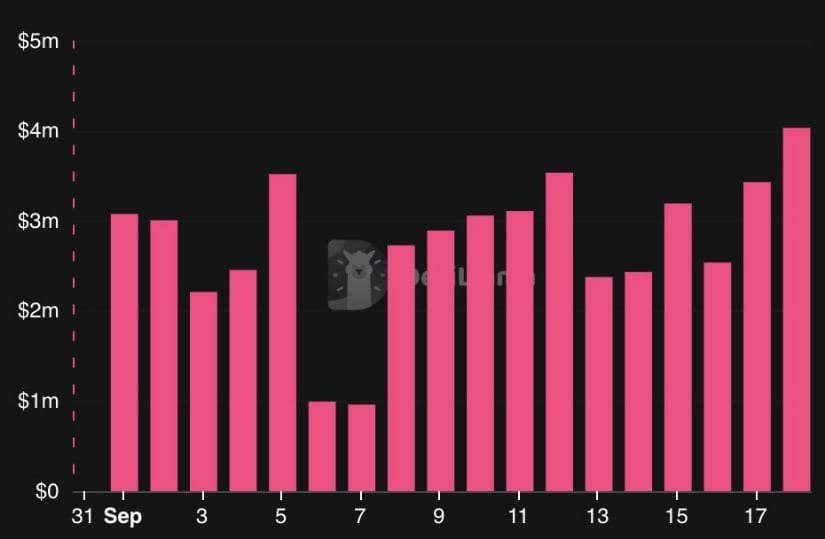

Ah, Hyperliquid, that indomitable sprite of the crypto world, has been inching upward with the pluckiness of a well-mannered terrier, despite the odd moody blip here and there. With revenue now tickling a rather impressive $4 million in a single day, the gang’s feeling positively chipper. These so-called “dips” aren’t weakness, no sir-they’re merely the market’s way of taking a polite breath before the next mad dash.

Technical Outlook: HYPE’s Short-Term Whiff of a Mishap?

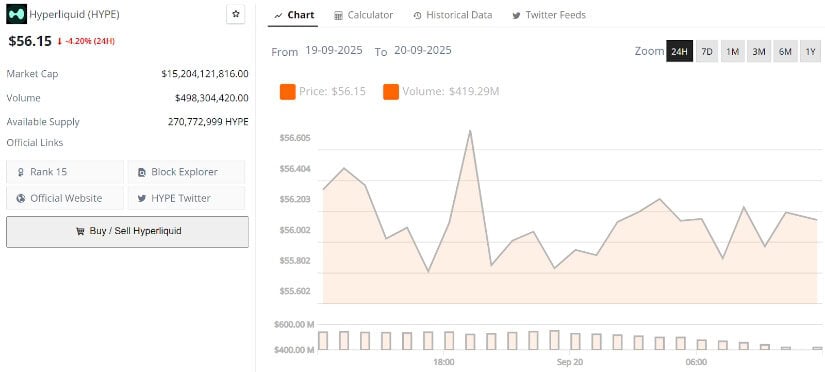

The week started with HYPE swaggering about like Bertie Wooster at a country dance, but alas, the tempo has taken a wee moment to pause. That $52 to $53 zone has behaved like a reliable valet, catching any wayward price as it tries to dodge the dance floor. Still, if selling pressure decides to gatecrash, we might see a polite stumble down to the $50 mark-nothing catastrophic, just the market adjusting its cravat before the next dance.

The fellow Nehal, who speaks with the air of a man who’s seen one too many market ups and downs, assures us that this dip would hardly topple the bullish house of cards. As long as $50 holds its ground like a proper English butler, the dance goes on. Buyers swooping in at this juncture would have us all tipping our hats, setting sights on a rebound towards $65 or maybe even $70 (quite the high tea, that).

Hyperliquid Price Prediction: Climbing the Ladder to $70

HYPE’s antics on the chart resemble the long climb of Jeeves up the social ladder-steady with occasional halts for reflection. Recently it paused near resistance, like a gentleman at a garden party wondering if it’s time to depart or fetch another cocktail. That small dip? Merely a reset, the market’s equivalent of straightening one’s tie, before pressing on upward. The highs are getting higher, the support just so, it’s all terribly proper and promising.

