In a stunning twist that would make even the most stoic of financiers raise an eyebrow, Ethereum has decided to show Bitcoin what’s what this week. Forget the old guard-ETH is rolling in ETF billions while BTC counts its dwindling millions. The times, they are a-changin’.

Rumors of Ethereum’s ETF success have been greatly exaggerated… because it’s actually happening. While Bitcoin ETFs are out here collecting pocket change like it’s loose lint in a washing machine, ETH-backed funds are raking in the big bucks. Like, real big. We’re talking $1.8 billion since August 21, according to that ever-helpful oracle, SosoValue. Bitcoin? A measly $388 million-and not all of it’s even clean money.

ET(H)Fs Are In Fashion, and BTC Got Left at the (Crypto) Ball

Ethereum isn’t just winning; it’s flaunting its victory with daily inflows so robust they’d make a Swiss banker blush. On August 26 alone, nearly half a billion dollars poured into ETH ETFs. Meanwhile, Bitcoin ETFs were busy having an existential crisis, losing $200 million on August 21-the financial equivalent of tripping over your own shoelaces in public.

And how did the market respond to this display of fiscal dominance? Oh, just gave ETH a hearty 7% price bump while BTC stumbled backward like a drunk uncle at a wedding. Yep, ETH is flexing, and everyone’s watching.

Bullish Bets & Sentiment: Traders Bet Big on Ethereum’s Comeback Tour

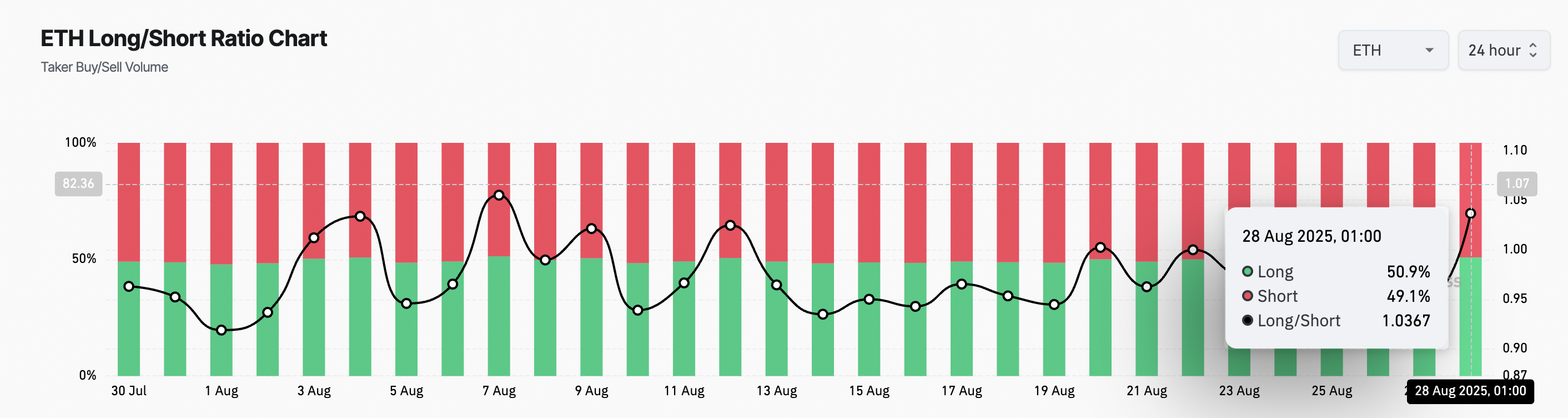

It’s not just cold, hard capital betting on Ethereum-it’s the warm, beating heart of the derivatives market too. Traders aren’t just cautiously optimistic-they’ve gone full parabolic. The long/short ratio, that trusty little barometer of greed v. fear, currently sits at 1.03. Translation: bulls are running wild, and bears have crawled under a rock somewhere.

If you’re wondering what a long/short ratio even is, relax-we’re not here to judge. Just know this: above 1 = bullish party mode. Below 1 = time to stock up on tissues and short-squeeze survival guides. ETH, for now, is all about the former.

