Oh, the irony! For the first time in the 18-month saga of US spot-crypto exchange-traded funds, Ethereum has wrested the crown from Bitcoin. Yes, you heard it right—Ethereum, that “other” crypto, siphoned off more institutional cash than its golden sibling. According to SoSoValue (because apparently we need analysts to tell us these things), Thursday saw $602 million flow into Ethereum ETFs, leaving Bitcoin’s $522.6 million inflows coughing in the dust. Truly, a David-versus-Goliath moment—if Goliath had been napping on his throne. 😴👑

This historic tidal wave came less than 24 hours after Ethereum ETFs shattered their own single-day record with a jaw-dropping $726 million haul. Cumulative holdings now hover just under five million ETH, while Ether’s price soared above $3,400 for the first time since January. One might say Ethereum is flexing harder than a gym bro on Instagram. 💪💸

The star of this circus? BlackRock’s iShares Ethereum Trust (ETHA). Yesterday, it gobbled up roughly $550 million, smashing its personal best—for the second day in a row, no less—and leapfrogging its Bitcoin counterpart IBIT on the leaderboard. Over the past five sessions, ETHA has hoovered up $1.25 billion and now holds nearly $7 billion worth of ETH. That’s almost one-fifth of all assets parked in US Ethereum ETFs. If ETFs were a popularity contest, Ethereum would be prom king. 👑🎉

Bloomberg Intelligence analyst James Seyffart chimed in on X (formerly Twitter, but who’s counting?) to put things into perspective: “The US spot Ether ETFs have raked in over $5.5 billion since launch, including more than $3.3 billion since mid-April.” He pointed out that part of this allure stems from double-digit cash-and-carry basis returns on CME Ether futures. But let’s not kid ourselves; futures alone don’t explain this feeding frenzy. His chart of CME open interest shows not only a sharp climb in ETH terms but also dollar-value figures starting to rival early-2025 Bitcoin futures activity. It seems even Wall Street can’t resist Ethereum’s charm offensive. 📈🔥

And guess what? The fun doesn’t stop there. Nasdaq has filed to add native staking to BlackRock’s ETHA. If approved, this move could let the fund earn network rewards and potentially boost its yield above 5%. Imagine an asset that grows *and* pays dividends—a unicorn in the financial world! ✨💰 Meanwhile, Bitcoin remains the heavyweight champ by sheer size, commanding over $150 billion in assets across spot BTC ETFs. Nate Geraci, president of ETF Store, tweeted that Bitcoin products logged inflows in 26 of the last 27 sessions, adding “over $10 billion” in fresh capital. Institutional money, folks. Pure and simple. Yet, Thursday’s flip in daily standings suggests Ethereum isn’t just warming the bench anymore. 🏋️♂️💼

Analysts credit Ethereum-specific catalysts for this shift: six-month highs in staking yields, whispers of SEC approval for staking-enabled ETFs by year-end, and bipartisan momentum behind bills like GENIUS and CLARITY that could cement commodity status for major cryptos. Whether Thursday marks an inflection point or merely a statistical hiccup remains to be seen. But for now, the unthinkable has happened: Ethereum ETFs beat Bitcoin ETFs. Cue dramatic music. 🎶🤯

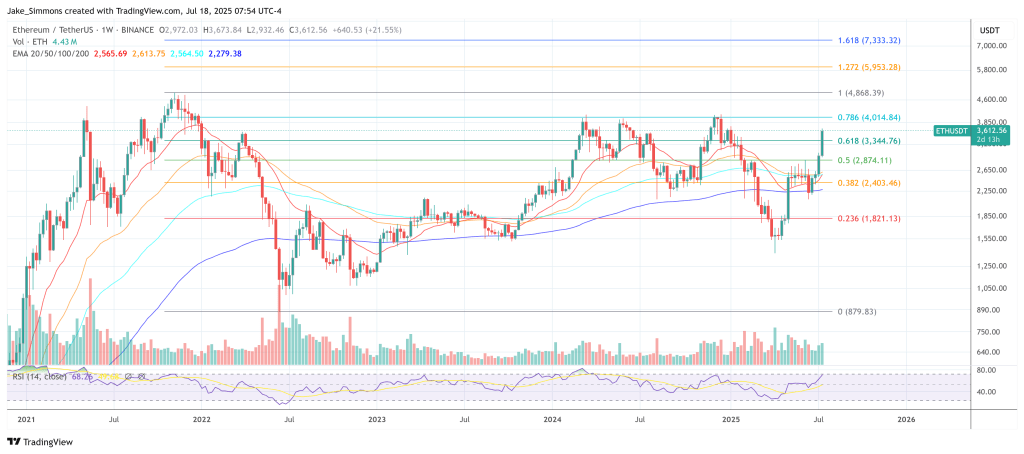

At press time, ETH traded at $3,612. Not bad for the little blockchain that could. 🚀📈

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- OKB PREDICTION. OKB cryptocurrency

- Silver Rate Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- USD GEL PREDICTION

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- Eric Trump Gets Fired Up Over 1,414 Bitcoin Acquisition – And You Should Too! 🤑💥

2025-07-19 05:43