Ethereum, that sprightly young scamp of the crypto world, took a most undignified tumble below the $2,800 mark-rather like a chap slipping on a banana peel outside the Drones Club. It did manage to pull itself together with a hasty bounce toward $2,900, but the whole affair had all the stability of a soufflé in a hurricane.

Volatility, that fickle mistress, has been dancing the Charleston with sentiment, leaving Ethereum in a spot where the next few weeks could determine whether 2026 is a year of champagne and caviar or bread and water. The bulls, bless their optimistic hearts, are attempting to reclaim lost territory, but their efforts thus far resemble a man trying to herd cats-admirable in theory, futile in practice.

To add insult to injury, the Coinbase Premium Index-a sort of financial barometer for discerning whether American institutions are feeling flush or frugal-has slumped to a positively Dickensian -0.08, its lowest since early 2023. This, as any self-respecting market observer will tell you, suggests that Ethereum is currently about as popular with US institutions as a rainy Bank Holiday.

The Coinbase Conundrum: A Tale of Two Exchanges

CryptoQuant, those tireless scribes of the digital ledger, have sounded the alarm with all the subtlety of a fire engine at a funeral. The Coinbase Premium Index, which measures the difference between Ethereum’s price on Coinbase (favored by the Wall Street set) and Binance (beloved of retail traders and whales with more money than sense), is flashing redder than a sunburnt tourist.

In layman’s terms, this divergence suggests that while Binance’s global rabble are propping up Ethereum’s price like a crowd of well-meaning but slightly tipsy pallbearers, the Yanks have decided to sit this one out. And since nothing good ever happens in crypto without Uncle Sam’s enthusiastic participation, this does not bode well.

The current state of affairs is rather like throwing a party where only half the guests show up-technically still a gathering, but lacking that certain je ne sais quoi. Without the Americans, Ethereum’s rallies have all the staying power of a New Year’s resolution.

Ethereum’s Precarious Perch

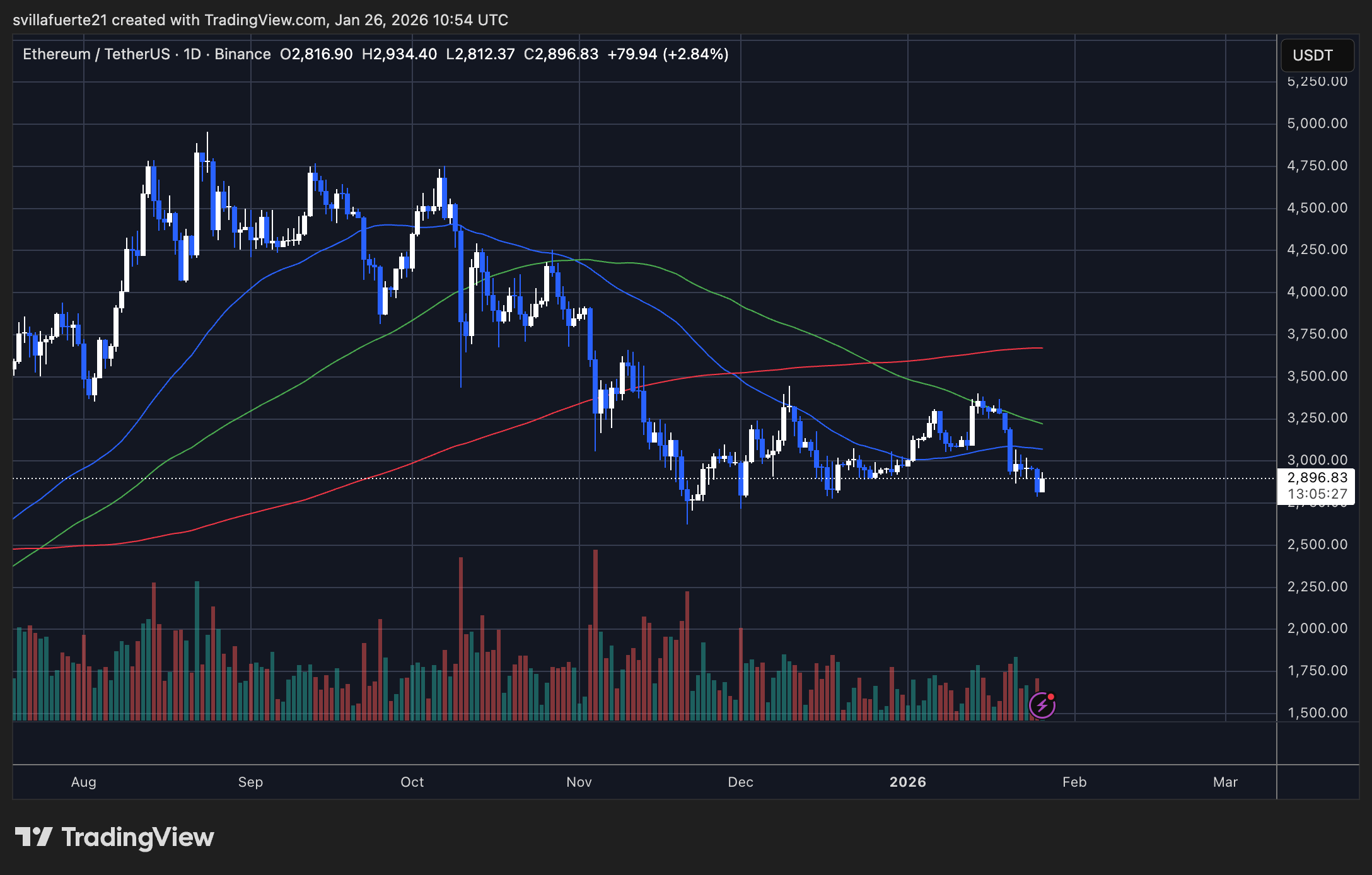

At press time, Ethereum was wobbling around $2,897, like a debutante attempting to balance a champagne flute on her head after one too many. The recent breakdown below $2,800 was swiftly reversed, but the whole episode left ETH looking about as robust as a house of cards in a stiff breeze.

Technically speaking-and we do so hate to be technical-Ethereum remains below its key moving averages, which is rather like a racehorse trailing the pack. The 50-period MA (blue, for those keeping score) looms overhead like a disapproving aunt, while the 100-period MA (green, if you must know) slopes downward with all the enthusiasm of a man facing a dental appointment.

The 200-period MA (red, naturally) still offers some support, like a faithful butler holding an umbrella over his master during a downpour. But if ETH fails to rally soon, the next stop could be $2,750-a destination about as appealing as a weekend in Bognor Regis.

For the bulls, the path forward is clear: reclaim $3,000, then charge toward $3,250 like a cavalry regiment on the offensive. Failure to do so may leave Ethereum looking about as lively as a fish on a Friday.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- Of Course a Digital Token I Don’t Own Is Suddenly the Belle of the Ball

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Gold Rate Forecast

- Mantle (MNT): The Blockchain That Became a Titan with USD1 & Real-World Assets 🚀

- Gold-Backed Crypto Coins Land on Polygon – But Why? 🤔💰

- Bitcoin’s $100K Break: A Spiritual Crisis? 😱🧠💸

- XRP: A Most Disappointing Turn of Events! 📉

2026-01-27 04:17