On‑chain data reveals that Mr. Garrett Jin, the quiet older gentleman, has moved approximately 261,024 ETH (about 545 million dollars) to Binance. An exchange deposit for a trader with an eye on the ledger can hint at a subtle instinct: more supply emboldens speculation about hedging or distribution. The timing was impeccable: the transfer slipped in as ETH simply could not hold its ground between 2,100 and 2,200 dollars, and soon after, the bids at the street market grew feeble.

BREAKING: OG WHALE, GARRETT JIN, DUMPING HIS CRYPTO AHEAD OF TRUMP’S SPEECH TODAY – HE JUST DUMPED 350 MILLION DOLLARS OF BTC AND 545 MILLION DOLLARS OF ETH. WHAT IS GOING ON??

– ardizor (@ardizor) February 15, 2026

After the deposit, Ethereum never dipped sharply, but its ascent after each lull veered off course. This is the mundane drama of distribution: anticipation erodes the hope of triumph, the market’s stage is already reshuffled.

On‑Chain Metrics Show Cooling Demand and Active Selling

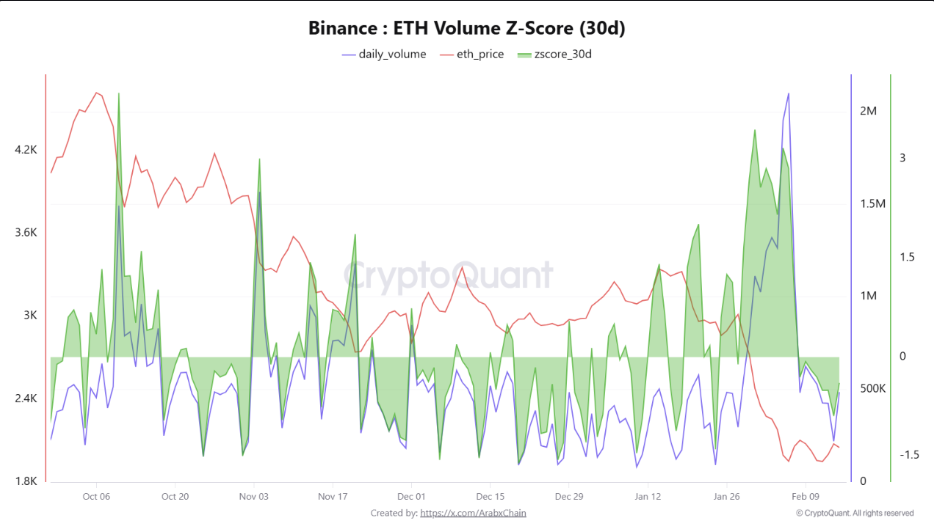

On‑chain activity reveals a cooling of conviction rather than a vicious panic. Binance data shows daily volume near 486,000 ETH, and the 30‑day volume Z‑score sits around −0.39. A negative score is a polite reminder that trading is below its monthly average.

Historically, such a condition unfolds during consolidation or redistribution. In human terms, fewer bold prowlers step onto the market’s stage; they’re reluctant to defend the support points. Instead of surrendering outright, Ethereum drifts lower as the audience dwindles – a quiet prelude to a larger act when liquidity reshapes the scene.

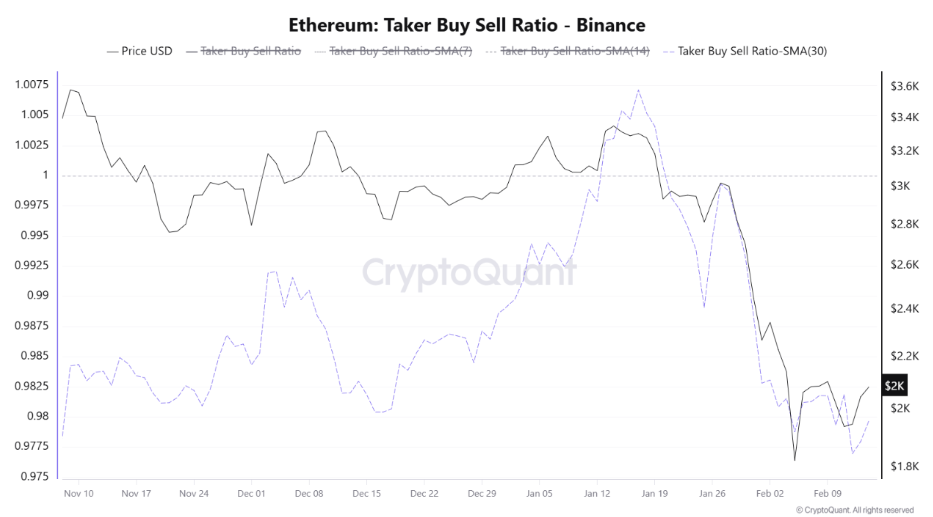

The taker buy/sell ratio has slid to 0.97, its lowest in months. For those who have not studied the books of supply and demand, a number below 1 is no longer: sellers are openly attacking bids rather than waiting. Derivatives traders, the loudspeakers in the market, often lead the rally; when their volume turns bearish, they jostle the knives, choking surface attempts for a straight up run.

Ethereum Price Structure Shows Post‑Breakdown Consolidation: What’s Next?

The recent sessions hold a subtle doorway, a sideways dance after Ethereum shed its previous range support of 2,500 dollars. No steep decline followed; rather, the price slipped into a narrow band below 2,000. The former support zone, shockingly, has become an overture of supply. Each disguised revival pushes into that corridor and stalls-like unwelcome customers leaving a crowded café. The realization that the market sits at a lower value persists through multiple sessions; the quiet chorus does not plead for a higher ED (equity debt).

Ethereum’s short‑term moving averages behave like a stoic guard above the price, holding the situation at bay. Volatility contracts, a sign that equilibrium is forming, rather than a continuing wave of change. If the price finally rebounds past 2,080 dollars, the story might turn a new chapter. But a slide below 1,800 could usher in a descend toward 1,500 in the near future.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- Dogecoin’s Dashing Cup-and-Handle: Is $0.25 the New $10? You Won’t Believe It!

- Vitalik Buterin Pushes Gas Futures Idea for Ethereum

- Meme Coins: September’s Silent Revolution? 🤑

- NYC Election Drama: Million-Dollar Bets, Big Losers & Market Shenanigans! 😂💸

- Will Ethereum’s $5K Destiny Unravel as Whales Assert Themselves? 🐋💰

2026-02-16 10:47