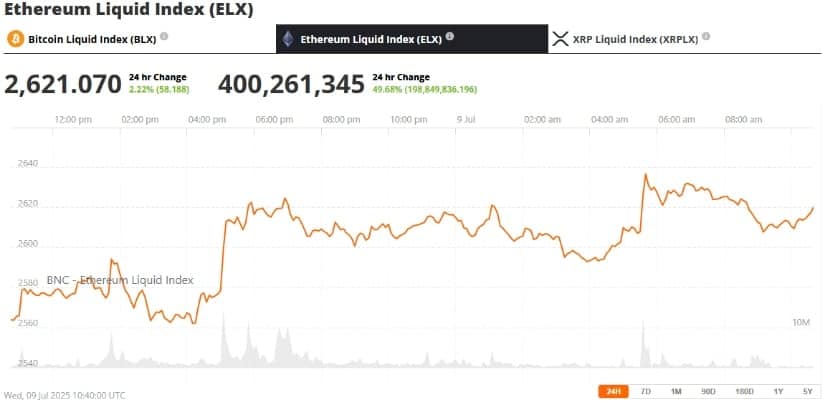

As I sit here, sipping my tea and pondering the mysteries of the cryptocurrency universe, I am reminded of the age-old adage: “the trend is your friend.” And, my dear friends, the trend is most certainly Ethereum‘s (ETH) friend at the moment. Trading above $2,600, ETH is poised to test key resistance levels around $3,200, driven by growing institutional demand and promising technical indicators. 📈

A Bullish Catalyst, Indeed!

As of July 9, 2025, Ethereum is trading just above $2,600, reflecting a gradual upward movement driven by strong technical indicators and rising institutional demand. Traders and analysts are closely watching key resistance zones around $2,800 and $3,200, where a breakout could signal the beginning of a new upward leg. The anticipation is palpable, rather like the moment before the curtain rises on a thrilling theatrical performance. 🎭

The recent emergence of a bullish Ichimoku Golden Cross on Ethereum’s weekly chart and a strengthening Relative Strength Index (RSI) are driving optimism in the market. As Titan of Crypto noted on X, “#Ethereum just triggered an Ichimoku Golden Cross… the next stop could be $3,100 in no time.” Ah, the sweet taste of optimism! 🍰

Chart Analysis: A Breakout Looms

The daily and 4-hour Ethereum charts reveal a tightening symmetrical triangle pattern. ETH has been trading within a narrow range between $2,500 and $2,650 over the past week, forming higher lows that indicate a potential bullish breakout. The tension is building, rather like the moment before a champagne cork pops. 🥂

According to technical analyst Michaël van de Poppe, “ETH is looking for a big breakout… I assume we’ll start to see a leg to $3,400-$3,500 if it breaks the resistance at $2,800.” His sentiment is echoed across the community as the current RSI for Ethereum sits near 60, a crucial level that often precedes strong upward price action. Meanwhile, MACD indicators on shorter timeframes are flashing buy signals, adding further momentum to the bullish outlook. The stars are aligning, it seems! ⭐️

Layer 2 Growth: A Long-Term Value Proposition

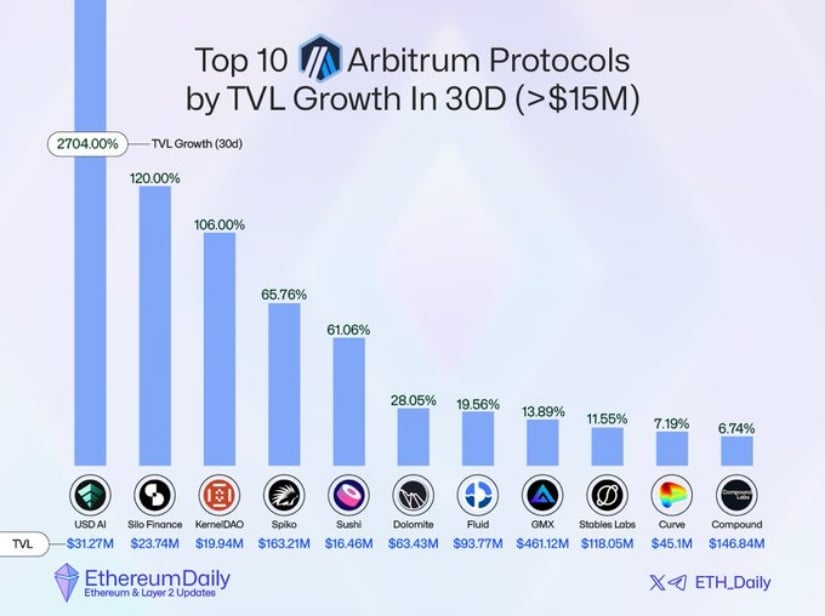

Behind the scenes, Ethereum’s Layer 2 ecosystem continues to gain traction. Protocols like Arbitrum, Optimism, and zkSync are witnessing increased transaction volumes and user adoption. As Ethereum gas fees fluctuate and users seek more cost-effective solutions, Layer 2 networks are becoming critical to the ecosystem’s scalability. Ah, the sweet taste of progress! 🍰

