Used to be, back in ’23, Hyperliquid was a name whispered in corners, a little dust mote. Now, in ’25, it’s kickin’ up a proper storm in the DeFi country, passin’ Robinhood in trades and lookin’ to rearrange the furniture in the whole exchange racket.

They got themselves a plan, see, an aggressive one. And a way with liquidity. Ain’t flyin’ under the radar no more, not by a long shot.

Centralized Exchanges Better Watch Their Backs: Hyperliquid’s Comin’ Up Fast

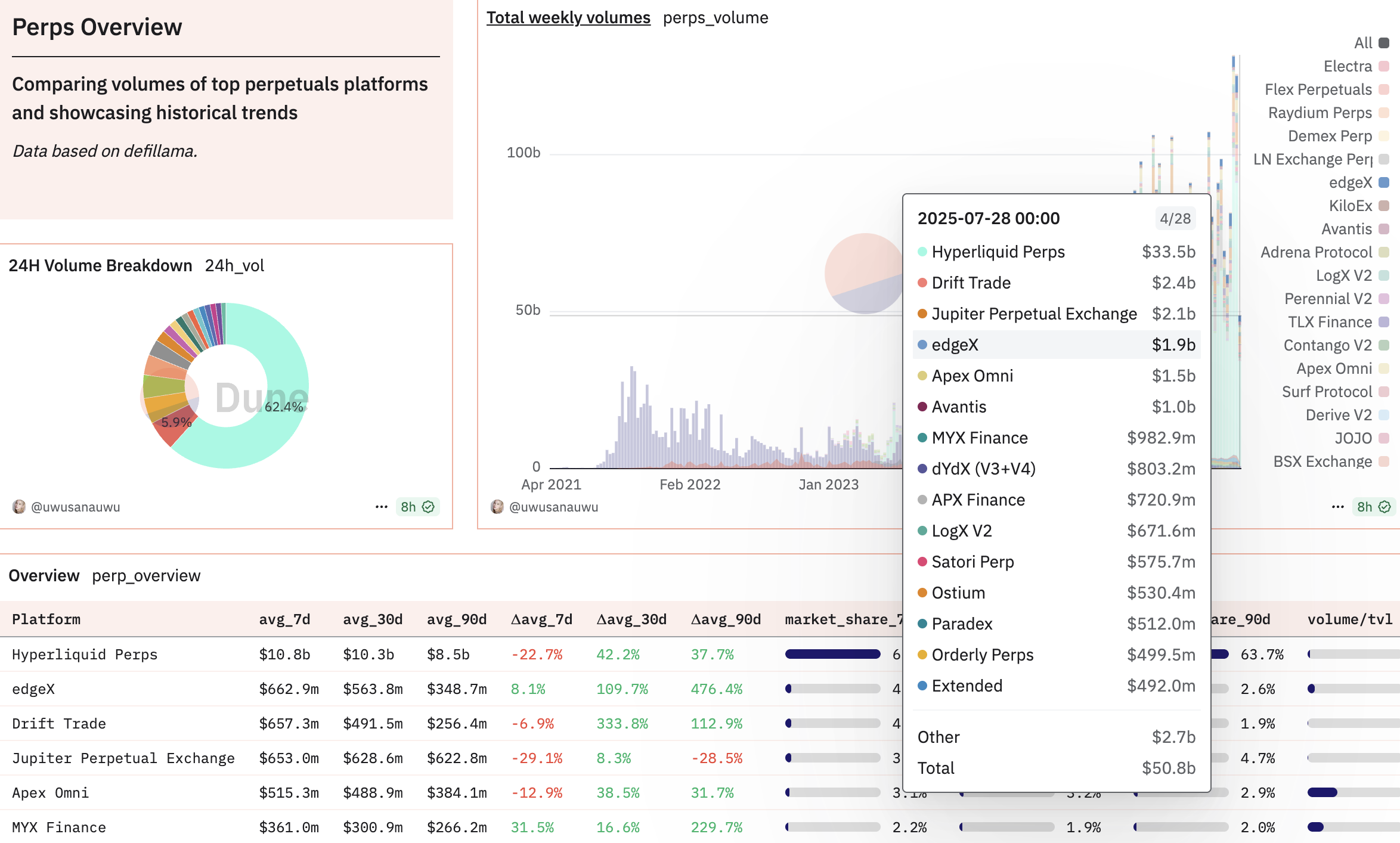

Folks been sayin’ DEXs just can’t grow like those big CEX barns. But Hyperliquid (HYPE), she’s lookin’ to prove ’em wrong. Leadin’ the perpetual futures trade now, beatin’ a lot of the big names. Kinda like a little fella outwrestling a giant, only with numbers and computers.

