Analysts, those brave souls who stare into the abyss of charts and whisper back predictions, have noticed Ethereum might be attempting a delicate waltz toward $4,440. Why? Because technical patterns, large-scale purchases, and a suspiciously gold-like breakout (complete with glittering charm) suggest it might just happen. Or, you know, the universe could collapse. Either way, here we are.

Ethereum Mirrors Gold’s Breakout

Market strategist Merlijn the Trader, who probably owns a pet owl named Fibonacci, has declared Ethereum’s price action a “striking resemblance” to gold’s 2024 breakout. “Gold led. Ethereum followed. Same pattern. Same setup,” he said, as if he’d just discovered fire. Historians of finance, take note: this is how empires rise-or at least, how crypto wallets swell.

Ethereum’s correlation with gold hit 0.7 in Q3 2025, thanks to ETFs and DeFi ecosystems growing like mold on a forgotten cheese. Analysts, now sounding like fortune tellers with spreadsheets, say if this continues, Ethereum might join the five-digit club. But beware! The Federal Reserve, that ancient dragon of interest rates, could still breathe fire and ruin everyone’s day. 🐉

Bitmine’s $250 Million Ethereum Buy Signals Institutional Confidence

Institutional investors, those financial knights in shining armor, are still buying Ethereum like it’s the last loaf of bread in a post-apocalyptic world. Bitmine Immersion Technologies recently added 63,539 ETH to its hoard-$251 million worth-drawing inevitable comparisons to MicroStrategy and Bitcoin. “It’s like the Discworld’s version of a dragon hoarding coins,” one analyst muttered, “but with more decimal places.”

Bitmine now controls 3 million ETH, or about 2.7% of the circulating supply. That’s enough to make even the most stoic economist raise an eyebrow. Tom Lee, a market oracle with a penchant for charts, insists ETH is undervalued. “It’s like buying a used car for $100,” he said. “Or, you know, a blockchain-based toaster.”

Technical Outlook: $4,440 in Focus

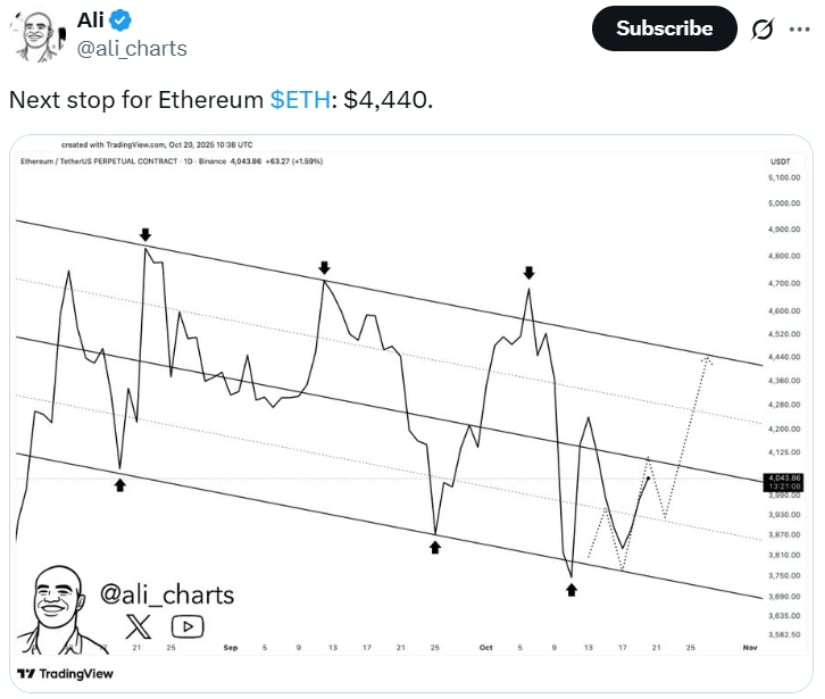

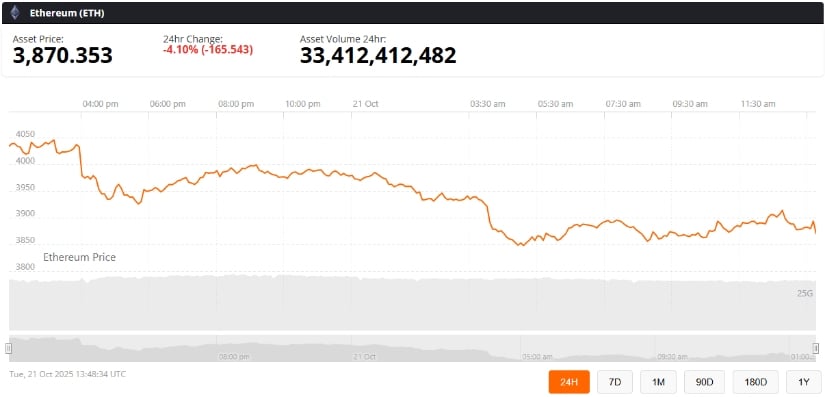

Technically speaking, Ethereum is currently playing a game of “touch the ceiling” with resistance at $4,440. Analyst Ali (@ali_charts), whose Twitter feed is 90% charts and 10% existential dread, noted that ETH broke a descending trendline. Support near $3,800 is holding, like a knight guarding the last bridge to Camelot. But don’t get too comfortable-ETH briefly hit $4,044 before retreating to $3,870 on October 21, because volatility is the truest companion of crypto. 📊

If support levels around $3,800 and $3,600 hold, Ethereum might just reach $4,440. But if they crumble, well… let’s not think about that. The market is like a cat with a laser pointer-unpredictable and slightly maddening.

Market Sentiment and Outlook

Ethereum’s long-term outlook is cautiously optimistic, which is code for “we’re all holding our breath and hoping for the best.” ETF inflows, DeFi adoption, and institutional love are creating a “positive medium-term view.” But short-term corrections? Oh yes. The market is a rollercoaster, and you’ve just bought a ticket for the “loop the loop of despair.”

Some analysts predict ETH could hit $4,800-$5,000 if macroeconomic conditions stay kind. But watch out for regulatory dragons in the U.S. and Europe. They like to hoard power and occasionally throw compliance bombs. 💣

Final Thoughts

Ethereum’s recent gold-like breakout and Bitmine’s treasure trove of ETH suggest a bullish future. But remember, short-term swings are part of the package. Technical trends and investor confidence point to $4,440, but the market is still a circus where the clowns are all wearing suits. 🎩🎪

Investors, keep an eye on support levels and the whims of macroeconomic gods. And if Bitmine keeps hoarding ETH, maybe they’ll start calling it “the new gold.” Or maybe not. The Discworld of finance is full of surprises. 🌌

Read More

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Of Course a Digital Token I Don’t Own Is Suddenly the Belle of the Ball

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- Mantle (MNT): The Blockchain That Became a Titan with USD1 & Real-World Assets 🚀

- NFTs Are Back! The Comeback You Didn’t See Coming 😂📈

- Blockheads at UGM: Beans & Blockchain Edition 🌾

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

- Bitcoin’s $100K Break: A Spiritual Crisis? 😱🧠💸

- Bitcoin’s Wild Surge: 3 Reasons Behind the $91K Miracle! 🚀

2025-10-22 00:57