Oh, Ethereum, you sly old fox! 🦊 Just when the bears were sharpening their claws and preparing to feast on your carcass, you’ve gone and done something rather cheeky. Is it a trap? A ruse? Or just a spot of good old-fashioned market mischief? Let’s dive in, shall we?

The chatter around Ethereum’s price has reached fever pitch-will it break $4,000, or is another collapse brewing? Spoiler alert: the bears seem to be winning this round (for now). Over the last 7 days, the ETH price has shed more than 8.6% and currently trades around $3,533, still 27.1% off its all-time high. Cue the violins. 🎻

But hold your horses-or should I say, hold your honey pots? 🍯 Beneath the surface, the data paints a different picture: one where the smart money may have already set the trap. Three clear signals and a bullish pattern suggest Ethereum’s recent breakdowns might be nothing more than an orchestrated bear trap. Oh, the drama! 🎭

Whale and Retail Concentration Flip Bullish

Ah, the whales-the titans of the crypto sea 🐋. The first signal comes from Ethereum’s on-chain concentration metrics. Over the last 30 days, whale holdings have risen by 1.82%, while retail wallets (small holders) have increased exposure by 1.87%. In most cases, whale moves end up outweighing investor and retail movements due to the sheer size of trading. Because, of course, whales are not known for their subtlety.

And this time, it seems that retail is following the ETH whales, possibly leaving investors or mid-size folks in a trap of sorts. Poor dears, caught between a rock and a hard place-or should I say, between a whale and a shoal of minnows? 🐟

Interestingly, mid-size investor wallets have offloaded, potentially hinting at redistribution toward the extremes; whales and retail, two groups known for having very different motives, but both seem confident here. One wonders if they’re whistling past the graveyard or genuinely onto something. 🕵️♂️

Adding weight to this view is IntoTheBlock’s Bull vs Bear address chart, which doesn’t use typical sentiment metrics. Instead, it tracks wallet behavior: bulls are those that have bought over 1% of daily traded volume, while bears have sold at least 1%. Ah, the eternal battle of the bulls and bears-a crypto colosseum! 🏟️

Over the last 7 days, bulls outnumber bears by 7: a slim edge, but enough to suggest conviction is leaning toward accumulation, not distribution. Accumulation, you say? How terribly civilized. 👌

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. Because who doesn’t love a bit of financial gossip with their morning tea? ☕

Long/Short Account Ratio Shows Traders Leaning Bullish

Despite the sideways action and frequent dips, traders haven’t flipped bearish yet. According to Binance’s long-short account ratio, Ethereum’s metric currently stands at 1.91, meaning there are nearly twice as many long accounts as short ones. Twice as many! One can almost hear the bears gnashing their teeth in frustration. 😤

It’s important to note: this isn’t the same as the long/short position volume ratio. The account ratio measures the number of user accounts holding long vs. short positions, not just trade size. So, no, this isn’t just some flash-in-the-pan statistic-it’s cold, hard evidence that traders expect upside continuation, even as the price chops around near key resistance. Historically, similar ratios have held just before major directional moves. Major directional moves, you say? Do tell! 📈