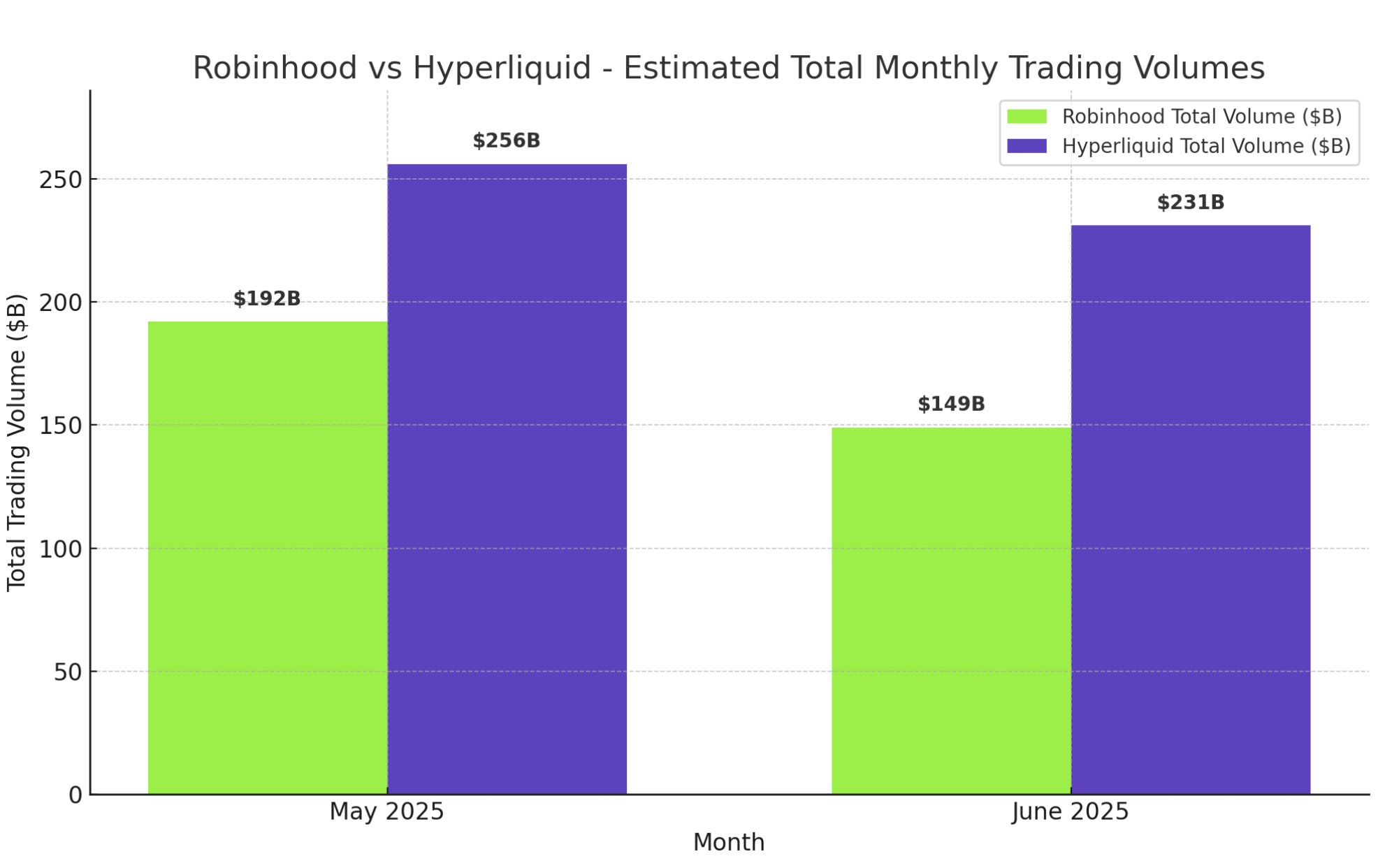

Come June of ’25, Hyperliquid pushed $231 billion worth of trades—a bit off from the $256 billion in May, but still.

Robinhood, well, they dipped a little further, fallin’ from $192 billion to $150 billion in the same stretch. Seems the gap between a young’un like Hyperliquid and them grandpappy CEXs is closin’ up. Makes a fella wonder, don’t it?

“Coinbase, Robinhood, Binance ought to be takin’ notes. Remember all that talk ’bout DEXs never scalin’? Hyperliquid just handed ’em a lesson,” that fella Lex Sokolin typed out on X. Smart man.

Artemis Analytics folks reckon Hyperliquid’s a “rising star”. A “rising star,” they call it. Sounds kinda fancy for a bunch of code, but alright. It means it’s growin’ quick and might just upset the apple cart.

“Two years, and Hyperliquid’s growin’ up to be the same size as Robinhood,” says Steven from Yunt Capital. Seems like a short time to go from nobody to somebody, if you ask me.

Now, the trick up Hyperliquid’s sleeve is this “Liquidity-as-a-Service” thing. Some investor fella says it’s “increasin’ its worth, and might be the best bet a body can make for the next few years.” Heavy words, those.

Course, growin’ that fast, things get a little shaky. Had a bit of a hiccup with the user interface recently—folk couldn’t place or close trades for a spell. Front end seemed alright though. Hyperliquid promised to make things right by refundin’ those affected by the blip. Even the best machines got their off days, I reckon. 🤷♀️

It’s still early to say DEXs will bury CEXs six feet under. But Hyperliquid’s showin’ us what these decentralized things can *do*. It’s stable, the trade numbers keep movin’ upward, and it’s a good, solid example of what happens when folks chase a different kind of exchange. It’s a sight to behold… and it might just change things.

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD CNY PREDICTION

- Ethereum’s $4K Comeback: A Tale of Desperation and ETF Tears 🚨

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- How Ripple’s Saudi Adventure Might Just Redefine Your Morning Coffee

2025-07-31 12:21