Oh, the drama! Ethereum (ETH) whales are swooping in like bargain hunters at a Black Friday sale, snatching up ETH as it dips below $4,000. 🛍️💸 Meanwhile, the rest of us are here like, “Is this a bear market or a clearance event?” 🤔🐻

The crypto world is split faster than a bad Tinder date. Some analysts are waving red flags 🚩, screaming “bear market!” while others are sipping champagne 🥂, whispering, “Buy the dip, darling.” Because, you know, nothing says “long-term accumulation” like a 1.84% drop in 24 hours. 📉✨

Whales: “Dip? More Like a Discount Buffet!” 🍤💰

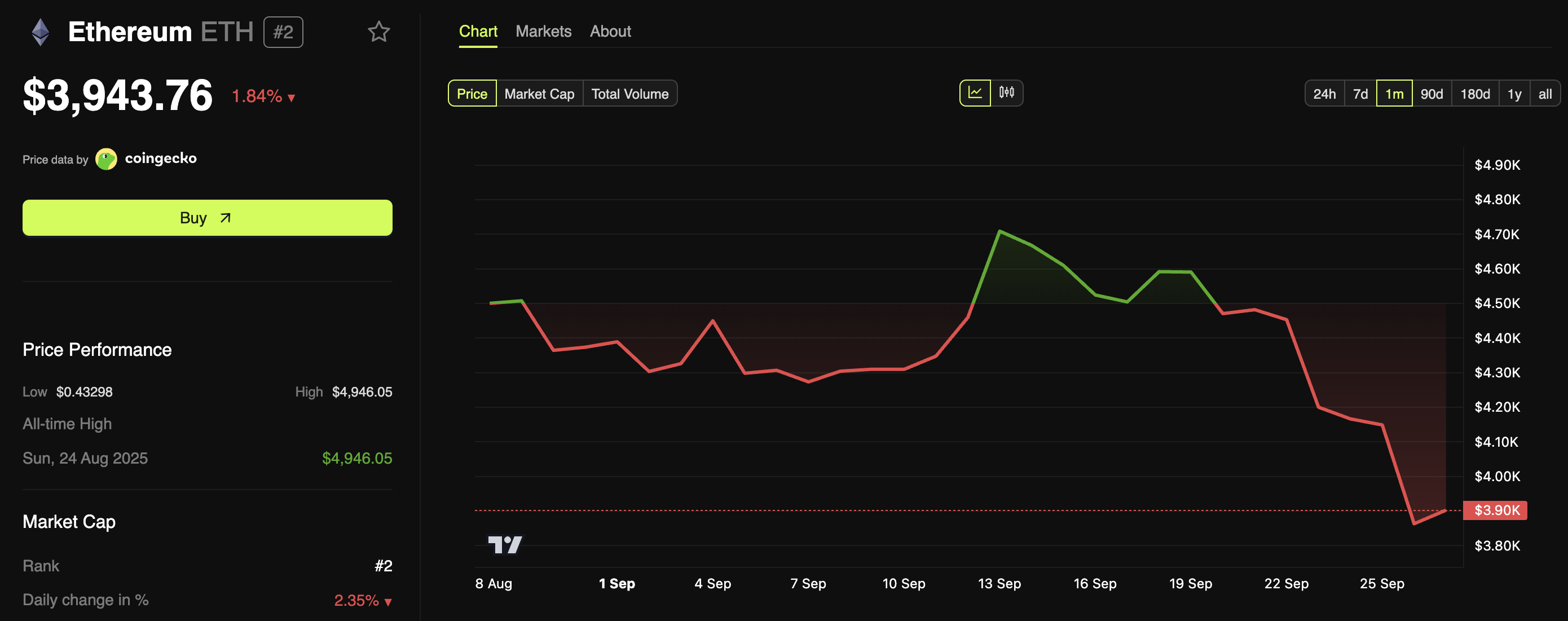

According to BeInCrypto Markets, ETH took a little tumble, landing at $3,943. 😱 But fear not! The whales are here, and they’re not just nibbling-they’re feasting. Over the past two days, 15 wallets gobbled up 406,117 ETH, worth a cool $1.6 billion. 🤑 That’s more than my entire life savings, but who’s counting? 🤷♀️

Peter Schiff, the crypto critic with a permanent frown, declared ETH is in a bear market. 🌧️🐻 But the whales? They’re like, “Bear market? More like a teddy bear picnic!” 🐻🧺

“Ethereum just tanked below $4,000. Despite all the Ethereum Treasury company buying, the #2 crypto is now in an official bear market, down 20% from its August record high. Bitcoin is next,” Schiff said. 😒

Meanwhile, analyst Cas Abbé is all, “One more chance to load up on ETH! Whales are already on it, and institutions are next!” 🚀🐳

“You’ll get one more opportunity to load on ETH. Whales have already started accumulating, and soon institutions will do the same,” Cas Abbé declared. 💼🐋

And guess what? Nearly 400,000 ETH were added to accumulator wallets in a single day. On September 18, they set a record with 1.2 million ETH. 🏆 That’s not just buying-that’s hoarding! 🛒💎

“This is a historic first for Ethereum. Some players are clearly not joking around, and some of these addresses could be linked to entities offering ETH ETFs, which have seen demand surge recently,” Darkfost added. 📈📊

Altcoin Gordon is like, “ETH is entering my long-term buying zone. Accumulate now, thank me later!” 🎁🎄

“ETH is entering my long-term buying zone. Accumulate at these levels and you’ll thank me in December,” he wrote. 🎅🎁

$ETH is now entering the buy zone.