According to recent data from L2Beat, Ethereum Layer 2 growth has outpaced even the most optimistic forecasts, with Layer 2 total value locked (TVL) crossing $20 billion. This adds long-term value to Ethereum as it prepares for mass adoption. The future is bright, indeed! 🌟

Institutional Inflows and Whale Accumulation: A Bullish Outlook

Wall Street is more biased towards Ethereum than Bitcoin. Specifically, Nasdaq-listed Bit Digital has transferred most of its treasury from BTC to ETH and now holds over 100,000 ETH. Sharplink Gaming also increased its ETH holding above 200,000 tokens. This trend is one of a broader institutional bias towards Ethereum fueled by the expectation of Ethereum ETF news and regulatory announcements. The smart money is on Ethereum, it seems! 💸

In the meantime, ETH whale movements show consistent accumulation below $2,500, a pattern typical prior to strong rallies. This on-chain action supports supply squeeze theory as increasingly more ETH is being sent to staking and long-term storage. The whales are buying, and that’s a bullish sign! 🐳

CoinShares information supports this trend as it indicates that Ethereum-based products have been outpacing those of Bitcoin in weekly inflows, with ETH products averaging 1.6% of AUM compared to Bitcoin’s 0.8% of the last 11 weeks. The institutional money is flowing into Ethereum, and that’s a good thing! 🌟

Staking, ETF Speculation, and Fundamental Drivers

The fundamentals surrounding Ethereum have strengthened significantly. Around 30% of ETH supply is now staked, reducing liquid circulation and increasing scarcity. This staking trend not only secures the network but also creates upward pressure on price as demand rises. Ah, the power of staking! 🔒

In addition, speculation around a potential Ethereum ETF approval timeline continues to drive market sentiment. The recent ETF application by Trump Media’s “Truth Social Crypto Blue Chip ETF” includes Ethereum with a 15% allocation, signaling growing institutional confidence. The ETF train is coming, and Ethereum is on board! 🚂

Successful launch of Ethereum’s Pectra upgrade has also laid a solid groundwork for the scaling and long-term growth ecosystem. Coupled with low Ethereum gas prices and validator network expansion, the overall image for ETH is getting bullish by the day. The future is bright, indeed! 🌟

Prediction: Will ETH Reach $3,200 and Beyond?

Based on technical levels, patterns of accumulation, and institutional buying, Ethereum has a decent setup to cross key resistances. A breakout above $2,800 with continued volume may take it to the $3,200 level, with longer-term targets up to $3,500 as visualized by van de Poppe and others. The stars are aligning, it seems! ⭐️

Though short-term movements cannot be ruled out, particularly if Bitcoin corrects, the overall configuration continues to be bullish. With Ethereum RSI today still increasing and record institutional inflows, the ETH future is optimistic. The trend is your friend, indeed! 📈

If the current momentum continues, Ethereum not only stands to regain $3,000 but also set itself up for a more extended rally towards $4,000 or even $5,000 by the end of 2025, depending on accumulation and ETF catalysts. The sky’s the limit, it seems! 🌠

Final Thoughts

Ethereum’s current price reflects improving investor sentiment, both retail and institutional. The presence of a favorable Golden Cross, strong support at $2,500, and heavy whale buying provides an optimistic technical perspective. As the second-largest cryptocurrency by market capitalization, Ethereum’s ability to absorb new Layer 2 innovations and attract institutional funds places it in a league of its own. Ah, the majesty of Ethereum! 👑

Here, the price prediction of Ethereum at $3,200 is not only a technical one—it is an achievable milestone on the path to increased adoption and market leadership. The future is bright, indeed! 🌟

Read More

- Gold Rate Forecast

- TRUMP PREDICTION. TRUMP cryptocurrency

- Brent Oil Forecast

- USD CNY PREDICTION

- Silver Rate Forecast

- ETH PREDICTION. ETH cryptocurrency

- Kraken & Deutsche Börse: A Match Made in Financial Limbo! 🦑💼

- TAO PREDICTION. TAO cryptocurrency

- Cristiano Ronaldo’s Meme Coin: A Scandalous 15-Minute Financial Farce 🤡💸

- XRP’s Big Week: SEC Drama, BlackRock Rumors & A Possible $6 Party 🚀

2025-07-09 21:21