In the grand theater of financial speculation, where the masses gather like peasants at a feudal lord’s banquet, the crypto analyst XForce has proclaimed with the gravity of a soothsayer that Dogecoin, that most whimsical of digital currencies, may yet ascend to the hallowed $1 mark. Yet, in a twist befitting the absurdity of our age, he tempers this prophecy with the sobering caveat that such an event may not transpire until the stars align in a manner not seen since the last great bull run. Ah, the technicals-those inscrutable oracles of the market-have spoken, and they reveal but a single, narrow path to this monetary nirvana, a path as treacherous as a Russian winter.

A Decade Hence, Perhaps, Dogecoin Shall Reign

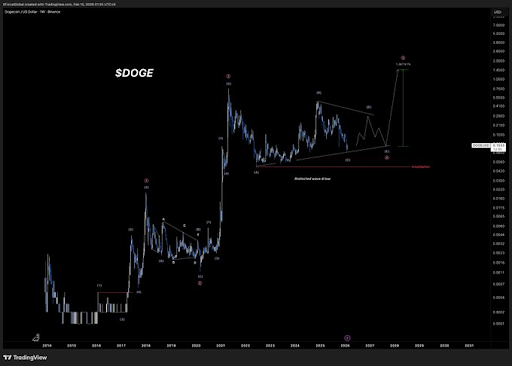

In a missive dispatched via the modern-day town crier, X, XForce declares that Dogecoin retains the potential for a tenfold leap in the coming years, a feat as likely as a muzhik finding a golden samovar in his cabbage patch. He elaborates, with the precision of a clockmaker, that this vision hinges upon a singular bullish trajectory, wherein Wave 4 of DOGE’s chart may form a triangle-a geometric marvel that, if realized, could propel the coin to $1.3 by the year 2028. Mark well, dear reader, for this aligns with the predictions of other market seers, such as Benjamin Cowen, who foresee the zenith of the next bull run in this very epoch. Yet, let us not forget the peril: should DOGE falter below $0.05, this grand design shall crumble like a poorly baked pirozhki.

For now, XForce observes that Dogecoin clings to its major low with the tenacity of a peasant to his last potato, perhaps the last of the meme coins to embark on a grand adventure. It has, in recent days, reclaimed the psychological threshold of $0.10, buoyed by the broader crypto rally led by Bitcoin. Yet, the derivatives market tells a tale of woe, for traders remain bearish, their long/short ratio dipping below 1. Volumes have waned, open interest has shriveled, and yet, in a curious twist, options trading has surged, as if the gamblers of the market sense an opportunity amidst the gloom.

CoinGlass, that modern-day ledger of financial folly, reports a 13% drop in derivatives trading volume and a 12% decline in open interest. Yet, options trading volume has leapt by 32%, and options open interest by 72%, a paradox as baffling as a Tolstoy novel.

Five Dollars? Surely, Thou Jest

Another prophet of the digital age, Bitcoinsensus, has ventured an even bolder prediction: that Dogecoin might soar to $5, a sum as extravagant as a nobleman’s feast. In a proclamation on X, this analyst avers that if history repeats itself-as it so often does in the cyclical madness of markets-DOGE could achieve this feat, for in past cycles it has surged 95x and 310x. This third cycle, now unfolding, may yet yield another parabolic ascent, a spectacle to rival the grandest of operatic tragedies.

Bitcoinsensus notes, with the wisdom of a village elder, that Dogecoin thrives in risk-on environments, typically after prolonged periods of consolidation. His chart, a masterpiece of lines and squiggles, suggests that this rally could materialize by 2027, a date as distant and uncertain as the end of a Tolstoy novel.

At the hour of this writing, Dogecoin trades at a modest $0.10, down 12% in the last 24 hours, according to the chroniclers at CoinMarketCap. Yet, in the grand scheme of things, what is a mere 12% when the promise of $1-or even $5-looms on the horizon? Ah, the folly of man, ever chasing the mirage of wealth, ever believing in the next great surge. Perhaps, in the end, it is not the price of Dogecoin that matters, but the absurdity of our pursuit.

Read More

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Dogecoin’s 45% Crash: Whale Sell-Offs & Meme Coin Mayhem 🐕💸

- 🚨 Bunni DEX Bites the Dust After $8.4M Oopsie! 🚨

- Dogecoin’s Dashing Cup-and-Handle: Is $0.25 the New $10? You Won’t Believe It!

- Vitalik Buterin Pushes Gas Futures Idea for Ethereum

- Meme Coins: September’s Silent Revolution? 🤑

- NYC Election Drama: Million-Dollar Bets, Big Losers & Market Shenanigans! 😂💸

- Will Ethereum’s $5K Destiny Unravel as Whales Assert Themselves? 🐋💰

2026-02-17 00:32