Ah, SharpLink…they call it the “ETH MicroStrategy,” 🤦 a title bestowed with the kind of reverence usually reserved for particularly stubborn houseflies. And now, wouldn’t you know it, this firm is trading below the value of the very Ethereum it so enthusiastically accumulates! A tragicomedy, truly.

This…development, shall we say, has stirred a peculiar excitement amongst those who spend their days staring at charts and muttering about “market turning points.” It’s a signal, they proclaim, one of those rare occurrences traders await with the patience of a saint…or, more accurately, the desperation of a gambler.

SharpLink’s NAV Discount: A Most Curious Affair

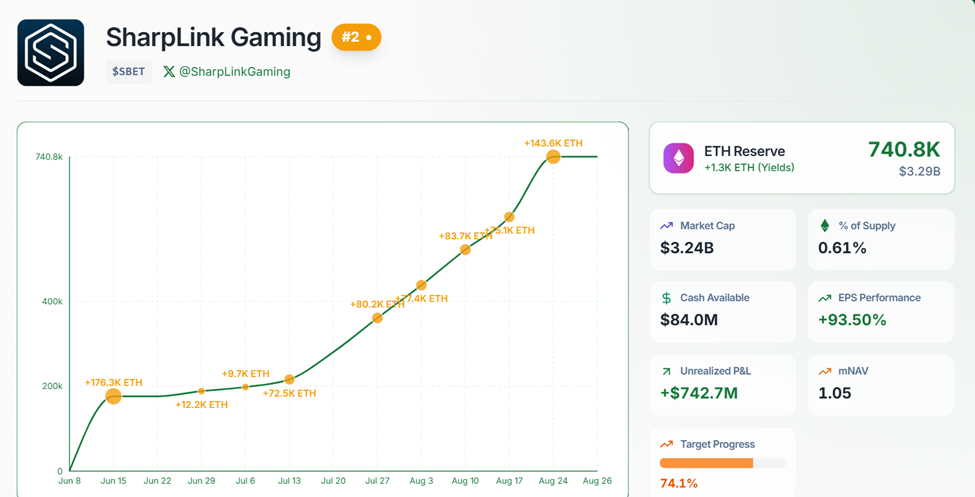

Currently, as I scribble these words (and try to ignore the nagging feeling that I should be doing something more productive), SharpLink’s market capitalization stands at a paltry $3.24 billion. A mere trifle, as it happens, considering the Ethereum it possesses is valued at $3.29 billion.

A discount! Imagine! Investors are valuing the company at less than its assets! It’s as if they’ve collectively decided, “Yes, we shall pay less for a container of digital coins than the coins themselves are worth.” The logic, as ever, escapes me. 🧐

One Mr. AB Kuai Dong, a crypto analyst of some repute (or at least, possesses a profile on X) has been keen to point out this “anomalous condition.” He explains, with the seriousness of a professor lecturing on the mating habits of dust bunnies, that a NAV below 1 indicates the company’s equity is discounted against its ETH holdings.

“This also means the overall market value of ETH MicroStrategy is lower than the value of the ETH assets on its books. The bottom-fishing reference line predicted by legendary traders has finally appeared this time,” Kuai Dong wrote, no doubt with a dramatic flourish.

For those who’ve seen a few market cycles, such discounts are as rare as a sensible opinion on crypto Twitter and are often interpreted as a sign that the last bears are about to be squeezed. Capitulation is nigh, they whisper…or perhaps they just need a good cup of tea. ☕

Buybacks, Buzz, and the Perils of Retail Signals

Last week, SharpLink announced a $1.5 billion buyback program. A grand gesture, certainly. It’s like a man throwing money into a well and hoping for a miracle. They aim to repurchase nearly half of their outstanding value. A bold strategy, or reckless abandon? The jury is still out, naturally.

NEW: SharpLink’s board of directors authorizes $1.5B stock buyback program

– SharpLink (SBET) (@SharpLinkGaming) August 22, 2025

This news caused a brief flicker of excitement, pushing the stock (SBET) from $18 to $21 before it condescended to fall back to $19.17. At a structural level, the NAV ratio, it seems, has become a…trading compass? A most dubious navigational tool, if you ask me.

“When mNAV > 1: swap stocks for coins. When mNAV < 1: buy back stocks…follow the treasury company’s moves,” an X user declared, with the solemnity of a prophet.

However, a word of caution, dear reader: do your own research. Sentiment, you see, also depends on the capricious whims of the Ethereum price. And as we all know, predicting the price of Ethereum is a fool’s errand. 🤪

Meanwhile, Mr. Donald Dean, an economist of some distinction, has boldly projected upside targets. SharpLink’s stock, he claims, could ascend to the dizzying heights of $37.22 if ETH reaches $4,600, $40.37 at $5,000, and a breathtaking $48.28 at $6,000. Such pronouncements should be taken with a generous pinch of salt.

$SBET SharpLink Gaming – NAV is equal to 1, Good Risk / Reward

Price Target: $37.22, $40.37, $48.28

Breakout and consolidation at the volume shelf launch area. SBET NAV is = 1.00, calculating no premium. Risk / reward is good here.

Price target are at 1.8x NAV:

ETH $4600 =…– Donald Dean (@donaldjdean) August 25, 2025

SharpLink, for its part, remains steadfast in its devotion to ETH. “At SharpLink, we have two major goals,” they proclaimed in a recent post, “Raise capital to buy ETH and put that ETH to work to generate yield on behalf of shareholders.” An admirable ambition, perhaps, but one that ignores the rather inconvenient fact that…

“T-Bills yield more than ETH staking. So you’re leaving money on the table by staking ETH,” pointed out a particularly astute crypto commentator known only as Grubles.

For many, the SharpLink discount is not about complicated treasury mechanics but about Ethereum finally hitting its bottom. A line in the sand, they say, where sanity momentarily prevails before the madness returns.

As of this moment, Ethereum is languishing at $4,415, down nearly 5% in the last 24 hours. A sorry state of affairs, indeed.

If ETH manages to claw its way upward, the SharpLink signal might prove to be an early warning. A fleeting glimpse of a broader Ethereum-led recovery. But don’t hold your breath. 🕰️

Read More

- TRUMP PREDICTION. TRUMP cryptocurrency

- Gold Rate Forecast

- Brent Oil Forecast

- Crypto Chaos: How Biden’s “Operation Choke Point 2.0” Left Crypto High and Dry!

- USD CNY PREDICTION

- Asia’s Financial Rampage: Stablecoins and the Race for Supremacy

- SOL’s Sky-High Gambit: ETF Dreams or a Crypto Mirage?

- JPMorgan: Bitcoin to Hit $170K-Gold’s New Rival?

- Winklevoss Twins Back $M Bitcoin Listing

- Bitcoin Plunges: Is $70K the New Rock Bottom? 🚀💸

2025-08-26 11:03