Jesse Peralta, the chap with the keen eye and a twinkle of mischief, posits that this little wobble could be just the springboard to the next vertical leap. $70 beckons like a grand soirée. Should HYPE break past the stubborn resistance festooned about $68-$70, well, one might say the momentum would be as fresh as a cucumber sandwich at tea, with hardly a nip of supply to dampen the party.

Sellers Flagging but HYPE Marches On

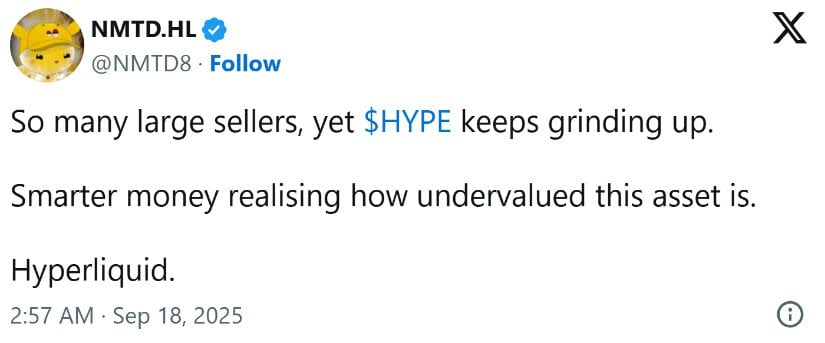

Even as the big blighters-those “sellers”-attempt a proper market inquisition, HYPE refuses to throw in the towel. It grinds upwards, stoic as an English bulldog with a bone. Key breakout levels are held with the dignity of an old-fashioned cellular library card, underlining a broader market structure that simply won’t quit. It’s supply and demand playing a gentle game of keep-away rather than the usual dandruff-inducing frenzy.

Analyst NMTD8, clearly a chap who’s traded his fair share of tales by the fire, notes that the clever money’s taken to Hyperliquid like a magpie to shiny objects. This smart money accumulation bolsters our razzle-dazzle narrative, syncing nicely with the earlier insights from Nehal and Peralta. If these wily investors keep piling in, well, the bullish story grows ever more convincing.

Fundamentals: The Sturdy Backbone Behind the Bullish Banter

While charts and trendlines dance their intricate jig, Hyperliquid’s fundamentals stand tall, flashing like a lighthouse on a foggy moor. Degen News reports that the platform’s 24-hour revenue has hit a remarkable high-water mark this month, crossing the $4 million threshold-no small potatoes. This steady flow of daily income speaks to genuine trading hustle, reinforcing the charts’ tale and turning the so-called “selling pressure” into little more than the market having a polite coughing fit.

Such stout fundamentals provide a solid cushion for HYPE’s broader bullish tendencies. With both technical wizardry and on-chain earnings singing in harmony, it’s as if the market’s gotten itself a most agreeable butler to tidy up any spills, leaving participants confident enough to hold fast through mild tempests.

Final Thoughts: Will Hyperliquid Keep Calm and Carry On Into Q4?

Like a seasoned cricketer who knows when to keep his eye on the ball, Hyperliquid has weathered tides of selling pressure with admirable aplomb. The trusty higher-low structure remains intact, daily revenue struts about at new highs, and the outlook is as constructive as a well-built country manor. Short-term dips? Merely the market’s polite little coughs before the grand crescendo.

As we peer into the foggy Q4 horizon, the burning question is whether our plucky buyers can keep their grip and nudge through the $65 to $70 resistance gauntlet. Should they succeed, brace yourselves for an extended rally that will have retail and institutional types alike clamouring for a ticket to the Hyperliquid ball. Hold onto your bowler hats, chaps; this party is just getting started! 🎉🍸

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Silver Rate Forecast

- BNB PREDICTION. BNB cryptocurrency

- Brent Oil Forecast

- USD TRY PREDICTION

- DOGE PREDICTION. DOGE cryptocurrency

- Crypto’s Grand Ball: Whales Flee, PUMP Sits Alone 🕺💸

- ATOM PREDICTION. ATOM cryptocurrency

- EUR USD PREDICTION

2025-09-20 16:08