In a most unassuming manner, Elliptic has revealed that Iran’s central bank has quietly hoarded more than half a billion dollars in dollar-backed stablecoins, employing blockchain magic to sidestep sanctions and prop up its floundering currency.

Blockchain Analysis Firm Claims Stablecoins Fortify Iran’s Shadowy Economy

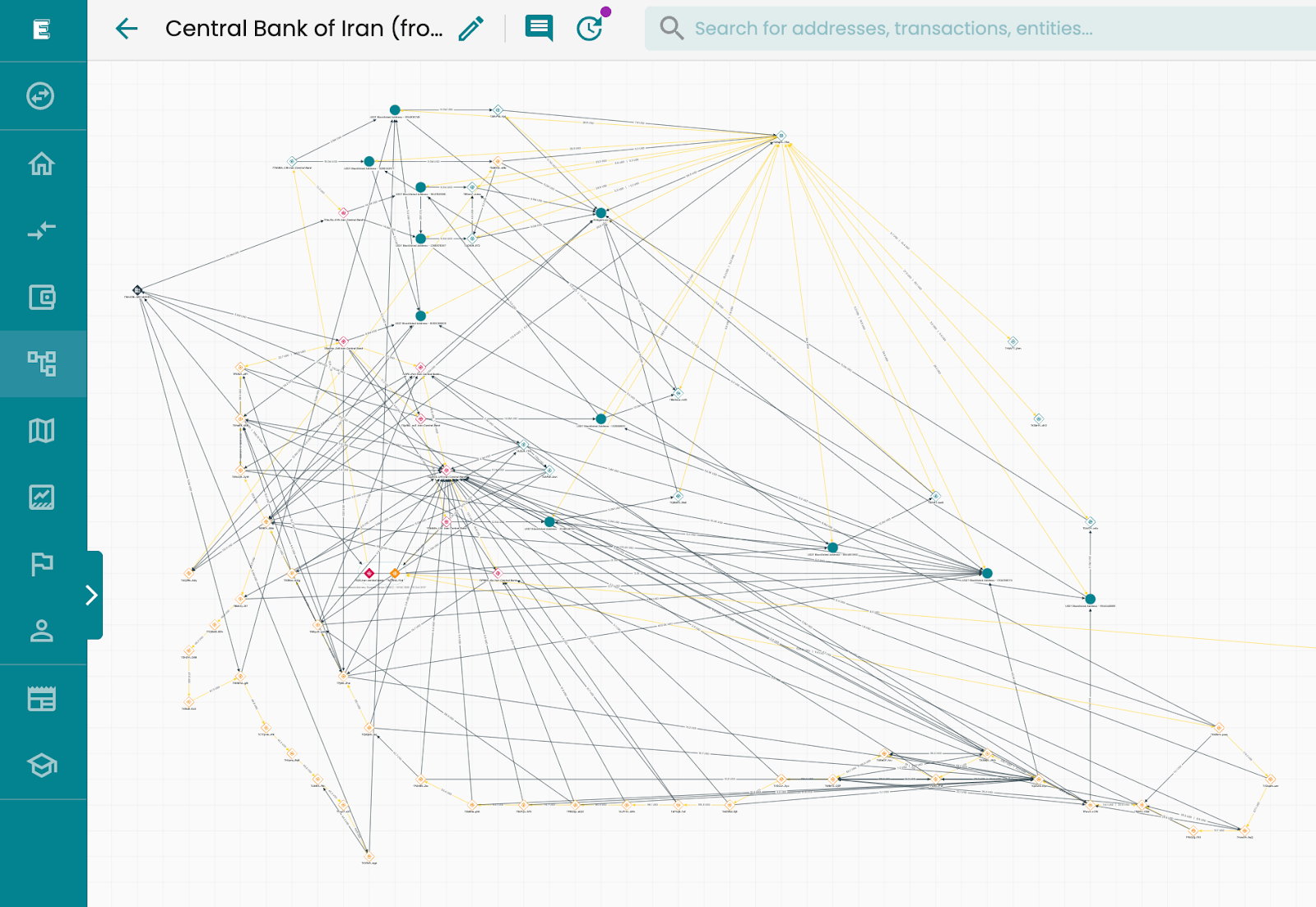

According to a new investigation by the esteemed Elliptic, the Central Bank of Iran (CBI) managed to amass at least $507 million in USDT, a stablecoin with ties to the U.S. dollar created by Tether. This revelation comes courtesy of Dr. Tom Robinson, the chief scientist and co-founder of Elliptic, who has meticulously mapped out a web of wallets linked to the CBI-like an accountant on a caffeine high.

Elliptic’s report suggests this figure is merely the tip of the iceberg, as only wallets firmly tied to the central bank were taken into account. The analysis reveals that the USDT was initially funneled through Nobitex, Iran’s largest cryptocurrency exchange, where it could be stashed, traded, or hawked for rials like a street vendor peddling trinkets.

The intrigue escalated during a period of intense currency turmoil, when the rial lost about half its value in just eight months-talk about a rollercoaster ride! Elliptic posits that the CBI likely wielded stablecoins as a means to inject some dollar liquidity into domestic markets, mimicking open-market operations that sanctions typically thwart, like trying to bake a cake without any eggs.

In June 2025, Elliptic noted a dramatic operational pivot. Following a notorious hack of Nobitex by a pro-Israel group-because nothing says “fun” like financial chaos-the flow of funds shifted from Iranian exchanges to a cross-chain bridge, transferring assets from Tron to Ethereum. From there, the funds danced through decentralized exchanges (DEX) and centralized exchanges (CEX), a process that continued through the end of 2025-truly a marathon of digital footwork.

Robinson describes this strategy as a form of “digital off-book eurodollars.” How very clever! It allows Iran to hold and transfer dollar value outside the traditional banking system, thus supporting a closed-loop trade mechanism sanctioned in 2022, enabling imports and exports to settle in synthetic dollars while dodging seizure risks like a cat avoiding a bath.

But, dear reader, do not be fooled! Elliptic reminds us that this activity is not as invisible as a ninja in the dark. Since stablecoins operate on public blockchains, Elliptic possesses the tools to trace flows and identify those pesky sanctioned actors. The firm notes that Tether has already frozen millions of USDT tokens connected to CBI wallets, showcasing how centralized blockchain architecture can reinforce sanctions enforcement like a well-oiled machine.

FAQ 🇮🇷

- How much USDT did Iran’s central bank acquire?

Elliptic estimates at least $507 million in USDT based on attributed wallets-no need for a crystal ball here! - Why did Iran use stablecoins?

Elliptic explains that USDT served as a means to stabilize the rial and conduct trade beneath the watchful eyes of sanctions-quite the juggling act! - Which blockchains were involved?

Elliptic tracked activities spanning Tron, Ethereum, and various bridges and exchanges-an elaborate web indeed. - Can this activity be stopped?

Elliptic observes that stablecoin issuers and CEX platforms have the capacity to freeze or block sanctioned wallets. However, that brings ethical complications and nuances, much like trying to decide whether to eat dessert before dinner.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- BNB PREDICTION. BNB cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- USD TRY PREDICTION

- Bitcoin, Loans, and Ledn: Mauricio’s Wild Ride to Financial Freedom 🚀💸

- Banks & Crypto: A Match Made in… Heaven?

- EUR USD PREDICTION

2026-01-21 23:42