In a twist that would make even the most seasoned poker player raise an eyebrow, an early Ethereum investor has apparently decided to cash in their chips, transferring their massive haul of ETH to a centralized exchange. The sell-off? A jaw-dropping $274 million profit! Talk about a strategic exit-if only my exit strategy from the gym could be so lucrative! 💸

As this digital drama unfolds, Ethereum (ETH) finds itself under pressure from US institutional investors who seem to be playing a game of financial chicken. Yet, amidst the chaos, some market analysts remain cheerfully optimistic about the second-largest cryptocurrency, probably while sipping chai lattes and discussing blockchain over brunch.

Ethereum OG Whale Exits With a Whopping 344% Gain

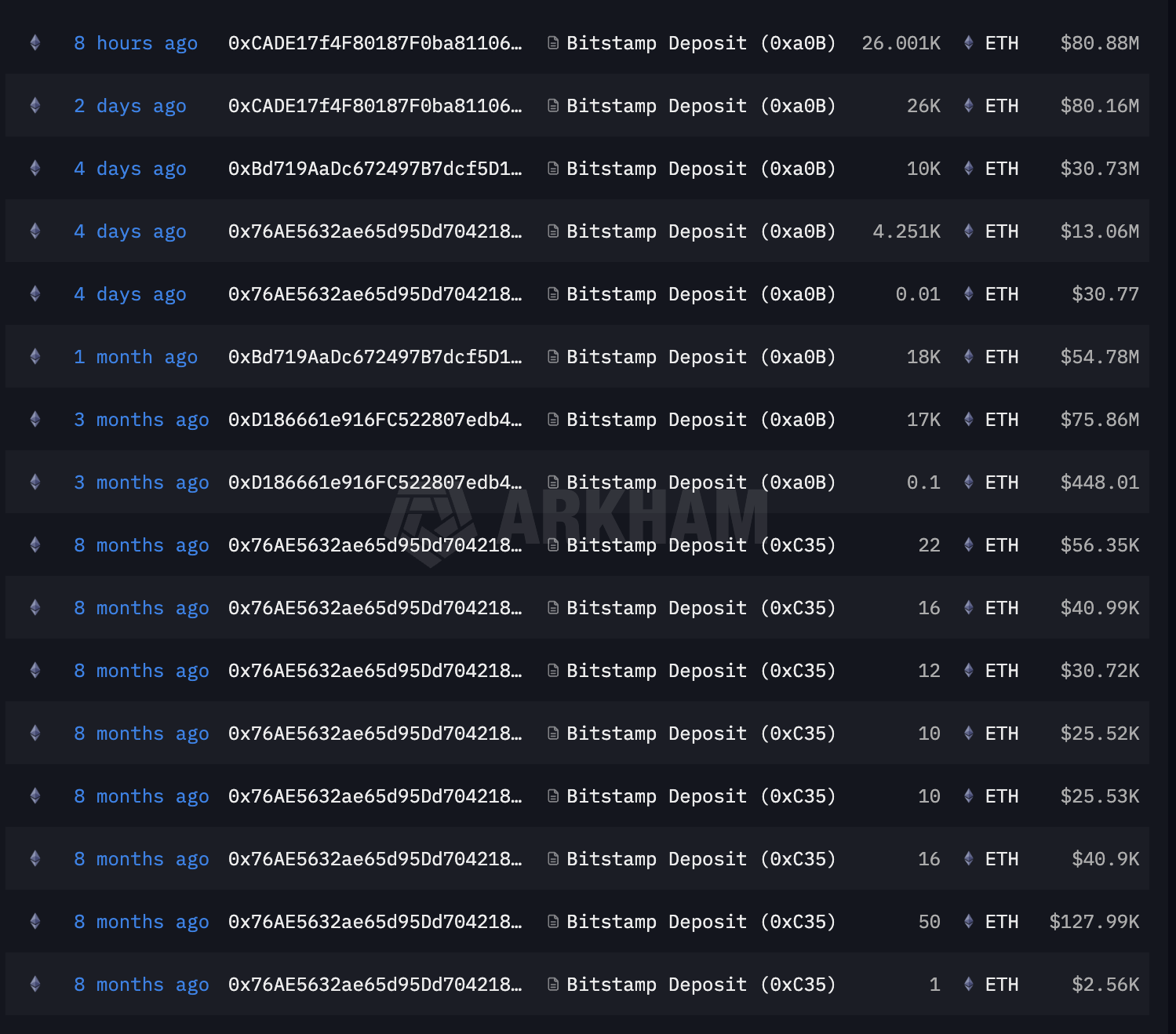

According to our friends at Lookonchain, this whale of a person-let’s call them “The Ether Sultan”-scooped up an eye-watering 154,076 ETH at an average price of $517. Recently, the Sultan started sending ETH off to Bitstamp, like a digital Santa delivering presents (or maybe just cashing out). 🎅💰

“In the past two days, they parked another 40,251 ETH ($124 million) into Bitstamp and still hold 26,000 ETH ($80.15 million),” Lookonchain posted on January 10. That’s right, folks-talk about a holiday haul!

Just a few hours ago, the Sultan made their final transfer of 26,000 ETH to the exchange. The total profit? A staggering $274 million, which is approximately 344% gain. If only my stock portfolio could boast such impressive numbers! 📈

These latest moves are reminiscent of a well-planned heist, starting with a mere 137 ETH sent to Bitstamp eight months ago. The plot thickened three months back with a hefty 17,000 ETH transfer, followed by another 18,000 ETH about a month ago. Clearly, this is less “panic sell” and more “slow and steady wins the race.” 🐢

