Ethereum, that capricious mistress of the crypto realm, soared like a caffeinated kite in early August, reaching an intoxicating crescendo of $4,793 on August 14-truly a performance to make even the most stoic hodler break into a triumphant jig.

Alas, as all good things do, her ascension was met with the inevitable-profit-taking fever swept through the market like a bad cold, slicing away much of those glittering gains, leaving investors clutching their virtual pearls and wondering if the ride would ever get less stomach-churning. Now, with derivatives traders waving their proverbial white flags, Ethereum faces the perilous possibility of tumbling below the $4,000 line-fittingly, the kind of number that makes strong men cry.

ETH Faces Heavy Sell Pressure – The Market’s Dramatic Sigh

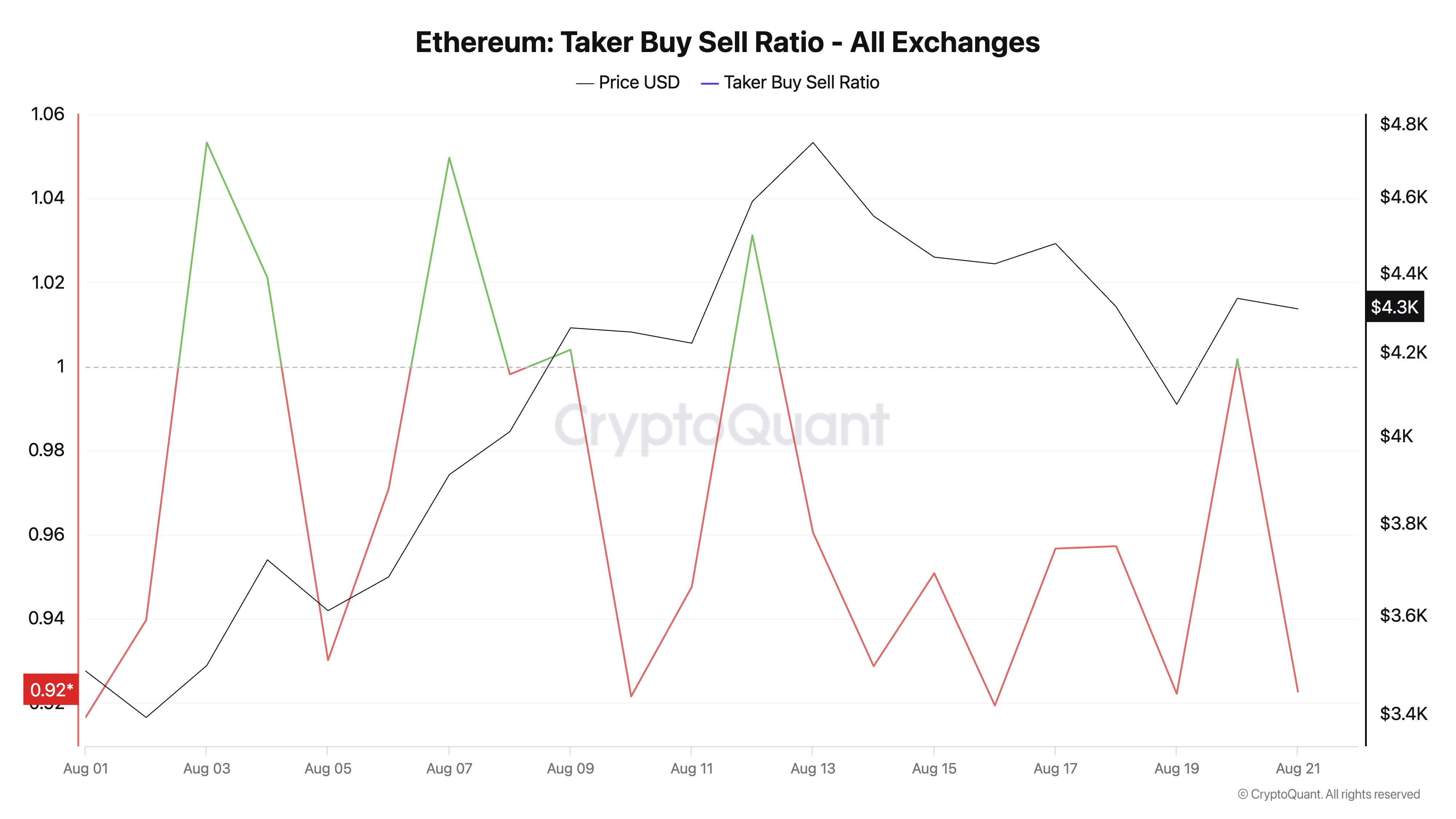

With sentiments growing gloomy faster than a Monday morning, Ethereum’s price has been weighed down by traders acting as if the apocalypse is nigh. Its taker-buy/sell ratio, a charming little statistic, has stubbornly refused to rise above one since August’s dawn-an unequivocal sign that the sell-off party is in full swing, and buy orders are outnumbered like hipsters in a Starbucks during a protest.

Currently, CryptoQuant reports the ratio at a teetering 0.92, suggesting the market’s mood is about as optimistic as a cat in a bath. The sell orders have pretty much taken the lead, confirming that everyone’s just here for the profits-until the profits run out, that is.

The buy-sell ratio measures market dance steps-above one means traders are twirling with enthusiasm, below one indicates they’re retreating, clutching their wallets and whispering sweet nothings about losses.

Since August’s start, that ratio’s been mostly below one, a relentless reminder that traders are busy locking in gains and preparing for the inevitable replay of “Market Crash Theatre.” The uptrend in July seemed like a brief flirtation, quick to turn into a cautious retreat, as if the market had remembered it’s nothing but a volatile lover-hot, then cold, then… cold again.

