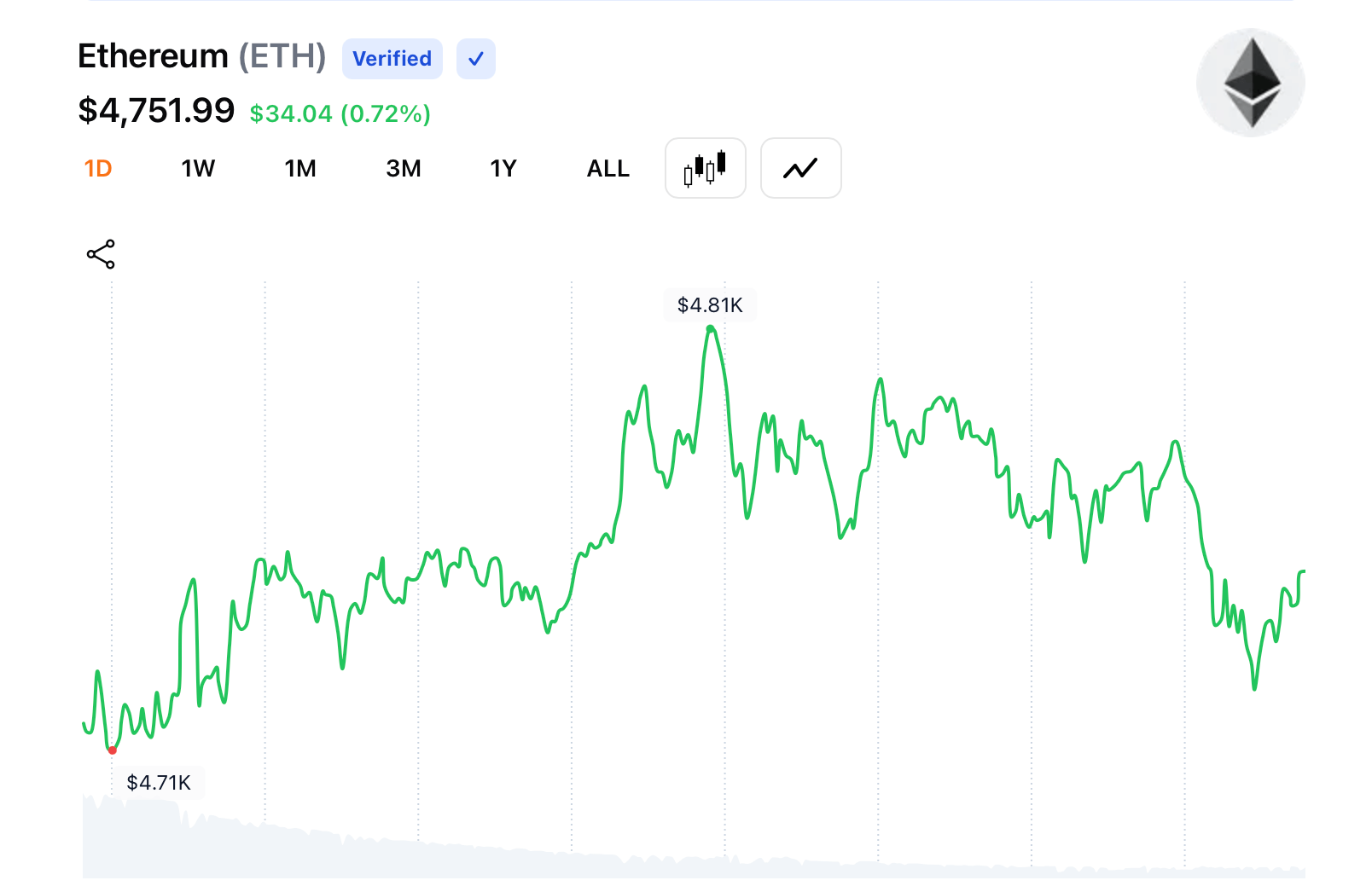

While Bitcoin has been hogging the spotlight with its record-breaking antics, our dear friend Ethereum (ETH) has finally decided to join the party. This week, it broke out of its long slumber, marking its first significant move since November 2021. With a 43% gain year-to-date, it’s left Bitcoin’s 23% in the dust. The big question now is, has Ethereum just started its grand adventure?

