TL;DR

- Ethereum’s been stuck in the $4K to $4.9K range, with traders on the edge of their seats. 🤨

- Exchange supply ratio plummets to record lows, which means less selling pressure than ever-fascinating, isn’t it? 😏

- Binance ETH open interest takes a 15% dive, syncing nicely with the recent 11% price drop. It’s all so *predictable*…not. 🤷♂️

Ethereum’s Latest Attempt at the Limbo: $4K or Bust

Ethereum (ETH) is chilling around $4,500 with a trading volume of $32.4 billion over the last 24 hours. It’s a bit wobbly right now, but still up 4% for the week. Classic Ethereum! It can’t make up its mind whether it wants to flirt with the $4,900 peak or get cozy at $4,000-it’s a real emotional rollercoaster. 🎢

According to Crypto Bully, the market’s been “lacklustre since the ATH sweep,” as Ethereum sways between two levels like it’s playing the world’s least exciting game of tug-of-war. Either it’ll break one of these levels or just keep dragging its feet. So, don’t get your hopes up just yet. 😬

Despite some grumbling from the price movement, ETH is still above $4,000-barely-and everything’s pretty stable for now. Short-term excitement? Not so much. Short-term pain? Probably, if that $4K support breaks. Stay tuned, folks. 📺

$ETH has been lacklustre since the ATH sweep

Broadly in a range between the ATH and the $4k level, so treat it like a range. Buy low, sell high. No big surprises unless one of these levels is shattered. 😴

Looking to…

– Crypto Bully (@BullyDCrypto) September 16, 2025

Crypto Bully also has his eye on $4,100 to $4,200, which seems like the sweet spot for now. But, wait for it-if ETH dips below $4K, prepare for the market to take a nosedive. 🛬

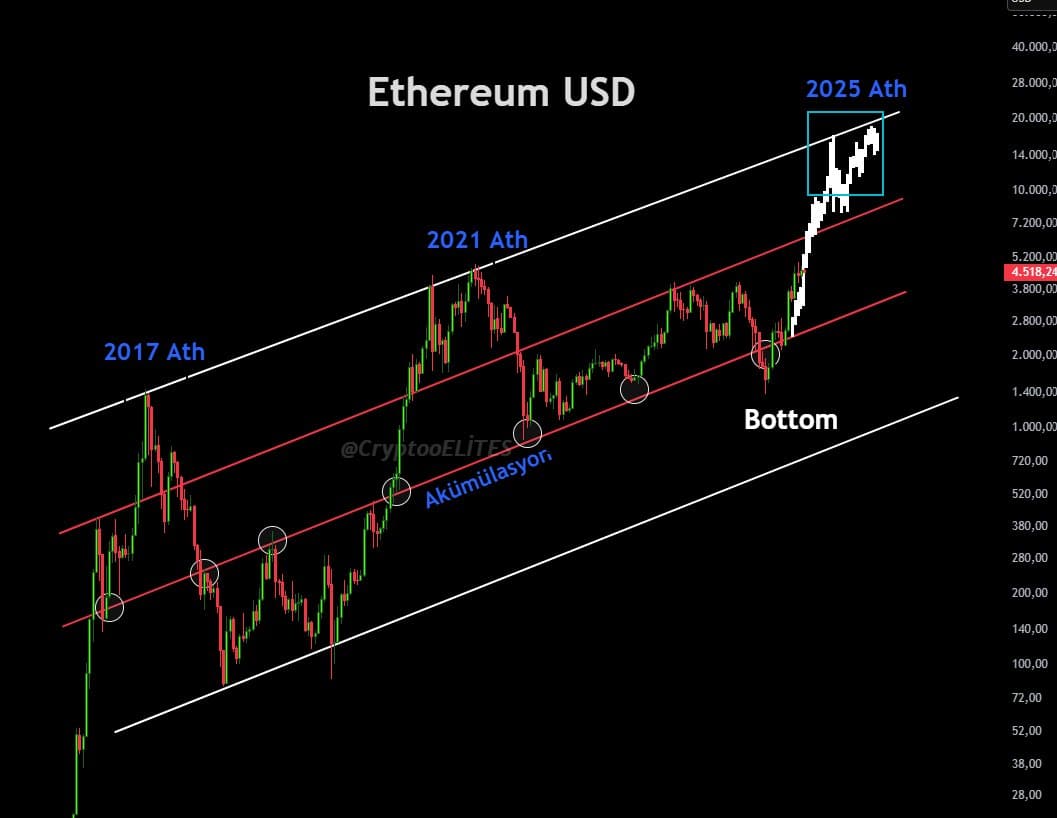

Long-Term Forecast: More Drama, Same Channel

CryptoELlTES shared a beautifully optimistic chart showing Ethereum’s price history. If the past is any indication, ETH could be lining up for a brand-new all-time high by 2025-think $15,000 to $20,000. If the rising channel holds, of course. But don’t get too attached to that idea just yet… 🤞

Exchange Supply and Open Interest: Less Drama, More Caution

Looking at on-chain data from CryptoQuant, it’s clear that ETH has been slowly disappearing from exchanges since 2020. The Exchange Supply Ratio has plummeted from over 0.30 to about 0.14-an all-time low. Where did it go? Who knows! More ETH is stashed away, keeping the drama on the down-low for now. 😶🌫️

Meanwhile, Binance’s ETH open interest (OI) is dropping like a rock-down an average of 15% over the last three months. This aligns nicely with a recent 11% dip in the spot price, proving that OI is still the market’s secret weapon for spotting local corrections. Predictable? Certainly. Thrilling? Not so much. 🧐

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- USD CNY PREDICTION

- Cronos Rises as Crypto Markets Crumble! 💸📉

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

- DOGE PREDICTION. DOGE cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

2025-09-18 07:35