In the frost-kissed realm of 2026’s first week, Dogecoin perched like a beleaguered sparrow on a cluster of supports, while three analysts-Cantonese Cat, The Great Mattsby, and Kevin-scribbled furiously, their charts a tangle of Fibonacci lines and existential dread. Was this a prelude to rebirth or merely a pause in the slow-motion ballet of collapse? Only the moon knew, and she wasn’t answering calls.

The Yearly Dogecoin Chart

Cantonese Cat’s yearly chart, a labyrinth of logarithmic scales, framed 2025 as a delicate truce with gravity. The 0.786 Fibonacci line, roughly $0.10879, had become a fortress, its walls reinforced by an inside candle that whispered of bullish continuation. “Ah,” the analyst mused, “price has respected the ancient geometry of despair-how very Victorian.” The chart’s next target, $0.73905, loomed like a gothic spire, promising catharsis if the 0.786 bastion held. One might almost call it poetic, if not for the palpable stench of volatility.

Structure, not momentum, was the name of the game-a truth as obvious as the nose on a Shiba Inu. Yet who could blame the market for playing it safe? After all, even the most bullish optimist might pause before leaping into a void.

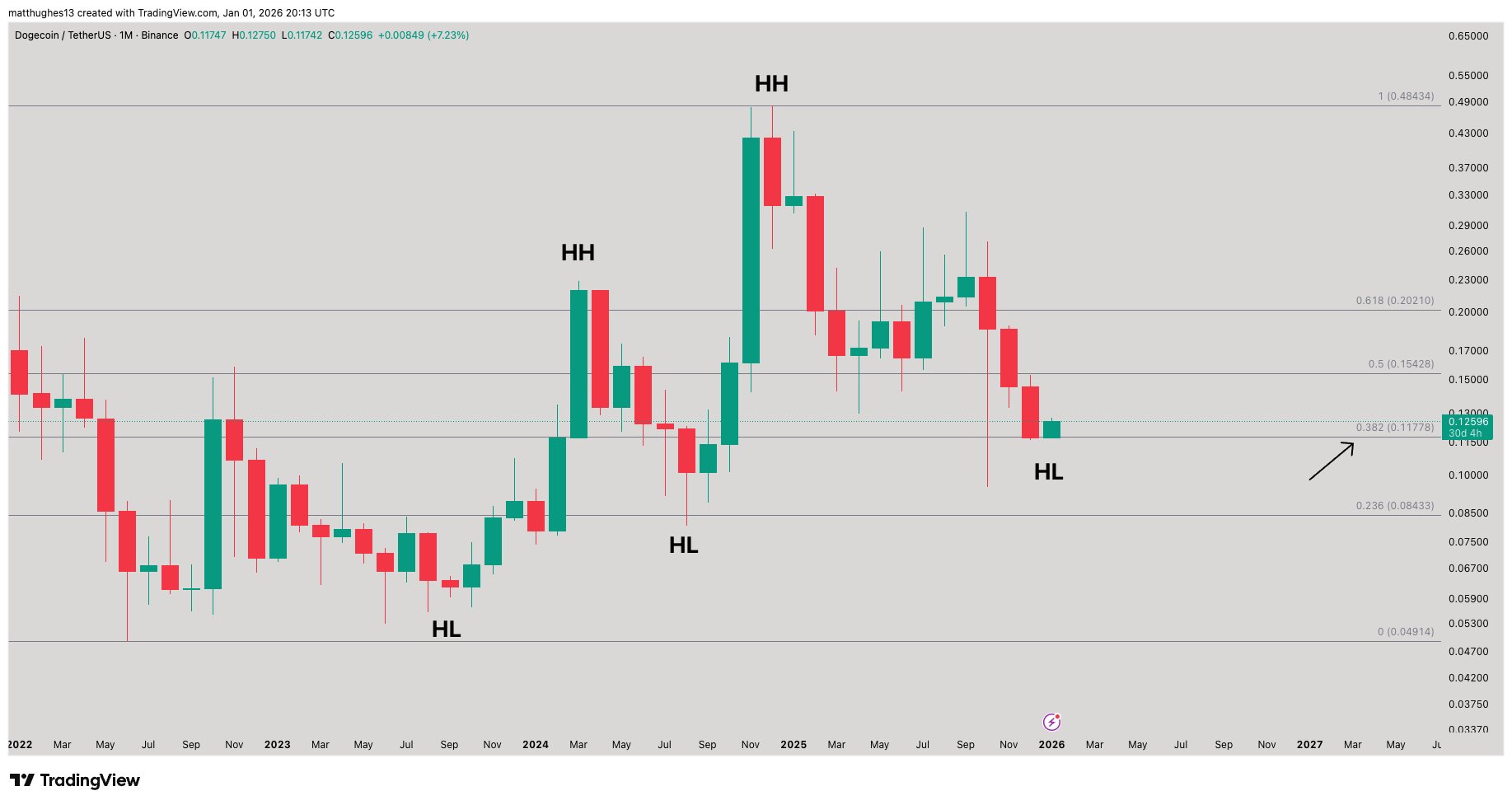

The Monthly DOGE Chart

The Great Mattsby, alias of a man who surely owns a monocle, narrowed the focus to the 0.382 Fibonacci retracement at $0.11778. “A higher low!” he declared, as if channeling a prophet. The “.11-.12 zone” became a romantic quest, its risk/reward ratio a sonnet to the brave. But should the $0.11778 line falter, the 0.236 retracement at $0.08433 awaited like a vulture in a black cape. On the upside, $0.15428 and $0.20210 shimmered like mirages, taunting the unwary with promises of “proof.” A basing process? Or a dead-cat bounce? The market, ever the sly fox, offered no answers.

The Weekly Dogecoin Chart

Kevin, aka Kev_Capital_TA, turned the spotlight to the weekly chart, where Dogecoin scribbled a “reversal demand candle” within a “major demand zone.” “Still early,” he cautioned, as if addressing a jury of anxious investors. His conditions-confirming the candle by Sunday, reclaiming BTC’s 4HR 200 SMA-felt like a witch’s curse wrapped in a financial forecast. All eyes, he insisted, should be on Bitcoin’s 88K-91K range, though one suspects even Bitcoin would roll its eyes at such demands.

For traders, the immediate task was clear: defend $0.11-$0.12 like a knight guarding a damsel. A weekly close could validate Kevin’s thesis-or consign it to the dustbin of overconfidence. Meanwhile, the 0.11778 level, if breached, would render the “bottoming” narrative as hollow as a hollow candlestick. Yet should it hold, the charts might just begin their slow waltz toward base-building, one confirmed close at a time.

At press time, DOGE clung to $0.13242, a precarious perch indeed. The market, ever the tragicomedy, left its audience hanging on the edge of their seats, clutching their wallets and their wits. Would it ascend? Collapse? Or simply forget the entire affair ever happened? Only time, that fickle old friend, would tell.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Trump’s Big Moves: Crypto in 401(k)s and No More Banking Discrimination!

- US Data Center Gold Rush: How AI Is Reshaping Power Markets with a Side of Humor!

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- 🚀 Solana’s November: Bull Run or Bull Plop? 🌽

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

- CNY JPY PREDICTION

- TRX PREDICTION. TRX cryptocurrency

2026-01-02 20:48