I hope you didn’t FOMO at the top. 😅💔

– Ted (@TedPillows) September 25, 2025

Shay Boloor is here to remind us that while everyone’s panicking, big names like Tom Lee and Peter Thiel are still team ETH. 🌟💪

“At the same time, the US govt needs stablecoins to support treasury demand. Most of that supply sits on ETH. Smells like opportunity under $4,000,” Boloor stated. 🕵️♂️💡

Leveraged Traders: “Oops, I Did It Again!” 😬💥

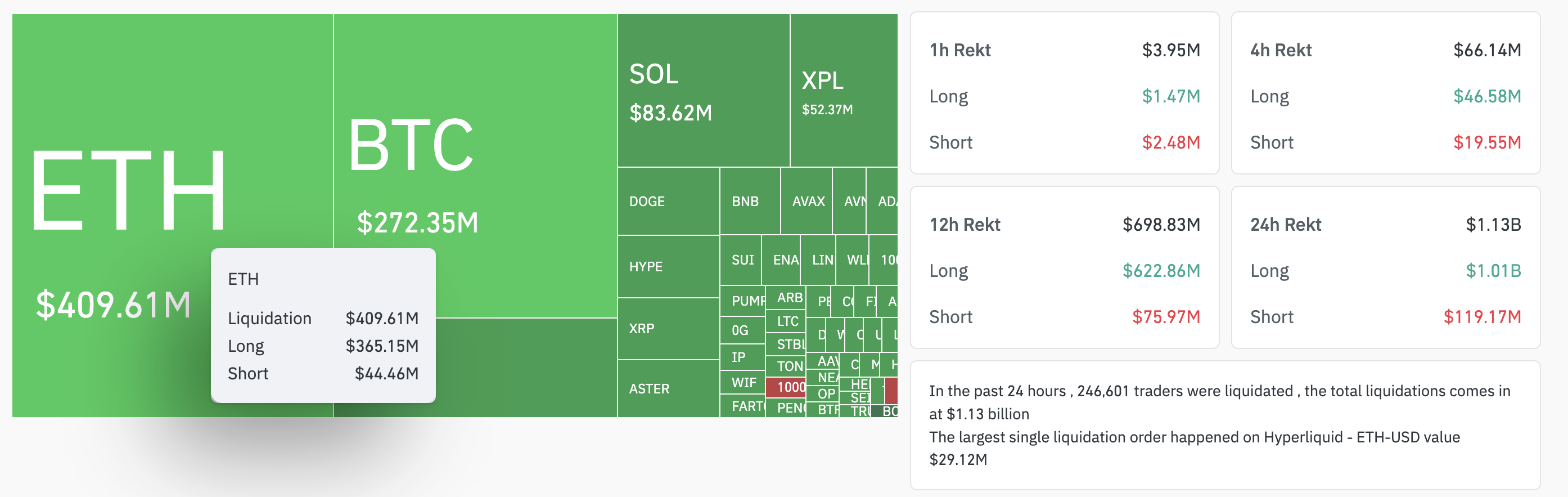

While whales are thriving, leveraged traders are crying into their keyboards. 😭💻 Over 246,601 traders were liquidated in 24 hours, totaling $1.13 billion. Ouch. 😖

ETH took the crown for liquidations, with $409.6 million. The biggest oopsie? A $29.12 million ETH-USD order on Hyperliquid. 😱💸

Today we’re seeing the largest ETH long liquidations since September 2021

The last time this happened $ETH went up 46% the month after 🔥

– Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) September 25, 2025

Darkfost pointed out that ETH’s Open Interest took a nosedive, thanks to all the liquidations. But hey, historically, this means the selling pressure might ease up, and we could see a rebound. 🌈📈

“Historically, such resets often follow periods of excessive leverage that push Open Interest higher… Once liquidations accumulate and reduce Open Interest, selling pressure tends to ease, creating conditions for the market to stabilize and sometimes even recover,” he revealed. 🧘♂️🔄

So, while the short-term looks like a rollercoaster 🎢, the whales and market signals suggest this dip might just be a pit stop before the next rally. 🚀 Keep an eye on those economic indicators and institutional flows-they’re the real tea. 🍵📉

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- USD CNY PREDICTION

- Brent Oil Forecast

- 🐻 Bitcoin’s Bearish Ballet: Strategy’s Comic Caution! 🎭

- TAO PREDICTION. TAO cryptocurrency

- Bitcoin Signals Recession…” but then contrast with the data. Also, mention the potential upside. Let me check character count. “Bitcoin Signals Recession, But Data Says Otherwise – Bullish Opportunity Ahead?” That’s 78 characters. Maybe shorten “Bullish

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- Bitcoin Takes a Nosedive, Heads for Uplift? 😱📈

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

2025-09-26 08:36