Lo! The token HYPE, like a weary traveler, now finds itself at the threshold of $34, its journey marked by the ebb and flow of market tides. With daily volumes swelling to $480 million, one might suppose it to be a phoenix rising from the ashes of despair-or perhaps merely a mirage conjured by the fevered imaginations of traders. Yet, lo! It has ascended 9% in the past 24 hours, while the seven-day sojourn has seen a slight descent, as if the market itself were sighing, “Not yet, not yet.”

Behold, the price has tested the $30-$33 support zone once more, a ritual as old as the hills. And lo! It rebounded, now inching toward the $36 resistance, as though the very cosmos conspires to test its resolve.

Support Zone Holds as Price Attempts a Reversal

Since June, HYPE has danced with the same support area, each time clinging to life, as short-term buyers, like drowsy knights, rush to its aid. The chart, now adorned with two recent lows, hints at a double-bottom pattern-a specter that haunts every bullish dream. “This level,” proclaims CryptoPulse, “has been a steadfast friend to the price, and if it holds, a reversal may yet unfold.” A reversal, you say? How quaint, how hopeful, how utterly untrustworthy.

Should the pattern hold, a breach above $36-$38 would be required, a barrier once deemed insurmountable. If cleared, the next targets-$40 and $50-may soon be within reach, though one suspects the market will scoff, “Not so fast, my dear.”

Observe the MACD line, now ascending above its signal, a sign of nascent momentum. Its reading, 0.098, and the signal’s -1.87, a tale of contrasts. The histogram, now positive, whispers of change, though the full chorus remains distant.

The RSI, at 45, climbs ever upward, surpassing its 40-moving average. Though still shy of 50, it signals a flicker of hope, a tender shoot in the frost of recent weakness. Neither indicator shouts of a trend, yet both murmur of a shift, as if the market itself were awakening from a long slumber.

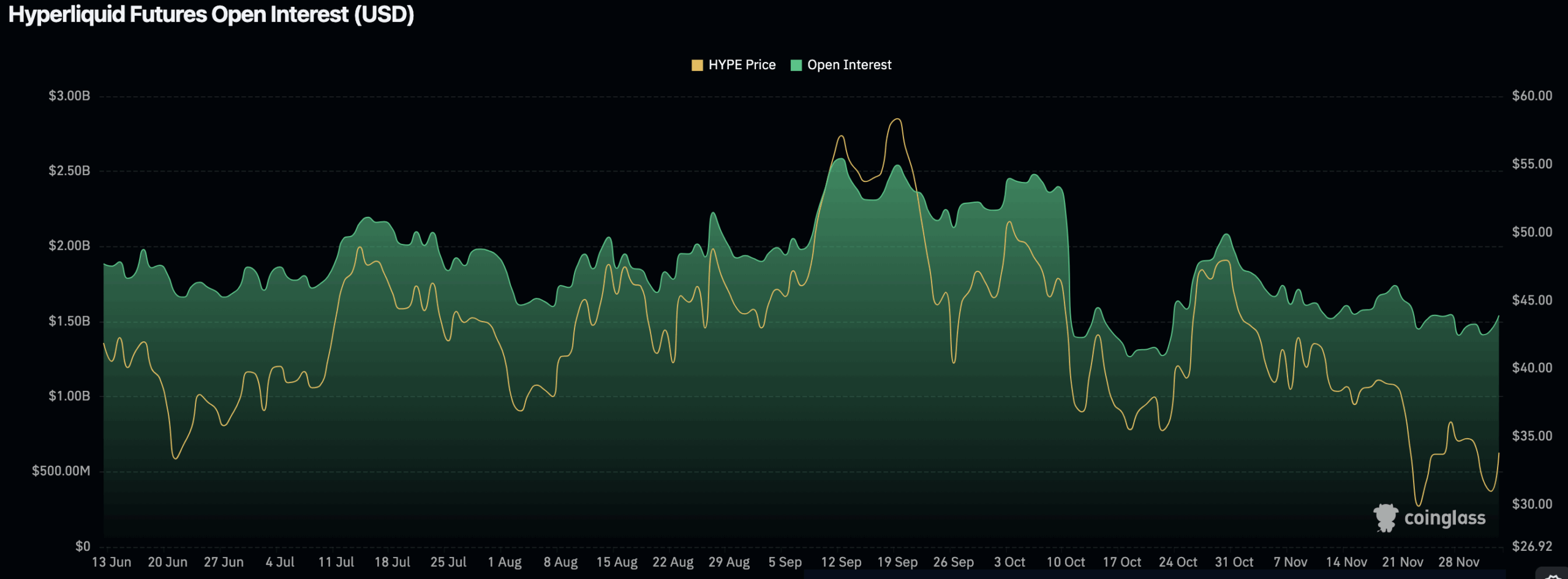

Futures Traders Return as Open Interest Rises

The futures open interest, once a shadow of its former self, now stands at $1.57 billion, a resurgence akin to a phoenix’s rebirth. Traders, like restless spirits, have returned to the fold, their positions expanding as the price stirs from its lethargy. A rise in both price and open interest, they say, is a harbinger of growing participation-though one cannot help but wonder if this is mere wishful thinking.

Historically, such setups have led to brief rallies, only to collapse under the weight of their own hype. Yet here we are, once more, dancing on the precipice. The market, ever capricious, teeters between hope and despair, a pendulum swaying in eternal uncertainty.

Meanwhile, Hyperliquid Strategies, that paragon of innovation, prepares to trade on Nasdaq under the ticker $PURR. A fund holding 12.6 million HYPE tokens and $300 million in cash, it promises to be a treasury reserve, a beacon for the Hyperliquid ecosystem. “A HYPE token treasury reserve,” declares Hyperliquid Daily, “holding 12.6 million tokens and $300 million in cash.” How thrilling! A merger with Nasdaq-listed Sonnet looms, potentially birthing a $1 billion digital asset treasury. One can only imagine the grandeur of such a union, though the skeptics among us might mutter, “Another bubble, perhaps?”

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Blockheads at UGM: Beans & Blockchain Edition 🌾

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- Tokyo’s Top Man Blesses Digital Devilry! 😈💰

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- 🤑 GAIN Token: Bull Trap or Divine Rebound? 🤑

- FLOKI’s Price Breaks Out: $0.000087 or a Fall?

- MEXC Unleashes AI-Powered Candlestick Chart Tool: Will It Save Your Crypto Trades?

2025-12-03 21:45