With momentum wilting like a daisy in a hurricane and macro pressure returning with the subtlety of a sledgehammer, analysts now peer through telescopes and crystal balls to discern whether Dogecoin’s current antics resemble a tragic opera of capitulation or the first act of a grandiose reversal. One might say the market is staging a play where the protagonist (DOGE) is both hero and fool.

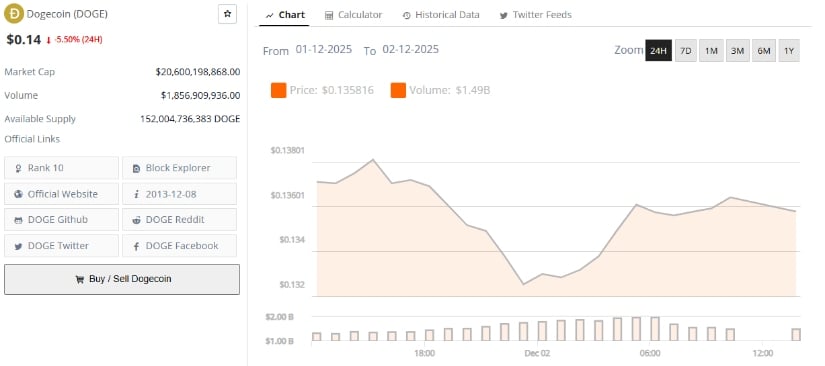

On December 2, 2025, DOGE briefly kissed $0.14 before recoiling like a lover spurned. GreenyTrades, with the solemnity of a priest at a funeral, declared the wick below support resembled past retracements where buyers, like phoenixes, rose from the ashes. Yet he warned, “This is not a fairy tale; it’s a thriller with plot holes.” The 0.786 Fibonacci level, now a haunted house near $0.14, has historically been a stage for reversals-or at least dramatic monologues from confused traders.

For those clinging to dogecoin price prediction models like a life raft, this zone is now a circus: not a guarantee of salvation, but a ringmaster’s whistle in the chaos.

Short-Term Pressure but Technical Bounces Like a Yo-Yo 🎢

@TATrader_Alan, a self-proclaimed “crypto alchemist,” dissected a 4-hour chart where Dogecoin’s rebound from a descending channel was as fleeting as a candle in the wind. RSI dipped below 30, an area where oversold investors typically throw confetti-though in this case, it was more like confetti tossed into a black hole. The price danced near $0.14 on December 2, a recovery from $0.132 before sellers returned with the enthusiasm of a tax audit.

Alan, a man who speaks in Wyckoffian riddles, noted Bitcoin’s stability above $90,000 had “helped maintain confidence” in meme assets. But he cautioned, “Confidence is a fragile flower-step too close, and it wilts.” His analysis, while poetic, is less prophecy and more interpretive dance. After all, crypto is not a textbook; it’s a surreal painting.

Short-term indicators? Mixed, like a cocktail with too much salt. Volume fluctuated like a heartbeat during a horror movie, open interest dwindled since October’s bloodbath, and social engagement levels on LunarCrush? Unstable, like a toddler on a trampoline. All signs point to: “Insert chaos here.”

Market Weakness and a Multi-Month Stroll Through the Garden of Doubt 🌱

Dogecoin’s October 10 plunge-a 63% freefall-still haunts its order books like a ghost in the machine. Though it recovered part of that loss, buy-side depth remains as thin as a politician’s promises. At $0.14, DOGE wavers between partial stabilization and a “not dead yet” sigh.

Analysts predict consolidation between $0.11 and $0.24, a range that feels like a purgatory for traders. Upside scenarios? Aggressive ones are as rare as a bear market rally. Most 2025 models foresee a recovery so gradual it could nap during the process.

Market Cycles: A Time Traveler’s Guide to DOGE 🕰️

Dogecoin’s multi-year cycle is the crypto community’s favorite parlor game. A TradingView comparison between 2014-2022 and 2025 labels the current phase as “Cycle 3,” drawing parallels to 2020’s consolidation. The analyst, a self-described “cycle oracle,” warns, “This is not a roadmap; it’s a Rorschach test.” Cycle models, they admit, are as reliable as a weather forecast in Siberia-beautiful in theory, disastrous in practice.

The model hints at a slow buildup toward 2026-2027, but with the caveat: “History is a mirror, not a map.” After all, liquidity, macroeconomic shifts, and Bitcoin’s whims can turn even the most elegant cycle into a Picasso.

Short-Term Indicators: A Tragicomedy of Errors 🎭

On shorter timeframes, Dogecoin remains trapped in a descending channel, its RSI oscillating like a pendulum of despair. The $0.14 support level, where past bounces occurred, now feels like a revolving door-traders enter with hope, exit with tears.

A popular trading example suggests watching for a breakout above $0.1510, though the creator wisely advises waiting for confirmation. After all, false signals are the crypto version of a bad date: awkward, costly, and best forgotten.

Futures funding rates swing like a drunkard’s compass, hinting at a market as indecisive as a goldfish in a maze. Direction? It’s as clear as mud in a swamp.

Fundamentals: The Emperor’s New Coins 👑

Beyond charts, Dogecoin’s uncapped supply model is a siren song for skeptics. Analysts note that sustaining price requires demand as relentless as a telemarketer on a caffeine high. This fact, they say, is the elephant in the room-though the room is also haunted by meme coins and viral tweets.

Sentiment, according to Chainalysis, drives DOGE like a puppet on a string. Influencers, viral posts, and market fear move prices faster than on-chain metrics. It’s less about numbers and more about the drama of a thousand retweets.

Meanwhile, Dogecoin ETFs from Bitwise and Grayscale have yet to generate institutional love. Analysts shrug: “Accessibility is great, but inflows? That’s a different story.” After all, even a rocket needs fuel-and right now, DOGE’s tank is half-empty.

Final Thoughts: A Shakespearean Ending (or Beginning?) 🎭

DOGE’s flirtation with the 0.786 Fibonacci level is a technically significant moment-like a character in a play who pauses at the edge of a cliff. Historically, such zones have been stages for trend exhaustion, but today’s indicators whisper of a market caught in a limbo of fragile sentiment and macroeconomic fog.

For long-term observers, the retracement may be a mirror reflecting market reassessments. For traders, the lack of direction is a masquerade ball of volatility and uncertainty. And for cycle-watchers, history offers context-but no guarantees. After all, crypto is a realm where even the most seasoned prophets might trade their crystal balls for popcorn.

DOGE remains a digital asset watched by millions, buoyed by a community as fervent as a cult. Whether this chapter becomes a prologue to recovery or a footnote in a multi-month saga will depend on the whims of macroeconomic gods and the next viral tweet. Until then, the stage is set for more drama, absurdity, and the occasional candlestick pattern that looks suspiciously like a duck.

Read More

- Gold Rate Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin’s Wild Ride: Overbought or About to Take a Nosedive? 🤠💸

- Ripple’s RLUSD: A Billion-Dollar Joke or Financial Genius? 🤡💰

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Winklevoss Twins Make Waves: IPO Madness and Political Shenanigans Unfold!

- Hyperliquid’s $1B HYPE Grab: Larry David Would Cringe 😂

2025-12-02 22:08