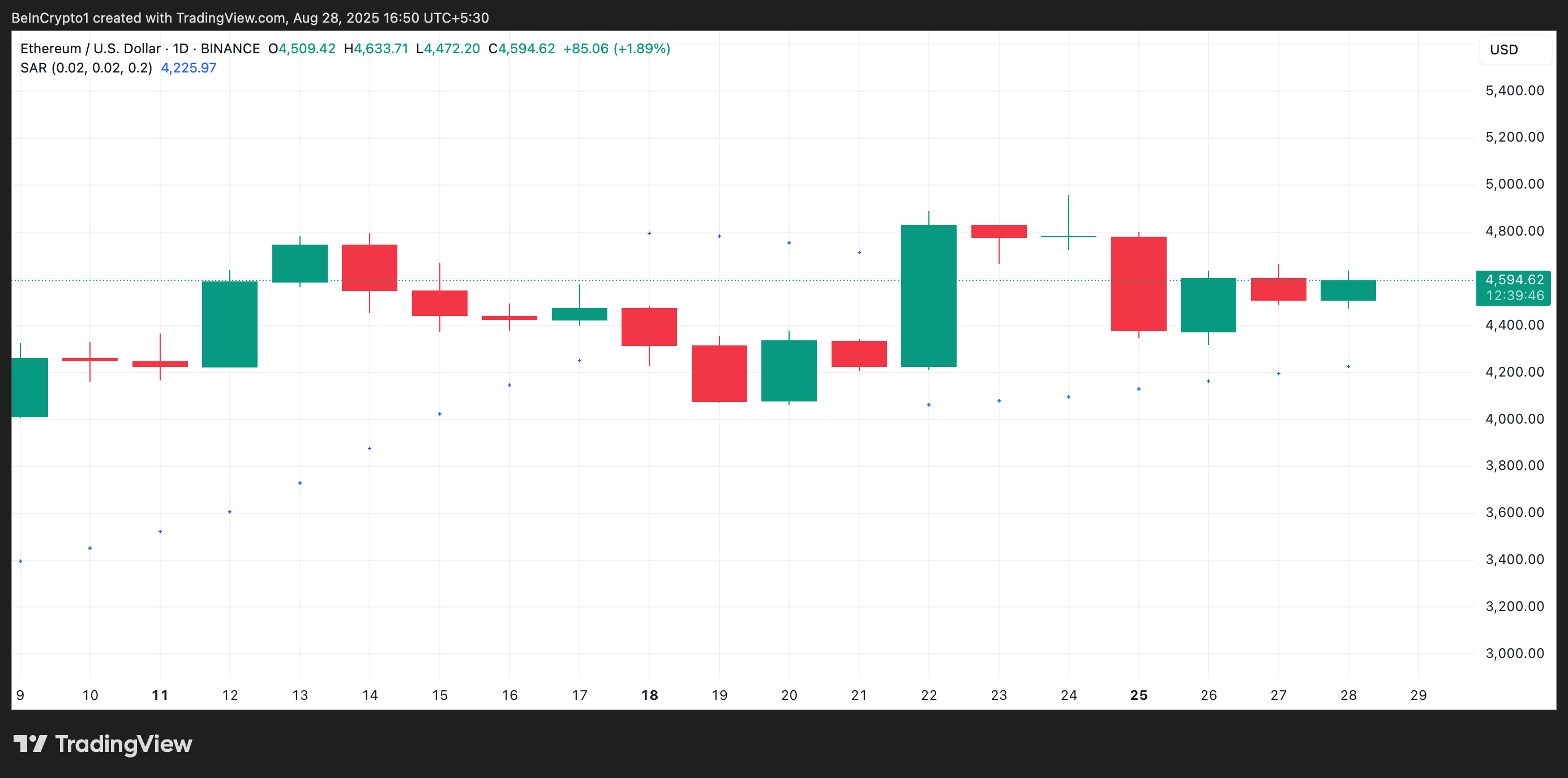

Even the charts are feeling poetic these days. Ethereum’s Parabolic SAR (no, not a new indie rock band) indicator is currently parked *under* the price-a bullish sign if there ever was one. Support at ~$4,225 isn’t a suggestion; it’s an invitation to keep buying while bears weep quietly into their laptops.

Where next? Well, if this ETF trend keeps humming along and the bulls don’t suddenly remember what “profit-taking” means, Ethereum could easily hit $4,957. Then again, should the music stop and inflows taper off faster than late-night crypto enthusiasm after a market crash, we may find ourselves eyeing that $4,221 support level with the same dread usually reserved for tax season.

For more crypto tea ☕️ and spicy chart action: Don’t forget to sign up for Harsh Notariya’s Daily Crypto Newsletter. Because who doesn’t want their inbox to be a little smarter-and a lot sassier?

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- SHIB Price Drama: Will Shiba Inu Rise from the Ashes or Plummet into Oblivion?

- BNB: To $1,000 or Total Chaos? 🤯

- XRP Price Tale: The River That Rises

- XRP Staking: A Tale of Tension and Tokens 🚀

2025-08-28 19:19