If you thought hedge funds ruled the crypto playground, think again. Turns out, advisors have stealthily snuck past them, tossing over a cool $1.35 billion into Ethereum ETFs-because apparently, hedge funds are so last season. Over 539,000 ETH they’re sitting on, pumping up their bags like it’s the Black Friday sale of digital assets. Meanwhile, hedge funds are huddling with $688 million, trying to keep up but looking a bit out of breath.

Big Players Jump in With Sparkles and Slang

According to Bloomberg’s crystal ball, Goldman Sachs is not just a pretty face – it’s got $721 million worth of ETH, adding more than 160,000 ETH to its collection. Jane Street and Millennium are sneaking in with $190 million and $187 million like the cool kids at the party. Other heavy hitters? Capula, DE Shaw, HBK-basically the Avengers of Ethereum staking.

Here’s the top ETH ETF hoarders, because who doesn’t love a good list?

Full scoop available for Bloomberg VIPs:

– James Seyffart (@JSeyff) August 27, 2025

Some firms decided to cut back-Schofield said “bye-bye” to over 16,000 ETH, and Van Eck trimmed a little, about 2,700 ETH. Shocking, I know, but hey, not everyone’s feeling the love every day.

The Market’s Basically On Fire 🔥

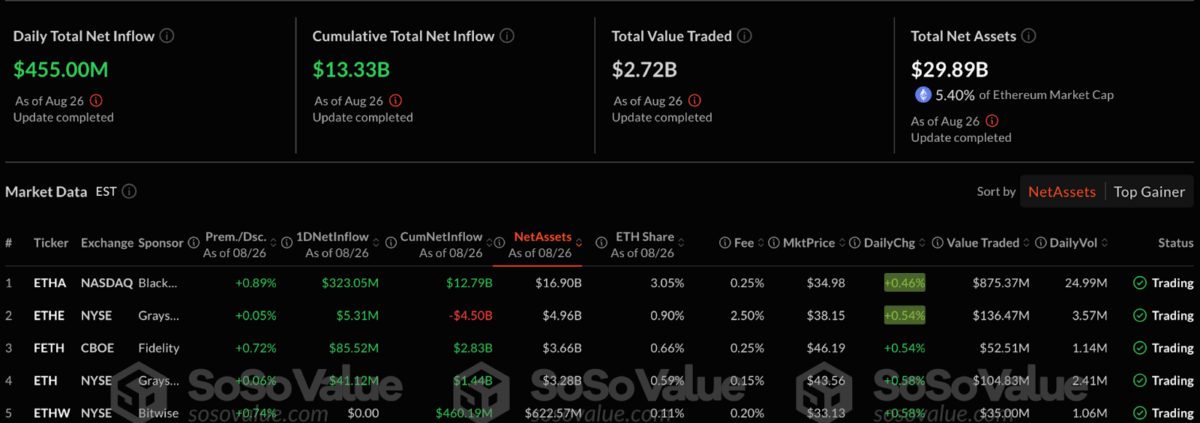

Recent numbers from SoSoValue show inflows are like that annoying relative who won’t leave the party-still strong. On August 26, spot Ethereum ETFs got a tidy $455 million boost. Since launching, they’ve cuddled up with a sweet $13.33 billion in inflows, making Ethereum some serious crypto VIP, sitting at around 5.4% of its market cap.

BlackRock’s ETH fund is basically the star of the show, with $323 million pouring in daily, pushing assets to $16.9 billion. Fidelity’s FETH isn’t far behind, grabbing $85.5 million and now nudging $3.66 billion in assets. Meanwhile, Grayscale’s ETHE is having a rough week-losing $4.5 billion in outflows, but hey, even troubled waters have their ripple moments.

The buzz? Everyone from your grandma to hedge fund whizzes is clamoring for Ethereum ETFs. The ticker tape of inflows and rising holdings just confirms Ethereum’s new status: crypto’s favorite runner-up behind Bitcoin-because what’s life without a little healthy competition?

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Ant Group’s “ANTCOIN”: Will It Conquer Crypto? Find Out What’s Next!

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- XRP Staking: A Tale of Tension and Tokens 🚀

- Bitcoin’s Dramatic Fall Puts Strategy’s Holdings in Crisis Mode! What Happens Next?

- TAO PREDICTION. TAO cryptocurrency

- Silver Rate Forecast

2025-08-27 22:13