The GENIUS Act, that paragon of legislative wizardry, has flung the stablecoin gates wide open. And lo! Ethereum, like a peacock in full plumage, struts forth to claim its spoils.

Dear reader, picture this: Sanjay Shah, a sage of Silicon Valley’s crypto oracle, opines that Ethereum’s architecture is “uniquely advantaged.” One might say it’s the Rolls-Royce of blockchains-polished, pedigreed, and perpetually late to dinner due to its own popularity.

Ethereum’s Market Dominance: A Love Letter in Price Charts 💸

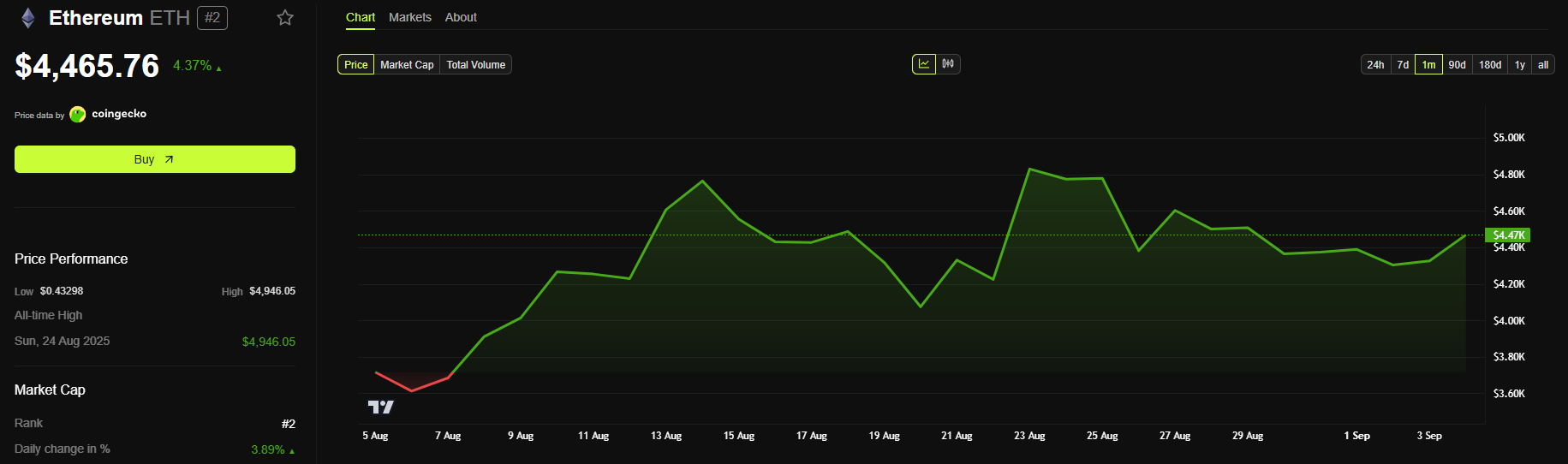

When President Trump, that indefatigable showman, inked the GENIUS Act into law, crypto markets erupted like a shaken soda bottle. Ethereum, ever the drama queen, hogged the spotlight. Its price pirouetted past $3,500, then $3,875, and now lounges at $4,465-like a cat on a sunbeam, smug and unbothered.

Investors, ever the hopeful romantics, now whisper sweet nothings about Ethereum’s “regulatory charm.” The GENIUS Act, they claim, is the key to unlocking stablecoins’ potential. Because nothing says “financial revolution” like a bipartisan bill with a catchy acronym.

“Ethereum is ripping, and the GENIUS Act? Probably the reason. Here’s why $ETH’s just getting started…”

– Crypto Auris, Twitter philosopher-king 🐦📈

Will Ethereum Be Finance’s New Anchovy? 🐟

Stablecoins, those digital dollar-doubles, aim to become the backbone of global finance. Savings! Payroll! Cross-border chaos! The GENIUS Act, with the grace of a butler clearing hurdles, now lets banks and fintechs waltz into the stablecoin ballroom.

Shah, ever the visionary, declares Ethereum “the anchor.” Not a rusty anchor, mind you, but a gilded one-L2s handle the bustling trade, while Ethereum’s L1 plays the stoic guardian. ETH, he claims, could be the “neutral, productive reserve collateral.” Translation: digital gold with a side hustle.

Why Ethereum’s Crown Won’t Tumble (Yet) 🦄

Ethereum’s trifecta? Global access, institutional safety, and a stubborn resistance to government meddling. It’s like a private club where the bouncer’s a decentralized algorithm. DefiLlama confirms: Ethereum hosts 52% of stablecoin liquidity. The other 48%? Merely auditioning for the role of understudy.

“Ethereum dominates the crypto economy the GENIUS Act accelerates. Rivals? They’ll need more than snazzy whitepapers to crash this party.” – Sanjay Shah, parting the crypto seas 🌊

L2s: The Valets of Scalability 🚖

Ethereum’s scalability woes? A tale as old as time. Enter L2s: Base, Optimism, Arbitrum-those sprightly errand boys processing transactions faster than a barista on Red Bull. The mainnet? A serene judge presiding over finality. It’s a tag-team match where everyone wins (except maybe gas fees).

“Institutions can have their cake and eat it too: high-speed payments without abandoning Ethereum’s security. It’s like hiring a butler with a rocket launcher.” – Shah, poetry in prose 🚀

Rivals, Schmivals: Ethereum’s Moat is Mighty 🏰

Solana and Tron may prance about with their “speed” and “low fees,” but Ethereum’s moat is stocked with alligators named Decentralization and Security. Its 10-year security record? Impeccable. Rivals’ résumés? Light on substance and heavy on buzzwords. Institutions, ever risk-averse, will flock here like moths to a decentralized flame.

The Path of Least Friction (and Most Liquidity) 🛣️

Private blockchains? A noble experiment, but liquidity-the lifeblood of finance-resides on Ethereum. Banks may flirt with proprietary rails, yet inevitably return to Ethereum’s “liquidity hubs.” Launching a stablecoin elsewhere is like hosting a party in a bunker: technically possible, socially baffling.

“The GENIUS Act’s a doorstop. Ethereum’s the doorman. Why build your own castle when you can rent a penthouse here?” – Shah, the bard of blockchain pragmatism 🏰🔑

As the stablecoin era dawns, Ethereum’s candle burns bright. Price soars, institutions swoon, and rivals gnash their teeth. The script writes itself: a blockbuster where the hero wins, the crowd cheers, and the sequel’s already greenlit. Roll credits. 🎬

Read More

- Gold Rate Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Ripple’s RLUSD: A Billion-Dollar Joke or Financial Genius? 🤡💰

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Whales Are Back! PUMP’s 135% Rally Alert 🚀💰

- ✨ Crypto Meets Couture: Hong Kong’s Fanciest Exchange Serves Drama & IPOs With a Martini 🍸

2025-09-03 23:20