Oh, the joys of crypto investing! 🎉 An inverted head and shoulders pattern, coupled with a neckline breach, has positioned the token for potential upside movement. While the broader market remains cautiously optimistic, WIF’s structure suggests buyers are gradually gaining control. Attention is now turning to the $1.00 zone and beyond. Fingers crossed! 🤞

Inverted Head and Shoulders Breakout Sets Bullish Structure

Analyst Crypto Joe, the self-proclaimed guru of all things crypto, shared a 1-hour chart of WIF/USDT, highlighting an inverted head and shoulders pattern — a classical reversal formation typically appearing after prolonged downtrends. The neckline, positioned between $0.89 and $0.90, has been broken, confirming the pattern’s validity. WIF is currently trading around $0.924, indicating bullish continuation following the breakout. Or so we hope! 🙏

The setup is further reinforced by a surge in volume coinciding with the neckline break, an essential component for confirming structural shifts. In addition, WIF remains above the 200-period moving average ($0.828) on the 1-hour timeframe, signaling strong upward momentum. But let’s not get too excited just yet! 🤓

Crypto Joe has placed a technical target at $1.15, based on the measured move method. This target projects the vertical distance from the pattern’s head to its neckline, applied upward from the breakout point. However, the pattern’s sustainability hinges on WIF maintaining support above $0.89. Fingers crossed, toes crossed, and maybe even a little prayer wouldn’t hurt! 🙏🙏🙏

Short-Term Pullback Emerges After Failed Breakout

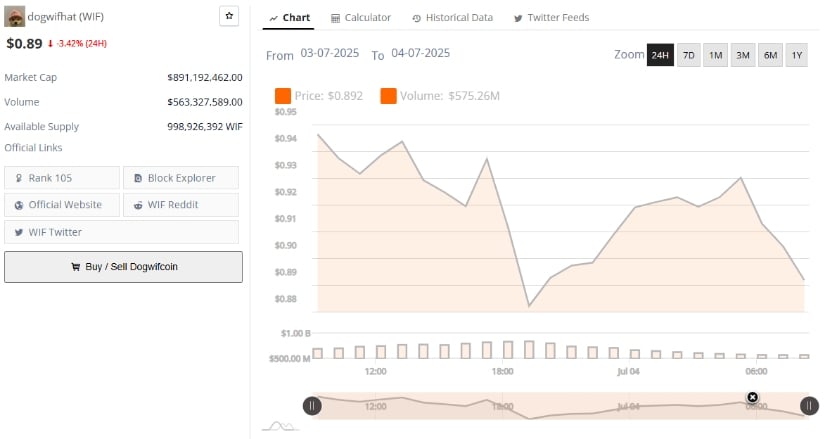

The 24-hour chart from July 3 to July 4, 2025, shows WIF undergoing a brief period of weakness despite the earlier bullish setup. After opening the session near $0.942, the token experienced a series of lower highs before falling to an intraday low around $0.880. A failed breakout attempt near $0.928 marked the turning point, leading to a retracement that closed the day at $0.89, resulting in a 3.42% loss over the period. Ouch! 😬

Volume analysis reflects reduced conviction. While trading activity spiked during the initial upward push, it declined steadily during the sell-off, closing at $563.3 million. This pattern suggests diminishing enthusiasm among both buyers and sellers, possibly leading to near-term consolidation. Maybe it’s time for a little break, WIF? 🛀

WIF’s market capitalization now stands at $891 million, with a circulating supply of approximately 999 million tokens. The psychological support at $0.89 remains critical, and any failure to reclaim levels above $0.93 may delay bullish continuation. Keep your eyes peeled! 👀

Indicators Present Mixed Momentum at the Time of Writing

As of July 4, 2025, Dogwifhat is trading at $0.892, down 3.36% over the last 24 hours. The daily chart shows consolidation within a horizontal range of $0.88 to $0.94, with repeated failures to break above the upper boundary. Price movement has been characterized by small-bodied candles and a lack of volume-driven breakouts, indicating limited commitment from traders in either direction. It’s like a game of chicken, and no one wants to blink first! 🐔

The Chaikin Money Flow (CMF 20) reads -0.01, suggesting a slight capital outflow. While not strongly negative, it reflects a cautious stance among larger participants. At the same time, the Bull and Bear Power (BBP 13) has turned positive at +0.127, marking a shift in short-term strength toward the bulls. This divergence between CMF and BBP suggests that while some buyers are becoming active, broader confirmation is still lacking. Sustained alignment between both indicators, along with a close above $0.94, may be required for WIF to resume a path toward the $1.15 technical target. Here’s hoping for a little more action, WIF! 🚀

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Chainlink’s Magical Leap: Trump’s Tariff Tricks & A Treasure Trove of Tokens 🪄💰

- BNB: To $1,000 or Total Chaos? 🤯

2025-07-05 01:27