By the third week of August, a curious phenomenon occurred in the crypto sphere-several altcoins decided to play hide and seek with their reserves, vanishing from exchanges faster than Jeeves from a scandal. This peculiar trend suggests that investors are quietly hoarding, perhaps in anticipation of a rainy day or simply because they’re tired of the circus. Meanwhile, the so-called “altcoin season”-which normally resembles a fever-has become as selective as a club where only the most eccentric are welcomed.

So, what tokens are acting sneakily, and what exactly is fueling this Lilliputian hoarding spree? Grab your monocle, and let’s delve into the jolly good details.

1. Ethena (ENA) – The Vanishing Act

According to the data from the ever-watchful Santiment, Ethena (ENA) performed a little magic trick-reserves slid from a hefty 1.3 billion down to a tidy 1.15 billion. In the parlance of the gold rush, 150 million ENA slipped out the back door, onto the cryptic streets of off-exchange pockets.

Meanwhile, ENA’s price shot up by 30%, leaping from a modest $0.51 to a saucy $0.65-imagine that! – so it’s clear the investors aren’t just playing with Monopoly money.

All this hustle and bustle coincided with the Ethena Foundation announcing a rather princely buyback of $260 million-around $5 million daily-swapping cold hard crypto for more cold hard crypto. The tokenomists audibly sighed with relief, estimating the buyback would snatch about 3.48% of circulating supply, making the old sell pressure feel rather useless.

Adding a generous sprinkle of success, Ethena’s revenue crossed the half-billion mark, and USDe supply clocked a record high of $11.7 billion-truly a season of milestones and mysteries.

2. BIO Protocol (BIO) – The Brainiac Pickpocket

Next on our tour is BIO Protocol, the de facto genius of the DeSci universe, which in August dazzled with a 265% surge. While the price was busy ascending, exchange reserves took a nosedive-dropping from a lofty 380 million to a somewhat less lofty 294 million BIO. That’s a lot of tokens sneaking out faster than you can say “Bull Market!”

In the third week alone, a withdrawal of 42 million BIO turned the reserves into a ghost town, making it the poorest they’ve been all year. Clearly, someone’s been busy hiding their chips.

The reasons? Well, dear reader, BIO launched a staking program early in August-attracting over 25 million tokens-or as some might say, giving investors a shiny new toy to play with. To spice the deal further, Arthur Hayes-yes, that Arthur Hayes-invested a cool million into BIO, which no doubt rekindled whispers around town that Bio Protocol is the next big thing.

Oh, and there’s more: users can now earn BioXPs for social media chatter, unlocking access to the ever-coveted BioAgent sales. Talk about turning social capital into crypto capital!

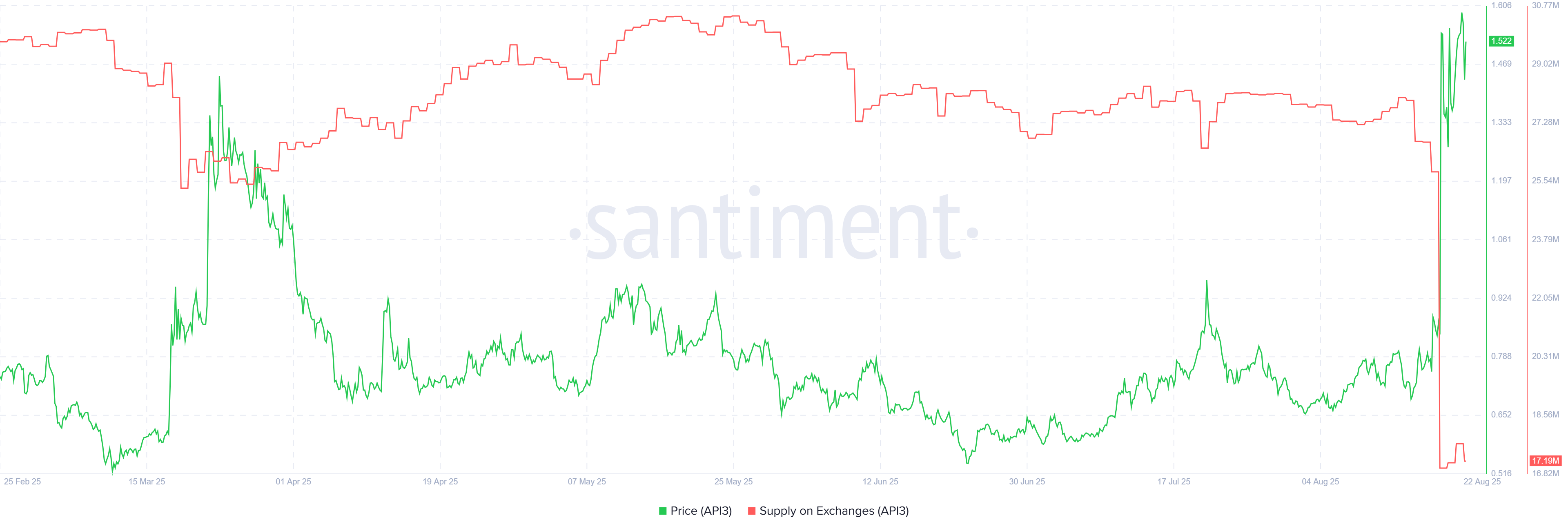

3. API3 – The Cunning Oracle

Last but not least, API3 rallied like a proper gentleman, with its price soaring over 130%. Reserves, however, decided to take a little holiday-they shrank to their lowest levels this year. Over 9 million API3 tokens simply vanished from exchanges in August’s third week, leaving just 17.19 million twinkling on the ledger.

The spark? Upbit listing API3-a classic move-making the token jump over 120% right after the listing. It’s almost as if the exchange said, “Hey, look over here!” and everyone obediently looked, then bought.

Meanwhile, chatter about the Oracle sector, fueled by Chainlink’s recent rally and fascinating data from Artemis, confirmed it’s the belle of the ball this summer. With all this hoopla, API3 holds steady above $1.50, looking as smug as a cat in a cream pot.

In sum, these three clever coins reveal that in August’s quiet rally, it’s not a broad parade but rather a select few charming the crowd with their own peculiar tricks-be it buybacks, staking schemes, or shiny new listings. The rest of the market? Well, they’re still watching from the sidelines, perhaps hoping for their turn at the magic act.

Read More

- Brent Oil Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- DOGE PREDICTION. DOGE cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

2025-08-22 14:17