Well, well, well… Ethereum‘s taking a bit of a breather, folks. After a dramatic fall from the lofty $3,240, it’s now testing the $3,150 support zone like a tired athlete gasping for air at the finish line. Bulls are giving it a shot, trying to defend this level after a small rebound, but hey, who can blame them? The market’s been like a rollercoaster, with more ups and downs than a toddler on a sugar rush. So, is this the start of a recovery? Or is ETH about to take another dip off the deep end? Stay tuned!

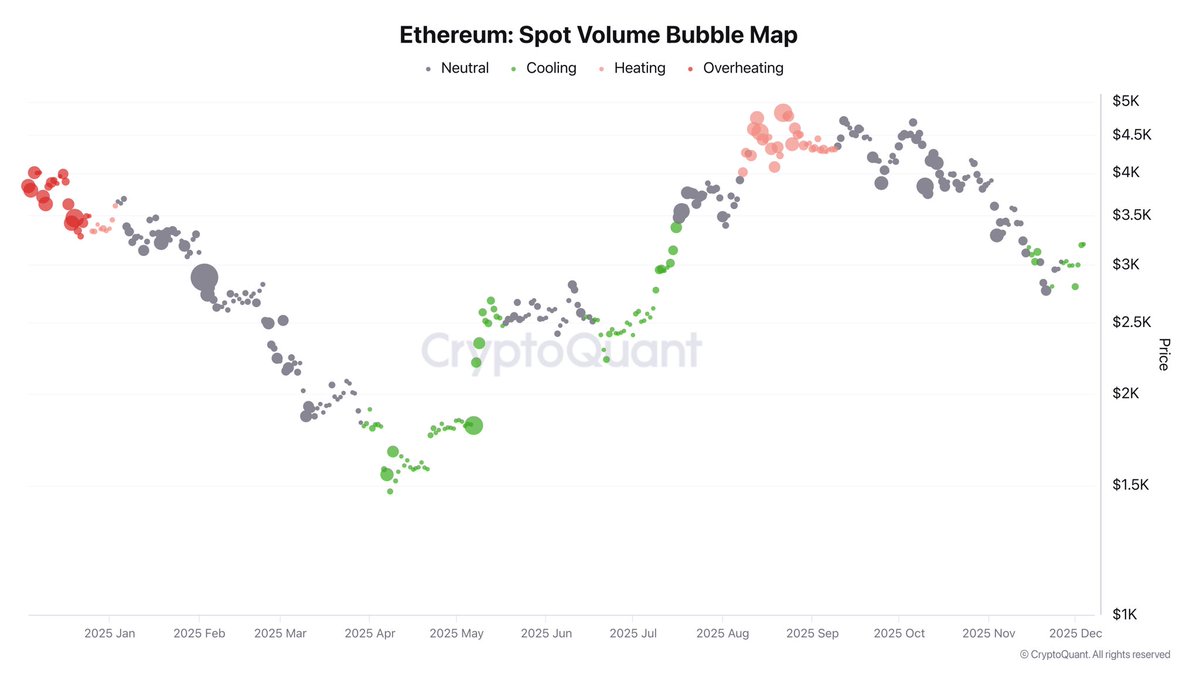

Enter stage left: Darkfost, the analyst with all the answers (well, most of them anyway). Darkfost tells us Ethereum’s price action is getting a makeover-no more small potatoes, people! Spot volumes have been shrinking faster than my enthusiasm for math homework, even as prices tried to do a little jig. With spot activity dropping faster than your favorite TV show after a bad season, futures are stepping in like the lead actor, calling all the shots on short-term price moves. Who knew? The real drama is happening off-stage in the futures market!

And guess what happens when spot volumes go MIA? That’s right, futures get all the attention. This causes the market to throw tantrums, making moves so fast they could make your head spin. Futures, with their magical powers, can send prices soaring or crashing faster than you can say “market manipulation.” We’re all waiting to see if Ethereum can turn this rebound into a real recovery or if it’s just another blip in the downtrend. Fingers crossed, folks!

Futures-Powered Rollercoaster: Buckle Up!

Darkfost’s analysis gets juicier as he talks about volatility. Oh, you love volatility, right? Nothing says excitement like a market that moves like a caffeinated squirrel. When spot volumes are this low, the market’s like a bowl of Jell-O, just waiting for something to poke it. Futures-driven momentum can take prices on a wild ride, creating sharper swings than your grandma’s dance moves at weddings. You’ve been warned!

Right now, futures are giving Ethereum a little push, keeping it above the $3,150 support zone. If this future-driven rally keeps up, the bulls might just get their act together and make a comeback. But let’s be honest-without spot market participation, one bad futures trade and we could be back in the pits. It’s a nail-biter!

So what’s the deal here? Futures could ignite a broader recovery if spot buyers start getting all warm and fuzzy inside, but if the futures crowd decides to bail, things could get messy fast. So, let’s all cross our fingers and hope for no more bad hair days in the market!

ETH’s Weekly Drama: Support Holding Strong… For Now

Ethereum’s weekly chart looks like a soap opera-will it make it, or will it crash and burn? After falling from the $4,500 stratosphere, ETH’s trying to make a comeback near $3,140. And guess what? It’s holding above its 100-week moving average (the green line, for those of you taking notes), a crucial support level that’s like the safety net in a trapeze act. Things are looking a bit more promising after the epic rejection near $2,700, where buyers came rushing in like a stampede at a sale. Good job, buyers! You saved the day!

But hold your horses! ETH’s got some serious resistance coming its way, hovering near the $3,400-$3,500 range. The 50-week moving average (blue line) is basically giving ETH the cold shoulder, like a bouncer at a club. If ETH wants to party, it’s got to break through this line. Otherwise, it’s back to the drawing board!

But don’t fret, there’s hope! Volume has been on the up and up, which means people are actually interested in ETH again (go figure!). But, the trend still has a bit of a “meh” vibe-lower highs since August-so ETH has to keep this rebound going or else it might fall back into the dreaded “consolidation zone.” We’re all watching and waiting… drumroll please!

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- Bankman-Fried\’s Wild Excuse

- Mantle (MNT): The Blockchain That Became a Titan with USD1 & Real-World Assets 🚀

- The Great AI Mirage: Stargate’s Shady Collapse & Power Struggles 🤖🔥

- 🤑 GAIN Token: Bull Trap or Divine Rebound? 🤑

- Trump Coin ETF: Canaries Singing on Wall Street? 🏦💸

2025-12-05 23:19