Bullish Triangle Still Intact After Testing Key Ethereum Price Support

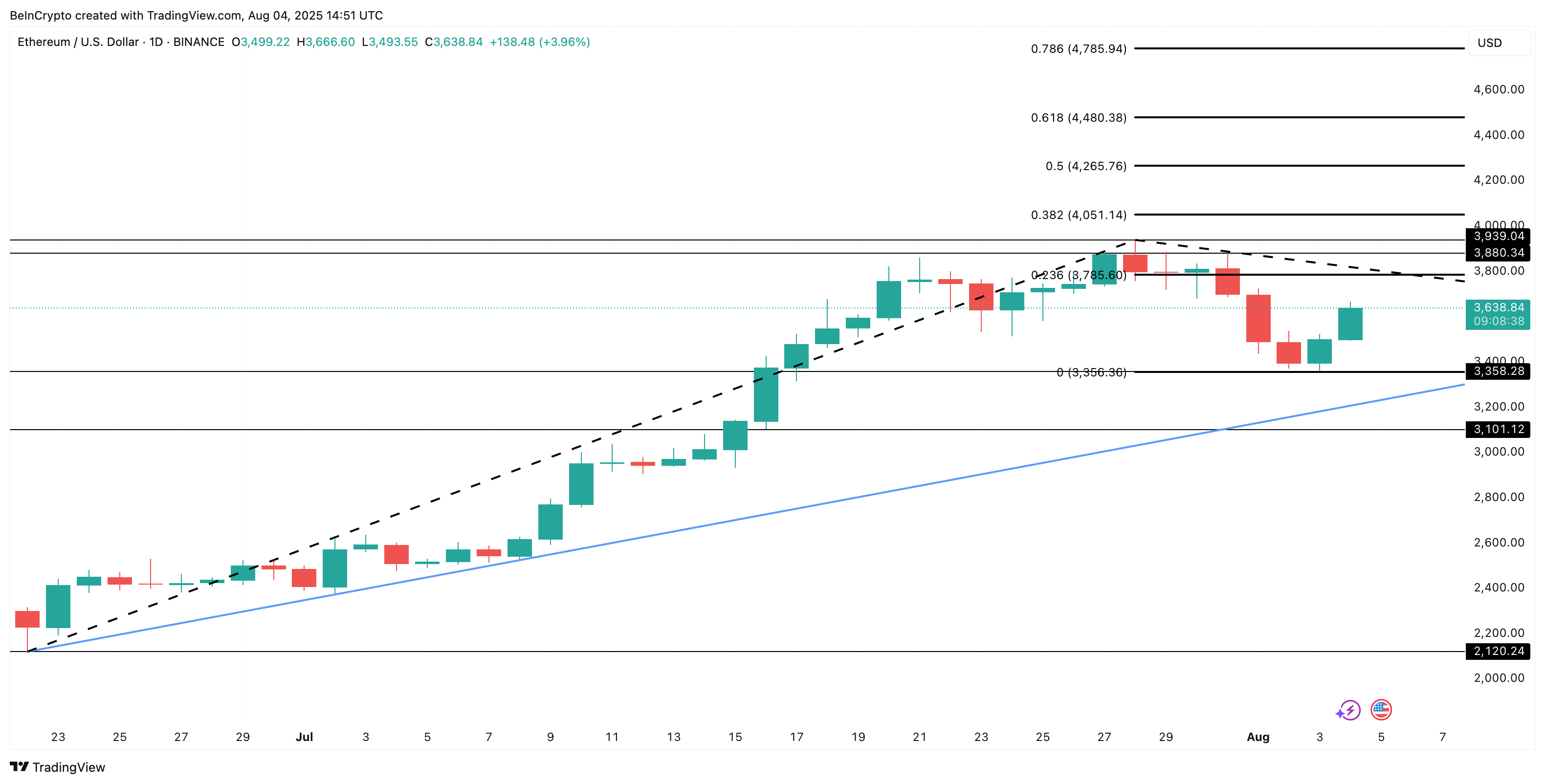

The most visually telling part of the Ethereum price structure is its bullish (ascending) triangle pattern on the daily chart. After an explosive move from the $2,120 low to $3,939, Ethereum entered a tight consolidation range. The 0.236 Fibonacci trend extension level, or the $3,785 price level, tried offering support but was quickly broken. Oh, the indignity! 😩

A long red candle followed, corresponding to the timeframe when ETH short positions took center stage. Even ETH selling intensified post the drop, with traders supposedly assuming that even the $3,356 support would be broken. And guess what, that support line was tested briefly. 🤔

The line was tested yesterday, aligning with the Smart Trader opening a short position. But then, the price rebounded, and would have already liquidated the trader. One bear trapped! Poor chap, he probably thought he was onto something clever. 🐻❄️

It won’t be wrong to assume that many similar short positions were opened. Ah, the sweet smell of schadenfreude! 🍬

Smart trader 0xCB92 is doubling down on his $ETH short!

His position has now reached 50,000 $ETH($171.7M) with over $10M in unrealized profit.

Liquidation price: $3,634.

– Lookonchain (@lookonchain) August 3, 2025

However, if the daily candle closes above $3,785, ETH price might just have the legs to test $3,939 and then $4,051, with the move to the latter qualifying as a clean breakout. Legs, you say? Surely you mean wings! 🦅

But then, if the key support of $3,356 is ultimately broken, the bullish hypothesis gets invalidated. Oh, the suspense! It’s enough to make one reach for the smelling salts. 🫠

Read More

- Brent Oil Forecast

- Gold Rate Forecast

- Silver Rate Forecast

- SEI PREDICTION. SEI cryptocurrency

- HYPE’s Chaotic Dance: Support or Surrender? 🐸📉

- BTC PREDICTION. BTC cryptocurrency

- EUR THB PREDICTION

- SOL AUD PREDICTION. SOL cryptocurrency

- JPY KRW PREDICTION

- WLD PREDICTION. WLD cryptocurrency

2025-08-05 03:28