Hyperliquid’s meteoric leap from $10 to $49, that glittering mirage of avarice, now wanes like a moth fluttering its last wings. The chart, once a canvas of frenzied ascent, now exudes a languid sigh, as if the very air has grown heavy with the scent of spent ambition. Traders, those modern-day soothsayers, whisper of a $31.50 battleground—a last stand for bullish bullfrogs 🐸.

Hyperliquid’s Cooling Act: A Ballet of Despair

From $10.30 to $48.50, Hyperliquid pirouetted through the dreams of investors, only to falter now like a prima donna mid-act. The price, once a tempest, now drizzles, retreating beneath its former bastion of support. Benaiah, that oracle of charts, sighs, “HYPE doesn’t look good”—a verdict as poetic as it is damning. If $35-$38 crumbles, the market may descend into a Darwinian free-for-all, where only the fittest bids survive. 💸

Chartist Benaiah, with a glint of sarcasm, notes the unraveling structure. The market, once a bullish beast, now yawns, its appetite for risk sated. A breakdown looms, but not yet—mercy delayed, perhaps, is mercy denied. The $31.50 level, that fabled Promethean flame, awaits its test.

$31.50: The Final Frontier or a Financial Fiasco?

Hyperliquid, in its latest convulsion, hovers near $37, a nervous tick on the Richter scale of crypto. Ali Martinez, that scribe of spreadsheets, warns: $31.50, once a wall of resistance, now wears the cloak of support. Bulls, armed with hope, and bears, with calculators, clash in this digital Iliad. Should HYPE falter, the $28 abyss beckons—a fiscal purgatory. 🕸️

Ali’s chart, a mosaic of Fibonacci clusters and Bollinger Bands, suggests a game of Jenga with the market’s sanity. Each candlestick flickers like a dying star, its volume a whisper in a storm. The 50-day MA, that ancient sentinel, now trembles as HYPE tests its resolve. A failure here could unleash a cascade of liquidations—crypto’s version of a Greek tragedy. 🎭

Fibonacci’s Web: A Loom of Retracement

Hyperliquid, ensnared in Fibonacci’s geometric snare, now dances to the tune of $34.50 and $29.75. Greeny, that numerologist of volatility, warns: each lower high is a dirge for bullish dreams. The 0.236 level, a ghostly $40.40, watches like a sentinel, its slopes steeped in portent. August’s chill, that crypto winter’s harbinger, looms. ❄️

Burns and Bets: The Deflationary Gambit

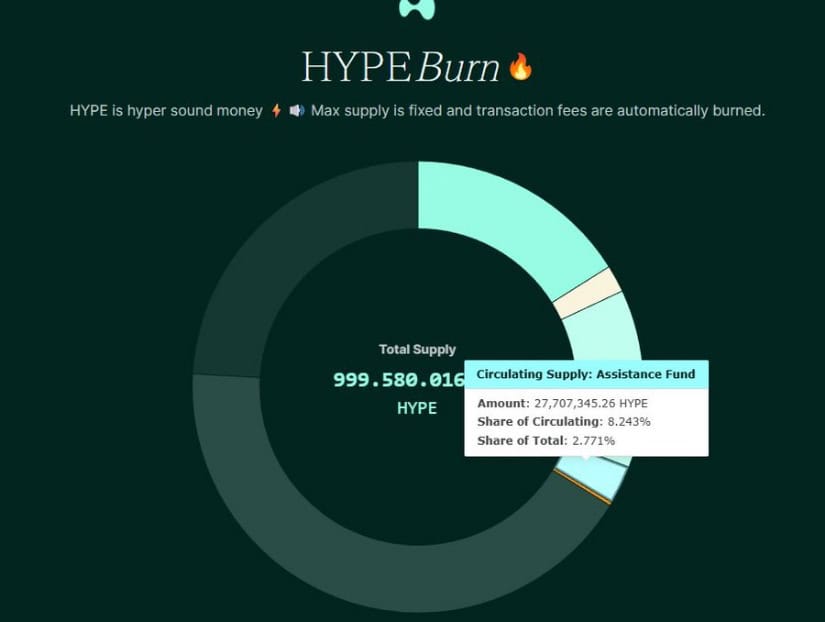

Amid the dip, a sly narrative emerges: Hyperliquid’s token burns, a silent coup on supply. Sakrexer, that alchemist of algorithms, reveals a 1 billion HYPE supply, now shrunk by automated burns. The assistance fund, a mere 8.24%, clings to its relevance like a drowning man to a buoyant meme. Each dip near $34 or $28 accelerates this deflationary engine—a fiscal phoenix rising from ashes. 🔥

This is no mere correction but a ballet of arithmetic: cheaper prices, more burns, fewer tokens. A rebound, when it comes, may sting like a wasp in a bullish garden. 🐝

Epilogue: Reset or Requiem?

Hyperliquid’s dip, that sly fox in bear’s clothing, may yet prove a prelude to a grander crescendo. The deflationary mechanics hum like a lullaby, while the $31.50 threshold teeters between salvation and surrender. If sentiment turns bullish again, this could be a reset—a phoenix’s egg. For now, the market watches, a jury of algorithms, awaiting the verdict. 🎩⚖️

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Trump’s Crypto Carnival: $800M in Gold-Plated Gibberish 🤑🤡

- Circle’s Amazing €300M Milestone with EURC! 🌍💸

- TRX PREDICTION. TRX cryptocurrency

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- Company Buys More Bitcoin, Because Hyperinflation or Something 🚀

2025-08-03 02:17