This mounting pressure spells trouble for ETH’s bullish dreams and might turn the current slide into a full-blown cliff dive if things don’t stabilize fast.

Traders Ditch High-Risk Bets – Because Who Needs Heart Attacks?

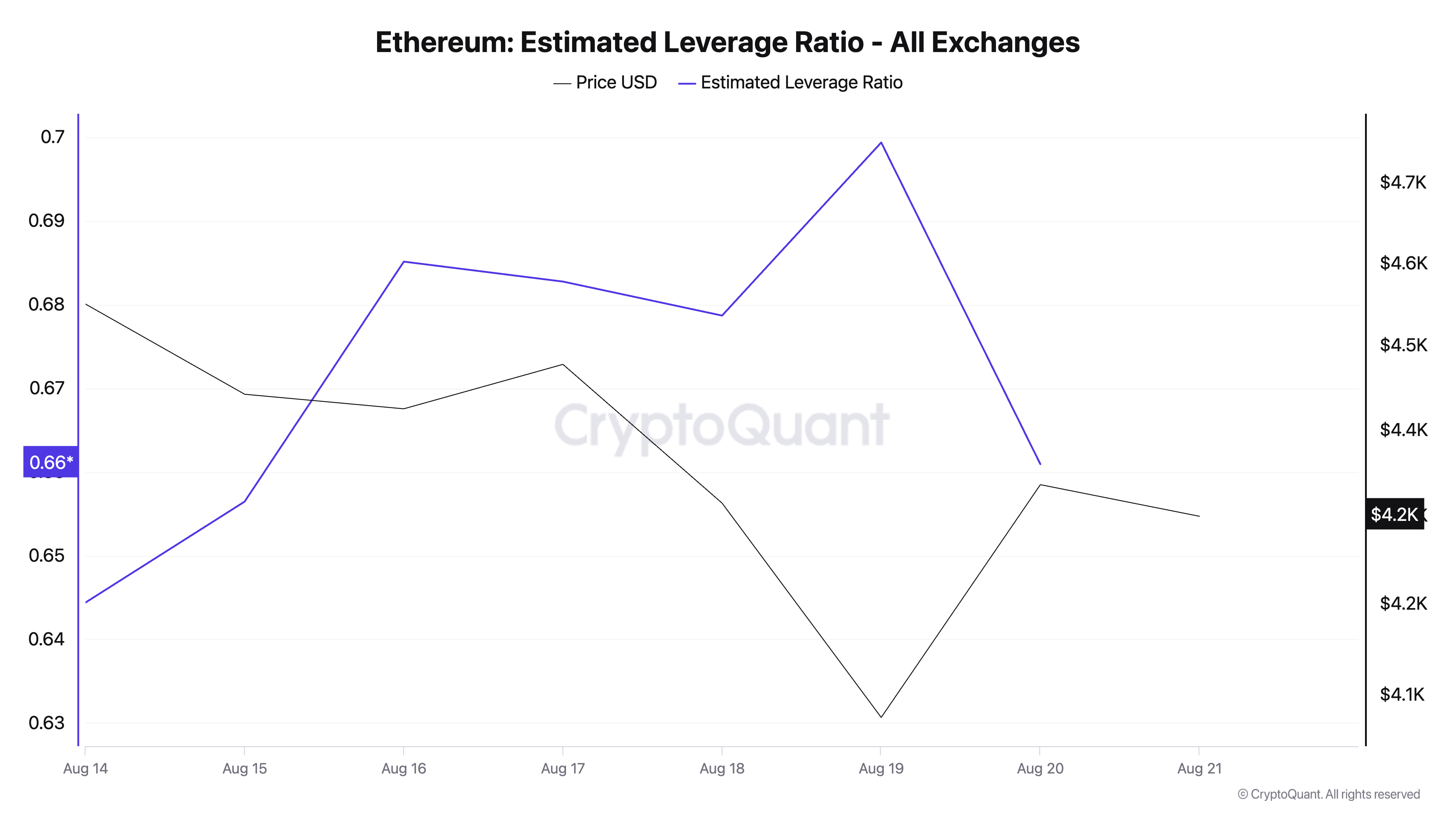

Adding to the drama, Ethereum’s Estimated Leverage Ratio (ELR)-a fancy term for measuring how much risk traders are willing to swallow-has plummeted to a modest 0.66, its lowest in five days, as if traders suddenly remembered they dislike risk more than they dislike pineapple on pizza.

This ratio, calculated by dividing open interest by the exchange’s reserve, is essentially the crypto version of a risk thermometer. When it drops-like now-it echoes traders’ new-found cautiousness, as if they’ve realized that high-stakes gambling is less fun when the house might just call “game over.”

In essence, the market’s turning into the financial equivalent of a prudish Sunday afternoon-less adrenaline, more knitting.

To $3,491 or to $4,793 – The Fateful Fork in the Road

Right now, ETH lounges around at $4,295, teasing traders with the possibility of a quick descent to $4,063-where the braver souls might see their hopes dashed. If that support crumbles, a plunge to $3,491 looms like a dark cloud, promising a less glamorous outcome for those still holding on for dear life.

But oh, what’s this? A rally? A miracle? Perhaps! If fresh cash inflow tips the scales, our beloved ETH might just bounce back, rekindling the fiery hope of reaching $4,793-proof that sometimes, in crypto, luck and stubbornness are the only strategies that matter.

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- TAO PREDICTION. TAO cryptocurrency

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- 2025: The Year the World Went Crypto Crazy (And Everyone Loved It)

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

2025-08-21 20:05