What to know: 🧐

Ah, the weekly drivel from Crypto for Advisors, CoinDesk’s attempt to make sense of the digital chaos for financial advisors. Subscribe here if you fancy a Thursday dose of confusion wrapped in jargon. 📰

In today’s installment, Dovile Silenskyte, the high priestess of Digital Assets Research at WisdomTree, deigns to explain Crypto Indices. Apparently, they’re not just random numbers on a screen. Who knew? 🤷♀️

Then, in the thrilling segment “Ask an Expert,” Eric Tomasewzki, a financial advisor at Verde Capital Management, answers questions with the gravitas of a man who’s seen too many charts. 📈

– Sarah Morton, your humble narrator 🎭

Crypto’s Silent Coup: The Art of Index Design 🎨

As the institutional herd tiptoes into the crypto circus, a stark truth emerges: in this madhouse, methodology is the product. Astonishing, isn’t it? 🤯

Behind every index lurks an invisible architect-deciding which assets to include, how to weight them, and when to rebalance. These choices don’t merely shape performance; they determine whether your index is a beacon of trust or a speculative farce. 🏗️

A well-crafted index, built on reliable data and clear governance, becomes more than a benchmark. It becomes infrastructure. The difference between a token basket and an institutional-grade index? Design integrity, darling. 🏛️

The new rules of index construction 📜

Crypto, bless its chaotic heart, defies the logic of equities. Supply is staked, liquidity scatters across venues, and regulations shift like desert sands. 🏜️

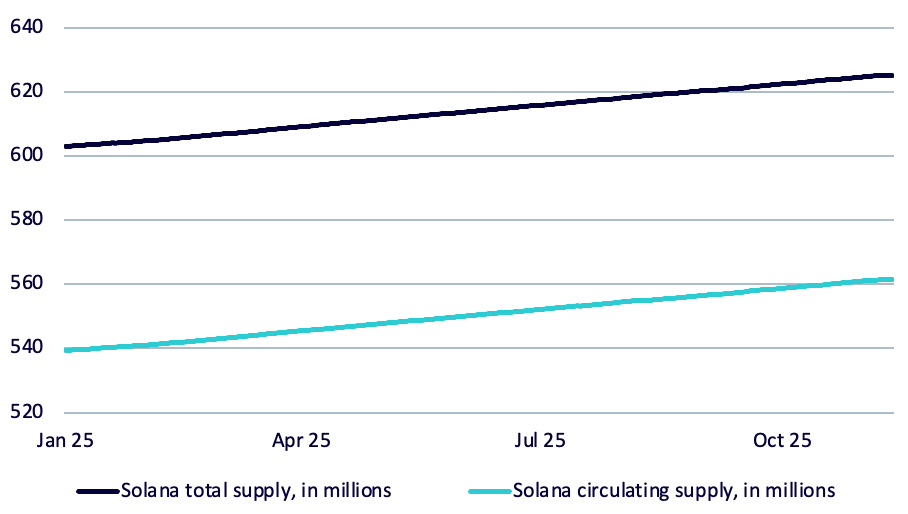

Illustrative supply comparison

Thus, building a crypto index is part data engineering, part governance design. A proper benchmark isn’t just a tracker; it’s an investment framework. Or so they say. 🤓

It all begins with intent. Broad market exposure or a niche narrative? That choice dictates the token universe, liquidity thresholds, and rebalancing rhythm. Too broad, and you’re drowning in noise; too narrow, and you’re gambling, not benchmarking. 🎯

Strong indices enforce discipline. Liquidity filters to avoid ghost tokens, custody screens for institutional access, and governance filters to exclude opaque assets. In crypto, eligibility rules are the bouncers at the club, separating the investable from the theoretical. 💼

