Ether exchange-traded funds (ETFs) had a wild day on Tuesday, pulling in a whopping $455 million, marking their fourth straight day of gains. Meanwhile, bitcoin ETFs managed a respectable but modest $88 million inflow.

Crypto ETF Momentum Builds: Ether Dominates With 4th Straight Inflow Day

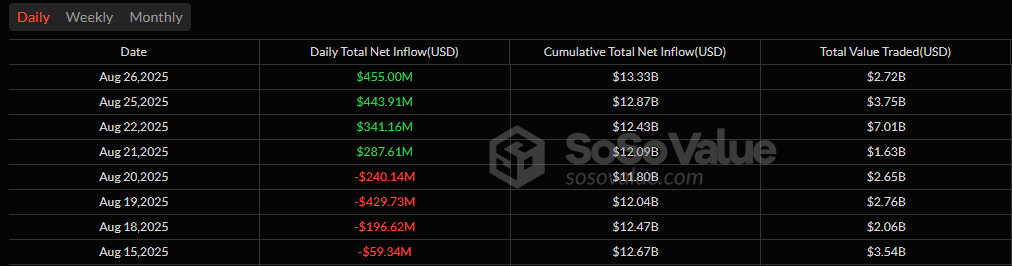

Ether ETFs are on a tear, refusing to let up. Tuesday, Aug. 26, saw the fourth consecutive day of inflows, with investors shoving $455 million into ether products. This is like a high school football team running up the score against a rival-except the rival here is bitcoin ETFs, which are just trying to keep up.

Leading the charge was Blackrock’s ETHA, which somehow managed to pull in a staggering $323.05 million. That’s more than some small countries’ annual budgets! Fidelity’s FETH wasn’t far behind with $85.52 million, and Grayscale’s Ether Mini Trust added a respectable $41.12 million. Even the flagship ETHE chipped in another $5.31 million. Notably, no ether ETF recorded outflows, which is like a basketball game where one team keeps scoring and the other just stands there, stunned. Total ether ETF trading volume hit $2.72 billion, pushing net assets to an eye-watering $29.89 billion.

Bitcoin ETFs also made a move, albeit a smaller one, drawing in $88.20 million. The flows were spread out: Blackrock’s IBIT (+$45.34 million), Fidelity’s FBTC (+$14.52 million), and Grayscale’s Bitcoin Mini Trust (+$11.32 million) did most of the heavy lifting. Bitwise’s BITB (+$9.05 million), Ark 21shares’ ARKB (+$4.05 million), and Vaneck’s HODL (+$3.92 million) rounded out the positive day. Trading activity reached $3.44 billion, with net assets holding steady at $143.15 billion.

With ether ETFs outpacing bitcoin inflows by more than 5-to-1, it’s starting to feel like a one-sided love affair. Investors seem to be smitten with ether’s ETF momentum, leaving the question: Can Bitcoin find its groove and catch up before the week is out? 🤷♂️

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Brent Oil Forecast

- Gold Rate Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Bitcoin’s Snail Pace Got You Down? 🚀 $HYPER to the Rescue!

- 🔥 XRP Staking: Firelight’s Bold Gamble Against DeFi Chaos! 🎲

- Robinhood’s Indonesia Gamble: 🤯 A Big Risk?

- USD PEN PREDICTION

2025-08-27 19:58