Oh, dear reader, gather ’round as we recount the tale of Ethereum‘s validator exit line, which reached a record-breaking height this week-so high, it made the sky blush! 🌟💸

The Validator Exit Wait: A Two-Week Ordeal, or How Ethereum Became a Waiting Room for Wealth

As of Aug. 20, 2025, a staggering 898,000 to 916,000 ETH are queued to leave staking-about 28,000 to 28,600 validators, each with a stake of 32 ETH, worth a tidy sum of $3.8 billion to $4.0 billion, with ETH prices hovering near $4,200 to $4,300 per coin. 💸📈

The wait for full withdrawal has stretched to a weary 15 to 16 days, with a withdrawal-sweep delay of roughly 9.4 days. Processing is pinned at protocol capacity, with exits effectively capped near 1,875 validators per day to keep the network steady. ⏳🔄

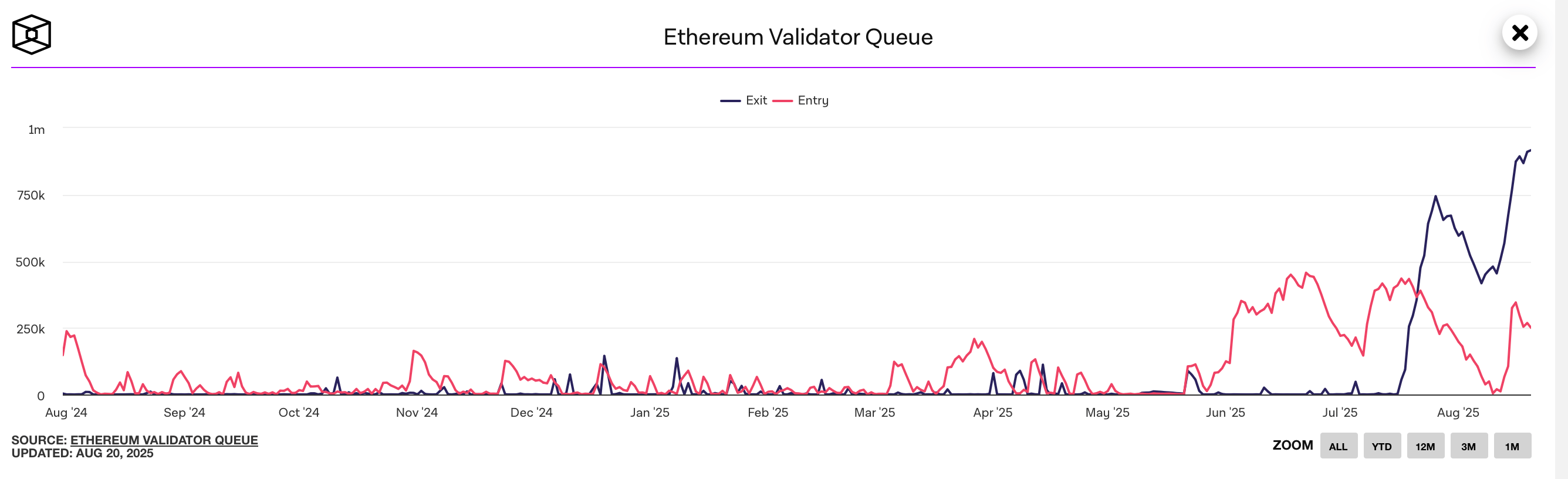

The queue swelled in recent weeks like a greedy ogre, devouring more ETH each day. Late July showed about 520,000 ETH waiting, climbing to roughly 693,000 by July 25, and so on-until it hit a record-breaking 910,461 ETH on Aug. 18-19. The subject is also a hot topic on social media channels like X. 🧙♂️💸

Though exits sped up, staking did not stop-like a merry-go-round that never slows down. An entry queue of about 230,000 to 268,000 ETH-waiting three to four days-signals steady interest in joining the validator set. Many believe the main driver is ETH’s price, with holders opting to cash out like mischievous children grabbing candy. 🎉💸

