Well, would you look at that? Hyperliquid has decided to throw caution to the wind and strut into the realm of impossibly high prices, landing at a dizzying $57.34. In just a week, this token has danced its way up over 24%! You’d think it was auditioning for “Dancing with the Crypto Stars.” Not to mention, a single day of exuberance brought it a sprightly 2.47% surge, puffing its market cap up to a cool $19.01 billion. With trading volumes jumping nearly 40% in 24 hours, it’s as if everyone suddenly remembered they had a little bit of HYPE lying around – because who wouldn’t want to be part of this party? 🎉

As a seasoned onlooker of this rollercoaster, I can see a delightful cocktail of solid fundamentals and technical prancing encouraging HYPE’s price gallop. But before you throw your virtual confetti, some momentum indicators are waving their little red flags, cautiously screaming, “Hang on! Is this sustainable, or are we in for a freemium cooldown next?” So, strap in as we explore the whimsical world of price surges and the potential highs (or lows) ahead.

So, What Exactly Has Caused This HYPE?

Several delightful little catalysts are behind HYPE’s meteor-like ascent this week:

- Paxos USDH Proposal: On September 8, Paxos had a lightbulb moment and introduced USDH, a compliant stablecoin crafted just for Hyperliquid, with 95% of reserve interest marked for HYPE buybacks. Talk about loyalty!

- Lion Group Holding Conversion: The Nasdaq-listed juggernaut, Lion Group, revealed it would reallocate a whopping $600 million worth of SOL and SUI into HYPE, flaunting Hyperliquid’s impressive infrastructure as the chariot driving them toward long-term wealth. They’ve clearly got their eyes on the prize!

- ETF and ETP Developments: Asset manager VanEck is hopping on the Hyperliquid bandwagon, pursuing a spot staking ETF in the U.S. and launching an ETP in Europe. It’s like a crypto road trip, and everyone wants a seat! 🚗

Onchain & Derivatives Overview: Hold onto Your Seats!

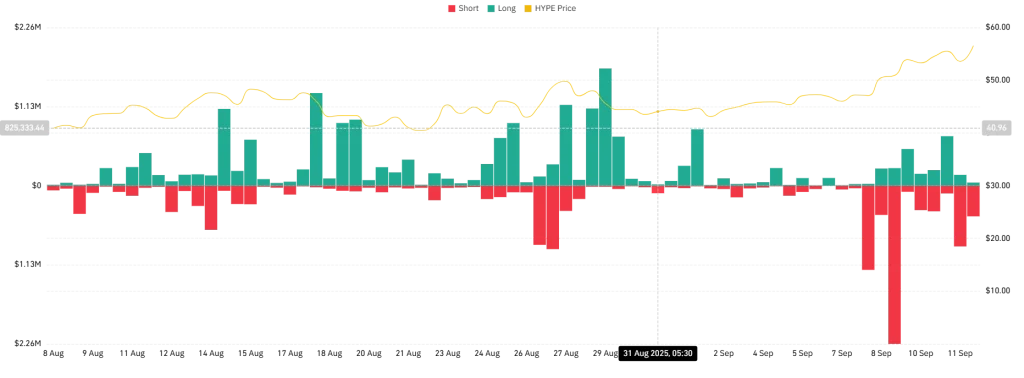

Liquidations have taken the stage like the lead singer in a rock band during HYPE’s latest surge. CoinGlass has gifted us a chart showing a delightful cluster of short liquidations in late August, which evidently helped push some sellers out into the cold. Recently, a few long liquidations decided to crash the party around September 10, highlighting the inherent risks of being too comfortable at these overbought levels. With $3.08 billion in longs and $3.21 billion in shorts, even a modest hiccup could send us spiraling into sharp liquidation cascades, resulting in wild volatility. Buckle up! 🎢

Hyperliquid Price Analysis: The Plot Thickens

As of this very moment, HYPE is trading at $57.18, kicking and screaming above its 7-day SMA of $51 and 30-day EMA of $46.95. This price movement is akin to an impressive gymnastics routine, illustrating a strong bullish trend, but don’t get too comfy just yet – there are caution flags waving all over the place! The 7-period RSI is sitting snugly at 83.91, which is basically a neon sign reading “overbought.”

Now standing before us is the resistance at $61.68, courtesy of the Fibonacci 127.2% extension. A triumphant breakout here could catapult us toward the shimmering $73.84 target, flirting with that enticing 200% Fibonacci level. But don’t forget, immediate support is lounging at around $49.70, with some deeper cushions cozily resting closer to $40.33.

What makes me giddy about this ride is the looming presence of liquidity. With turnover clocking in at 3.23% and volume rising nearly 40% daily, Hyperliquid appears to be well-prepared to absorb any selling pressure if profit-taking comes knocking at the door. That being said, chasing this rally at these dizzying heights requires your best risk management dance moves. 🕺

FAQs: Your Burning Questions Answered!

Is HYPE overbought right now?

Why, yes! With an RSI of 83.91, we’re looking squarely at overbought conditions, which may very well suggest a short-term pullback or a chance to just catch our breath.

What’s the next resistance level to watch?

HYPE is eyeballing resistance at $61.68. If it breaks above this threshold, the next target is potentially a dreamy $73.84.

Why is Hyperliquid attracting institutional attention?

The Paxos USDH proposal and VanEck’s ETF plans are serving HYPE a big bowl of legitimacy for breakfast, while Lion Group’s $600 million conversion is a solid affirmation of booming institutional confidence. Just wait until they send party invitations! 🎊

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Silver Rate Forecast

- USD CNY PREDICTION

- How Ripple’s Saudi Adventure Might Just Redefine Your Morning Coffee

- XRP Price Tale: The River That Rises

- Solana Whales Dance: ETF Drama & $210’s Fatal Attraction! 🐳💸

- AI’s Dilemma: Will It Save Us or Sell Us Out? 🤖💸

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

2025-09-12 12:59