Weighting, maintenance, and market reality ⚖️

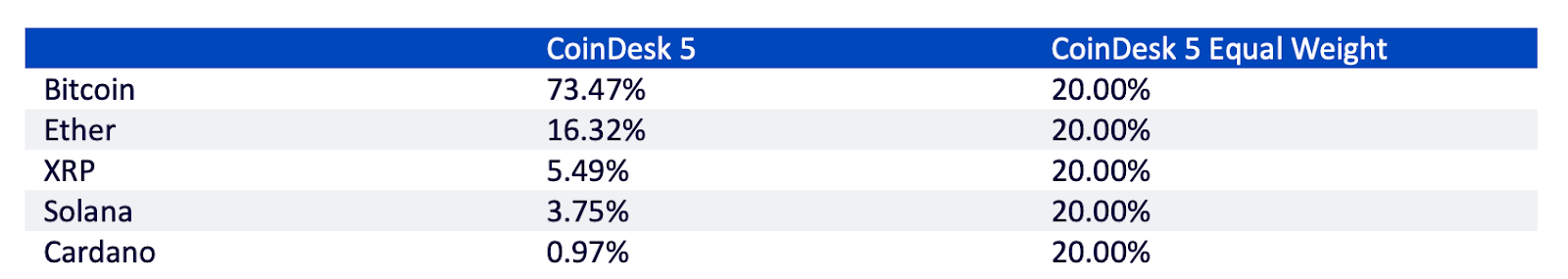

Weighting tells the tale of market structure. Market-cap weighting crowns the giants-Bitcoin and Ether-while equal weighting gives the underdogs their moment. 🦸♂️🦸♀️

Side-by-side comparison of CoinDesk 5 and CoinDesk 5 Equal Weight indices

But weighting alone won’t save your index. Maintenance will. Crypto never sleeps; tokens fork, migrate, or vanish overnight. Quarterly rebalances, liquidity tests, and concentration caps aren’t optional-they’re survival tools. 🛠️

The institutional test 🧪

Index design is crypto’s hidden frontier, where technical precision meets investor confidence. Rules-based, transparent indices lay the foundation for exchange-traded products (ETPs) that investors might actually trust. Miracles do happen. 🙏

For the masochists among you, read the full paper: Market Insight: Crypto Index Construction. 📖

IMPORTANT INFORMATION

This material, crafted by WisdomTree and its affiliates, is not to be mistaken for advice, a forecast, or a recommendation. Opinions are as fleeting as crypto prices and may change without notice. No warranty is given, and no responsibility is accepted for errors or omissions. Reliance on this material is at your own peril. Past performance? A poor predictor of future folly. 📉

– Dovile Silenskyte, Director, Digital Assets Research, WisdomTree 👩💼

Ask an Expert 🧑💼

Q: What makes a crypto index meaningfully diversified when it all feels correlated?

A: Ah, correlation-crypto’s favorite party trick. During stress events, it spikes like a fever, but over full cycles, dispersion can be dramatic. A meaningful index avoids overweighting the largest market cap. Instead, look for:

1. Differentiated economic models (L1s, L2s, etc.)

2. Sustainable token emissions

3. Real fee capture (revenue)

The goal isn’t to eliminate volatility-that’s crypto’s middle name. It’s to avoid a portfolio that secretly tracks a single narrative. 🎭

Q: Should Bitcoin still be the anchor weight in a diversified crypto portfolio?

A: Absolutely. Bitcoin is the only digital asset with commodity-like properties, predictable issuance, and no venture-style dilution. For most investors, it’s the risk-control asset, not the risk asset. We typically anchor portfolios with 50 to 70 percent BTC, depending on risk tolerance. The rest? Satellite positions for thematic growth. 🚀

Q: What’s a reasonable rebalancing schedule for a crypto model portfolio?

A: Quarterly works best. Frequent enough to capture dispersion, but not so frequent you’re trading noise. Rebalance when tokens cross predefined bands (e.g., BTC deviates by 10% from target weight). Discipline removes emotion-a rare commodity in this asset class. 🧠

Q: Where do you see the next major shift in index construction?

A: From asset-based indices to cash flow-based indices. Instead of “top 10 assets by size,” we’ll see indices weighted by:

- Protocol revenue

- Yield efficiency

- Validator economics

- Restaking demand

- RWA collateral growth

It’s the smart beta evolution, crypto-style. 🧩

– Eric Tomasewzki, financial advisor, Verde Capital Management 💼

Read More

- Gold Rate Forecast

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Brent Oil Forecast

- CNY JPY PREDICTION

- Silver Rate Forecast

- HBAR: $32 Million Hangs in the Balance! 😲

- Stablecoins in Korea: The Galactic Race to Regulate 🚀💰

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- Will XRP Break $3.6 or Crash? The Bullish-Bearish Tug-of-War 😅💸

- Coinbase Aims for a Billion-User Open Era

2025-11-20 19:50