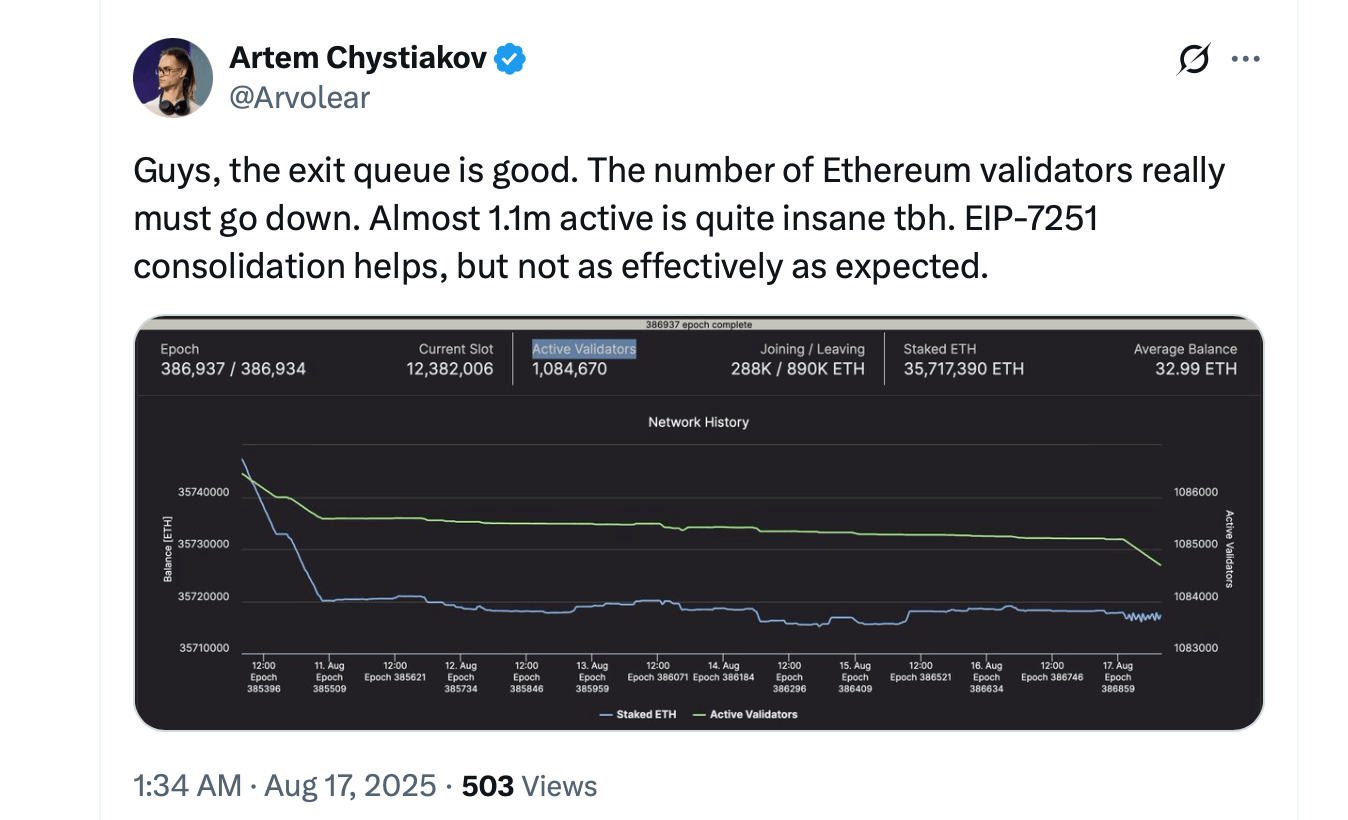

Altogether, Ethereum’s active validator count sits near 1.08 million, with about 35.5 million to 35.6 million ETH staked-around 29% of the circulating supply. This forms the base from which the exit churn limit is calculated. The protocol’s guardrails scale with the active validator total to avoid abrupt shifts in the set. 🧠💸

Over the past week, net staked ETH fell by roughly 43,900 ETH (about $178 million), yet total staked balances remain broadly steady as entry and exit flows offset. The figures show no clear increase in exchange inflows that would point to immediate, large-scale selling. At press time, ETH is exchanging hands for around $4,278 per coin. 💸📉

Many observers tie the elevated queue to several forces-profit-taking after ETH’s price strength, validator consolidation, rotation into restaking, and liquidity prep around potential staking-enabled products-all within the protocol’s planned exit constraints. 🧠💸

In short, the record exit queue reflects Ethereum’s throttled withdrawal design: processing runs at capacity, entry demand persists, and staking participation stays high even as withdrawals make their way through the system. ⏳🔄

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- TAO PREDICTION. TAO cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

2025-08-20 20:08