Is Ethereum Set for a Whopping Surprise?

At the beginning of the year, Ethereum (ETH) was trading at a measly 0.036 BTC per coin. By April and May, it had plummeted to 0.019 BTC, but it’s since soared to 0.042 BTC. 2025 has been a slow burn for ETH, with its momentum taking a bit longer to kick in, but several magical factors have fueled its recent ascent. Top of the list is the vanishing act of ETH on exchanges-levels not seen since the dark ages of July 2016.

As of this writing, data from cryptoquant.com reveals that centralized exchanges are holding a mere 18.4 million ether, the lowest level in over nine years, dating back to July 17, 2016. With exchange reserves dwindling, it’s like the selling pressure has vanished into thin air. Adding to the enchantment, institutional demand has been robust, thanks to exchange-traded funds (ETFs) and publicly listed companies jumping on the bandwagon.

Ethereum ETFs, which made their debut on July 23, 2024, after Bitcoin’s grand entrance in January, had a rocky start. But now, the nine ether ETFs collectively hold around 6.4 million ETH, worth a staggering $30.54 billion, accounting for more than 5% of the circulating supply. Following Bitcoin’s lead, treasury firms have also begun hoarding ETH like there’s no tomorrow.

In total, 14 publicly traded companies are sitting on a treasure trove of 2,963,408 ETH, valued at approximately $14.29 billion. As ETFs and corporations gobble up Ethereum (ETH), the supply on exchanges is shrinking faster than a chocolate bar in a classroom. This tightening of supply, coupled with growing demand, has ETH supporters buzzing with optimism. One particularly bold X account proclaimed:

“ETH is going to $10,000 this cycle. If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.”

Many ETH enthusiasts share this rosy outlook, and X is brimming with posts echoing similar sentiments. One user mused, “It’s mind-boggling to think ETH on exchanges is at its lowest in nearly a decade. It feels like most of it is locked away, staked, or lost forever. If the supply keeps shrinking while demand ramps up… well, we all know how this fairy tale ends. And, $10K won’t be a stretch. Are you ready for it?”

Samir Kerbage, the chief investment officer at Hashdex, believes the rise of stablecoins will give ETH an extra boost. In a note to Bitcoin.com News, he stated that ether’s new all-time high is a clear sign of investor demand that goes beyond Bitcoin.

“As Ethereum and other smart contract platforms provide the infrastructure for many of crypto’s most mature use cases, including stablecoins and tokenization, we anticipate continued strong demand for this emerging asset class,” Kerbage wrote.

The Hashdex executive added:

“I would expect ETH to surpass $10,000 once we start to see stablecoin solutions being implemented for payments within the U.S.”

Ethereum’s meteoric rise hints at a broader transformation in the digital asset world. With institutional involvement, shrinking exchange reserves, and the rise of stablecoins all converging, ETH’s role could expand beyond mere speculation. For many, this isn’t just a rally-it’s the dawn of a new era. 🌟🚀

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Chainlink’s 2025 Hype? It’s a Wild Ride! 🚀

- Meme Market Mayhem: DOGE’s $0.23 Saga Unveiled

- Hong Kong’s Stablecoin Shenanigans: The Big Circus Begins! 🎪🚀

- USD GEL PREDICTION

- Bitcoin’s HODLers: The New Titans of the Digital Age 🚀💰

- Why Is Everyone Suddenly So Bullish About Stellar? 🚀 You Won’t Believe These 5 Price Targets!

- USD CNY PREDICTION

2025-08-24 17:58