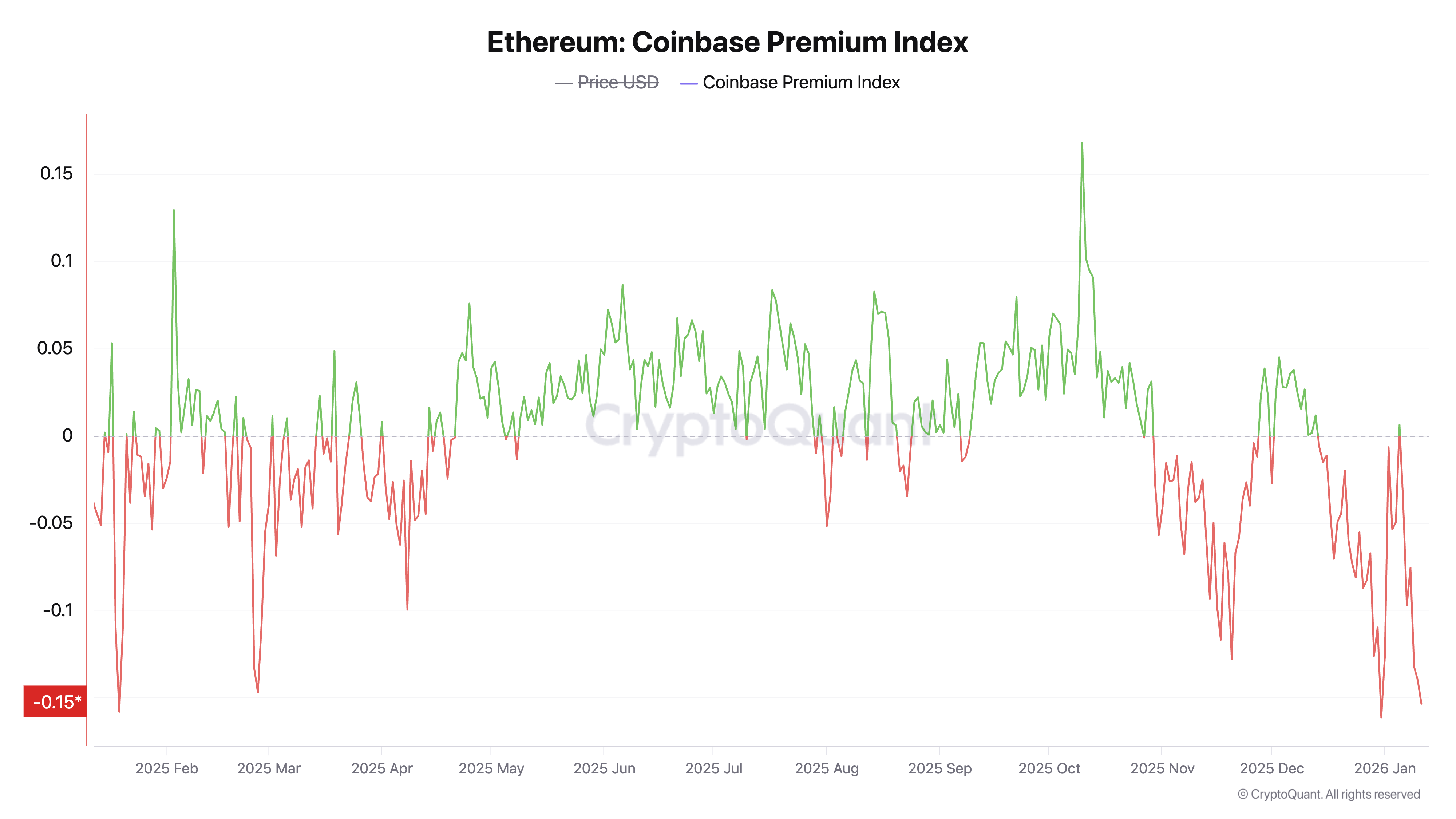

The timing of this grand exit aligns perfectly with signs of institutional caution-a bit like a storm warning for cryptocurrency enthusiasts. The Coinbase Premium Index for ETH is looking decidedly negative, indicating that ETH is trading at a discount on Coinbase compared to its offshore pals. It’s like finding out you could’ve bought your favorite sneakers for half the price if you’d only shopped internationally! 🏷️

Is Ethereum “Undervalued?”

Despite all this selling pressure that feels like a financial weight loss program, some analysts are waving their pom-poms for ETH, cheering from the sidelines. Quinten François boldly claims that Ethereum is “massively undervalued,” like that hidden gem in the thrift store everyone wishes they had found first. 🛍️

$ETH is massively undervalued

– Quinten | 048.eth (@QuintenFrancois) January 11, 2026

Milk Road chimed in, noting that the volume of economic activity settling on Ethereum has been booming, even as ETH’s price seems to have taken a leisurely stroll in the opposite direction. It’s like watching a sprinter run by while you’re stuck in traffic! 🚦

The analysis highlights that large investors are still prioritizing Ethereum for its reliability, liquidity, and regulatory clarity-because who wouldn’t want their investments to come with a side of legality?

“As more activity moves on-chain, transaction volume and fee generation increase, raising the economic weight placed on Ethereum’s base layer. When usage stays high, ETH has historically struggled to remain flat for long. We will go higher as adoption continues. Always zoom out,” Milk Road stated, possibly while gazing dreamily at their charts.

From a technical perspective (which sounds awfully fancy, doesn’t it?), analysts are spotting patterns that suggest a price recovery might be on the horizon. 🧐

$ETH looks ready to move higher.

The falling wedge and channel are broken.

Consolidation is complete and the target sits above $4,400.

Do not overthink it. The trend has shifted.

– Crypto King (@CryptoKing4Ever) January 10, 2026

So, here we are in the wild world of Ethereum: a tug-of-war between short-term selling panic and long-term market confidence. With early adopters making their exits and a grim Coinbase Premium looming large, the landscape remains as complex as a Rubik’s cube after a few too many cocktails. Whether ETH’s price will eventually align with these fundamentals? Stay tuned, folks! 🎢

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- XRP Staking: A Tale of Tension and Tokens 🚀

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

- Bitcoin’s Dramatic Fall Puts Strategy’s Holdings in Crisis Mode! What Happens Next?

2026-01-12 08:03