In a twist that could make a pretzel jealous, a governance proposal within the hallowed halls of Curve Finance is sending ripples through the DeFi community, as one particularly astute contributor suggests a pause in the protocol’s grand adventure into the wild, wild west of Ethereum Layer 2 networks. 🐴

On the fateful day of July 31, a brave soul from CurveDAO decided to throw caution to the wind and submit a proposal. This proposal, which could be mistaken for a particularly dry tome on the history of paint drying, argued that Curve’s Layer 2 escapades are about as profitable as a chocolate teapot. Apparently, they generate little revenue and divert resources from far more exciting ventures, like the shiny new crvUSD stablecoin. Layer 2 networks, you see, are supposed to be the knights in shining armor, improving Ethereum’s scalability and becoming the talk of the town. But alas, it seems they’ve turned out to be more like the court jesters. 🤡

Curve Earns More From Ethereum in a Day Than 450 L2s Combined

The proposal, which could have used a bit more pizzazz, highlighted Curve’s rather dismal revenue generation across 24 Layer 2 networks. According to the proposal, the protocol earns a staggering $1,500 daily across all these Layer 2 chains, which, when divided by the number of networks, amounts to a princely sum of $62 per network. Yes, you read that right—$62! That’s less than what you’d find in the couch cushions of a particularly generous sofa. 🛋️

In light of this shocking revelation, the proposal boldly stated that such returns do not justify the engineering costs and long-term upkeep required to support these fast-moving blockchain networks. It’s like trying to keep a pet rock alive—lots of effort for very little reward.

“Bringing Curve to L2s has been tried now, but the stats speak for themselves. Very little returns while consuming lots of developer time to develop, while also having mostly much higher maintenance cost due to their fast pace, short-lived nature,” the author noted, probably while shaking their head in disbelief.

In stark contrast, Curve’s Ethereum mainnet is like the golden goose, laying eggs of income on a daily basis. The protocol reportedly rakes in around $28,000 per day from its Ethereum pools—more than 18 times the combined daily revenue from its Layer 2 ventures. Talk about a cash cow! 🐄

“Curves’ Ethereum Pools generate on a slow day $28,000 of revenue, the equivalent of approximately 450 L2s, given their average revenue,” he noted, likely while sipping a cup of tea and pondering the mysteries of the universe.

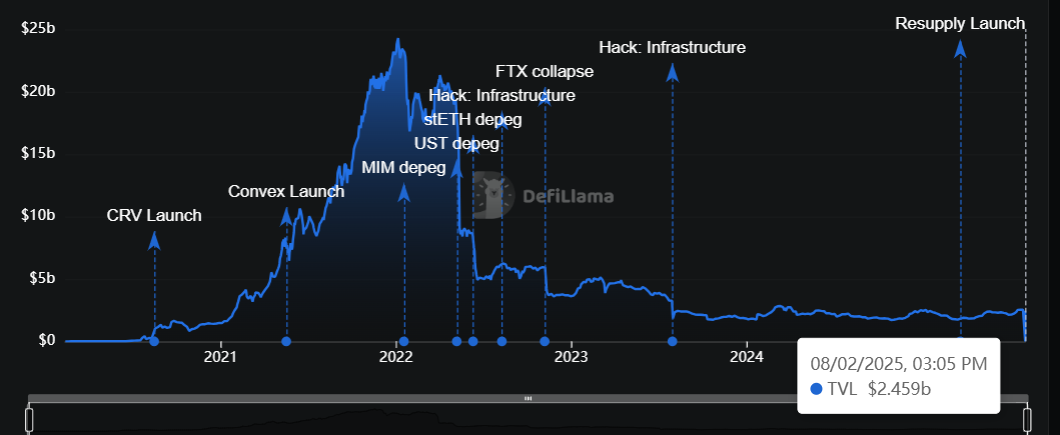

This is hardly surprising, considering that over 90% of Curve’s total value locked (TVL) remains firmly planted on the blockchain network, according to the wise sages at DeFiLlama.

Thus, the proposal urged the protocol to cut all development on Layer 2 networks and focus on the golden child that is Ethereum. Because why chase after rainbows when you’ve already found the pot of gold? 🌈

“Each of those chains require at least the same care as Ethereum, while giving back only very little. By cutting all development in this direction, Curve can regain the head-space to push into more fruitful directions,” the author wrote, probably while dreaming of a world where all chains were equally profitable.

Meanwhile, the proposal’s radical stance has sparked a lively debate within the DeFi protocol’s community about the multi-chain expansion moves. It’s like a family dinner where everyone has an opinion, and no one is afraid to share it.

DeFi analyst Ignas, who seems to have a knack for spotting trouble, noted that Aave, another prominent DeFi protocol, is experiencing similar challenges. According to him, Aave’s expansion across multiple chains has proven about as profitable as a lead balloon, reflecting the difficulties many DeFi protocols face when trying to juggle numerous Layer 2 networks.

Ignas suggested that the challenges stem from a lack of user traction across most Layer 2 networks, indicating that the Ethereum Layer 2 ecosystem may be approaching saturation. It’s like trying to fit a square peg in a round hole—frustrating and ultimately unproductive.

“We reached an L2 saturation point…Real tough time for undifferentiated L2s,” Ignas stated, likely while shaking his head in disbelief at the state of affairs.

Data from L2Beats supports this viewpoint, revealing that only a handful of Ethereum Layer 2 networks—such as Polygon, Arbitrum, and Optimism—are seeing substantial activity. The rest? Well, they’re just sitting there, twiddling their thumbs.

Meanwhile, Curve’s core team has distanced itself from the proposal, stating that it does not reflect their current roadmap. Because nothing says “we’re not listening” quite like a polite refusal.

“To be clear: this post does not come from the team currently working on Curve, and no one in the team agrees with it (so we probably will NOT take that direction),” the protocol stated, likely while rolling their eyes at the audacity of it all.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- South Korea’s Crypto Clampdown: Leverage Gets the Boot 🚪💸

- Solana Whales Dance: ETF Drama & $210’s Fatal Attraction! 🐳💸

- Solana’s Inflation Diet: Will DeFi Starve or Thrive? 🍔💸

- Render Rises, Bitcoin Dips-Traders, Beware!

- TRUMP PREDICTION. TRUMP cryptocurrency

- XRP’s Wild Ride: Is the $2 Mark the End of the Road?

2025-08-03 00:42