So, Bitcoin’s doing that thing again-dangling just under the spotlight like the last slice of avocado on your toast, teasing us with the promise of growth. Exchange outflows are way up, and those fancy institutional buyers are snapping up BTC like it’s Black Friday and they’re the only shopper left. The data’s basically shouting, “Hold my coffee,” hinting that September might just be the month Bitcoin decides to stop playing coy and make a bold move.

Bitcoin Exchange Outflows: The Great Escape or Just Quiet Hoarding?

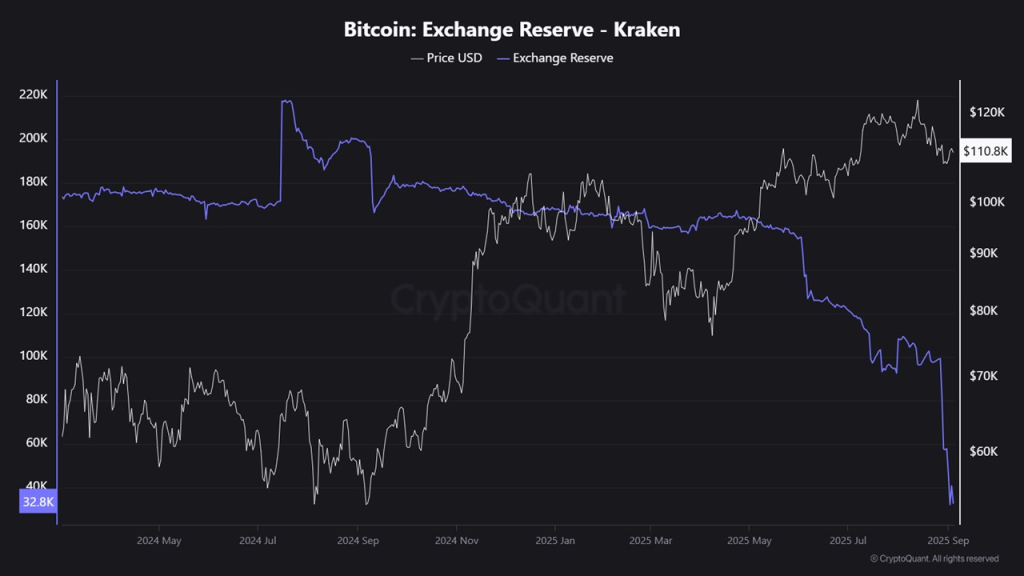

CryptoQuant’s crystal ball (or just some fancy charts) tells us that Kraken gave up nearly 65,000 BTC in the last couple of days. That’s like watching someone carry a bag of gold bars out the door-major stash alert.

Now, normally when markets peak, folks are rushing INTO exchanges to sell, like they’re trying to unload a dodgy blender at a garage sale. But nope, this time the chart looks more like a zen garden-quiet, calm, and full of determined accumulation vibes.

Retail heads are somewhere hiding under the bed, but the big kahunas are busy scooping up supply. History tells us retail frenzy usually shows up near the top, doing their “OMG TO THE MOON!” dance. So, if they’re still chillin’, maybe Bitcoin’s not done climbing just yet.

Institutions Are Playing Cupid with Bitcoin 💘

While the average crypto fan might be binge-watching Netflix instead of buying coins, institutions are busy piling in. Believe it or not, public companies now collectively hold over ONE BILLION BTC tokens. Yep, you read that right-billion with a “B”. Deep pockets are buying every dip, turning the FOMO dial way up.

This kind of move screams bullish narrative so loud it’s practically trumpeting from the rooftops. Sure, Bitcoin’s volatile, but scarcity + mainstream love = long-term date material.

Liquidation Levels: Drama Incoming or Just Another Day? 🎭

Now, don’t get too comfy. CoinGlass data suggests some spicy volatility brewing close by. There’s a cluster of liquidations just waiting to pounce if Bitcoin wiggles between $112,600 and $114,000. On the downside, the drama’s lurking near $109,500 and could even dive to $107,000.

Translation: expect some candle-waving, lever-shaking action that might resemble a hammering scene from a soap opera. But hey, that shakeout could be exactly what Bitcoin needs to gather strength, pump past the $124,000 all-time high, and maybe even catapult itself to the dazzling $130,000 mark this September.

Right now, Bitcoin’s flirting around $110,890, down just a smidge (0.75%), hanging in that critical zone where institutional muscle meets exchange data mojo. With coins sneaking out of exchanges and companies hoarding like it’s a digital gold rush, the whole BTC drama feels more like the prelude to a blockbuster than a flop.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

- BlackRock & Stablecoins: A Most Convenient Arrangement 🧐

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

2025-09-04 17:05