Darling, while Bitcoin languishes in its own little rut, Ethereum has decided to join the party-how frightfully predictable. For weeks now, ETH has been flirting with the $3000 mark like a debutante unsure whether to dance or faint. The spot market? Calm as a cucumber sandwich. The derivatives? Oh, they’re sharpening their knives-just not today, darling. Options traders, bless their hearts, aren’t betting on fireworks anytime soon. So, brace yourselves for more thrilling consolidation-because nothing says “exciting” like watching paint dry. 🎭

Now, the pressing question-when will ETH finally escape this $3000-$3200 purgatory? Or will it simply nap through 2026? 💤

The Market Is Fashionably Late-As Always

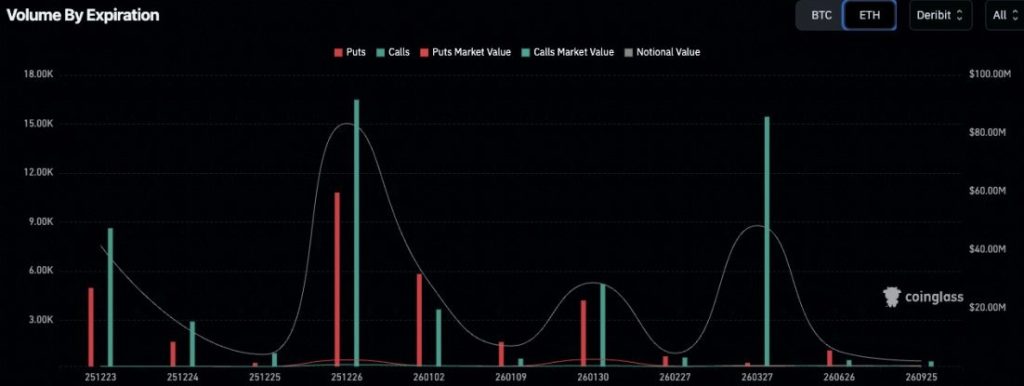

Ethereum options traders are behaving like society matrons-planning for next season’s soirées while ignoring tonight’s dull affair. Late-2025 and 2026 expiries are all the rage, while short-dated contracts gather dust. This, my dear, is what we call “rollover chic”-extending exposure because immediate action is simply too gauche.

History, that tiresome bore, tells us ETH has done this before-mid-2023, early 2024-yawn. Weeks of consolidation, then a trend. Will it happen again? Probably. Will it be exciting? Unlikely. 🥱

Options data confirms it-late-2026 is where the action is (or isn’t). Short-term bets? Oh, darling, no. Traders are holding their positions like vintage wine-aging beautifully but utterly undrinkable right now. Translation: ETH isn’t going anywhere fast. How thrilling. 🍷

Strike Prices: The Boundaries of Boredom

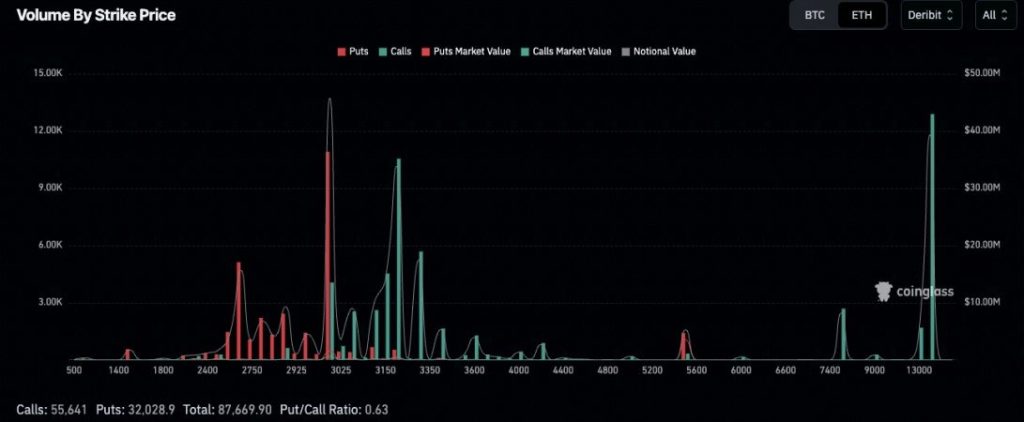

Call interest hovers between $3,000 and $3,300-how original. Puts? Modest, like a vicar’s allowance. The put-to-call ratio? A mildly optimistic 0.63-hardly the stuff of legend. This positioning, darling, means ETH is stuck in its $3,000-$3,200 cage like a pampered parrot-chirping but not flying. 🦜

$3,000 is ETH’s emotional support blanket-$3,200 is where enthusiasm fizzles out. Until fresh money waltzes in, expect ETH to loiter in this range like a wallflower at a ball. 💃

What Could Possibly Shake ETH From Its Slumber?

ETH is wedged between rising support ($2,900) and resistance ($3,200-$3,250)-like a guest trapped between two dreadful conversations at dinner. A breakout? Only if ETH reclaims $3,200 with the vigor of a caffeinated terrier. Until then, enjoy the snooze-fest. 🐕

Volume has dropped like a bad soufflé-but fear not! Compression often precedes a breakout. Or a collapse. Either way, it’ll be more entertaining than this current tedium. $3,200? Possible. $3,300? Only if buyers suddenly remember they exist. 🍰

Conclusion: ETH’s Strategic Nap

Ethereum isn’t stuck-it’s strategically dormant, darling. Options traders are punting risk into 2026 like aristocrats deferring debts. The $3,000 floor holds, the $3,200 ceiling taunts, and until volume returns, ETH will continue its riveting performance as the world’s most expensive paperweight. Bravo. 👏

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Starknet’s $365M Staking Spree: Bitcoin Meets Chaos!

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- CNY JPY PREDICTION

- BNB: To $1,000 or Total Chaos? 🤯

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Trump’s Crypto Carnival: $800M in Gold-Plated Gibberish 🤑🤡

- Mark Twain’s Take: South Korean Crypto Exchange Looks for a Sugar Daddy

2025-12-24 11:09