In the grand theater of the markets, where the curtain rises and falls with the whims of the invisible hand, Ethereum stands as a stoic actor, its price hovering above the $4,300 mark, a testament to resilience amidst the cacophony of pullbacks. The air is thick with anticipation, as if the very fabric of the financial world holds its breath, awaiting the next act in this absurdist drama. 🌪️

The Market’s Unyielding Embrace: Ethereum’s Odyssey

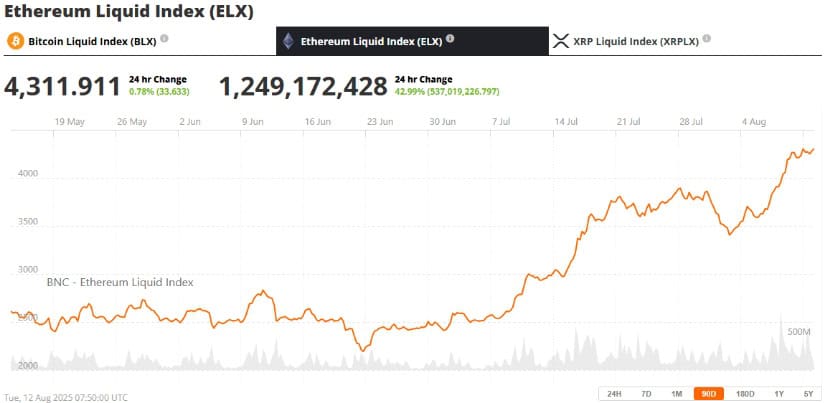

Ethereum, that digital Prometheus, has risen from the ashes of July’s lows near $2,380, ascending to heights unseen since the last cycle’s zenith. Its breakout above the $4,000-$4,100 supply zone on the weekly chart is not merely a technical triumph but a metaphysical shift, a rebellion against the gravity of bearish sentiment. And yet, in this triumph, there is a quiet irony-the higher it climbs, the more it invites scrutiny, like a man on a scaffold, both admired and judged. 🧐

On the 4-hour chart, ETH dances within a rising wedge, a pattern as precarious as a tightrope walker’s balance. Immediate resistance at $4,352.88 looms like a specter, while support at $4,232.38 stands as a fragile lifeline. The 20-EMA and 50-EMA, at $4,194.45 and $4,011.90 respectively, trail behind like loyal but weary companions, their bullish structure a silent testament to the market’s unspoken faith. 📈

A 4H close above $4,352 could unleash a torrent, propelling ETH toward $4,460, and eventually the $4,800 “weak high” liquidity zone-a threshold as tantalizing as it is treacherous. But in this game of financial chess, every move is both a step forward and a potential misstep. ♟️

The Corporate Titans: Hoarding Ethereum Like Digital Manna

While the US-listed spot Ethereum ETFs gather assets with the diligence of ants, corporate treasuries emerge as the true leviathans of ETH accumulation. Companies like SharpLink Gaming and BitMine Immersion Technologies hoard Ethereum with a fervor that borders on the comical, their reserves swelling like the bellies of gourmands at a feast. Direct holdings, it seems, are the new black, and ETFs the passé accessory. 🤑

“Publicly traded ETH treasury companies can stake their holdings and participate in DeFi, generating yield on top of price appreciation-something US spot ETFs cannot do,” proclaims Geoffrey Kendrick, Global Head of Digital Assets Research at Standard Chartered, with the air of a prophet unveiling divine secrets. Since June, these corporate behemoths have purchased nearly as much ETH as all US-listed ETFs combined, their collective grasp now controlling 1.6% of Ethereum’s circulating supply. A small fraction, perhaps, but one that carries the weight of a thousand whispers. 🤝

Technical Whispers: The Breakout’s Siren Call

Ethereum’s RSI on the 30-minute chart stands at 55.10, a number as neutral as a Swiss diplomat, while the Money Flow Index (MFI) at 68.17 hints at capital inflows approaching the precipice of overbought territory. The Bollinger Bands on the 4H chart frame the price like a portrait, trading between the midline ($4,232.38) and the upper band ($4,352.88). A breakout above the upper band would be a clean break, a rebellion against the confines of the wedge, as dramatic as a prisoner escaping his cell. 🕊️

Spot exchange data from Coinglass reveals net inflows of $842,850 on August 12, a testament to the buying interest between $4,250 and $4,300. This trend suggests that dips toward support are not mere retreats but invitations, as if the market itself is saying, “Come, take my hand, and rise again.” But in this dance, every step is a gamble, every rise a potential fall. 🎢

The Horizon: $5,000 and the Promised Land Beyond

Analysts, those modern-day soothsayers, argue that sustained closes above $4,200 on both daily and weekly timeframes could position ETH for a swift march toward the $4.5K-$5K region. A decisive breakout past $5,000 may then open the path toward the cycle target of $10,000, a number as mythical as it is coveted. Strong fundamentals, growing institutional interest, and Layer 2 ecosystem growth form the pillars of this optimistic narrative, yet one cannot help but wonder: is this the dawn of a new era, or merely the calm before the storm? 🌅

With the broader market heating up and Ethereum maintaining its throne as the leading smart contract platform, the next breakout could define the remainder of this bull cycle. But in the grand scheme of things, is this not just another chapter in the endless saga of human greed and ambition? Ethereum’s price today reflects consolidation after a strong rally, yet the technical and fundamental backdrop leans bullish, like a ship setting sail into uncharted waters. Traders, those eternal optimists, will watch closely to see if $4,350 can be breached in the coming sessions. But in the end, are we not all just passengers on this wild ride, clinging to hope and humor in equal measure? 🚀

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- Will the Bank of England’s Stablecoin Limits Stick? 🤯🤑

2025-08-12 23:22