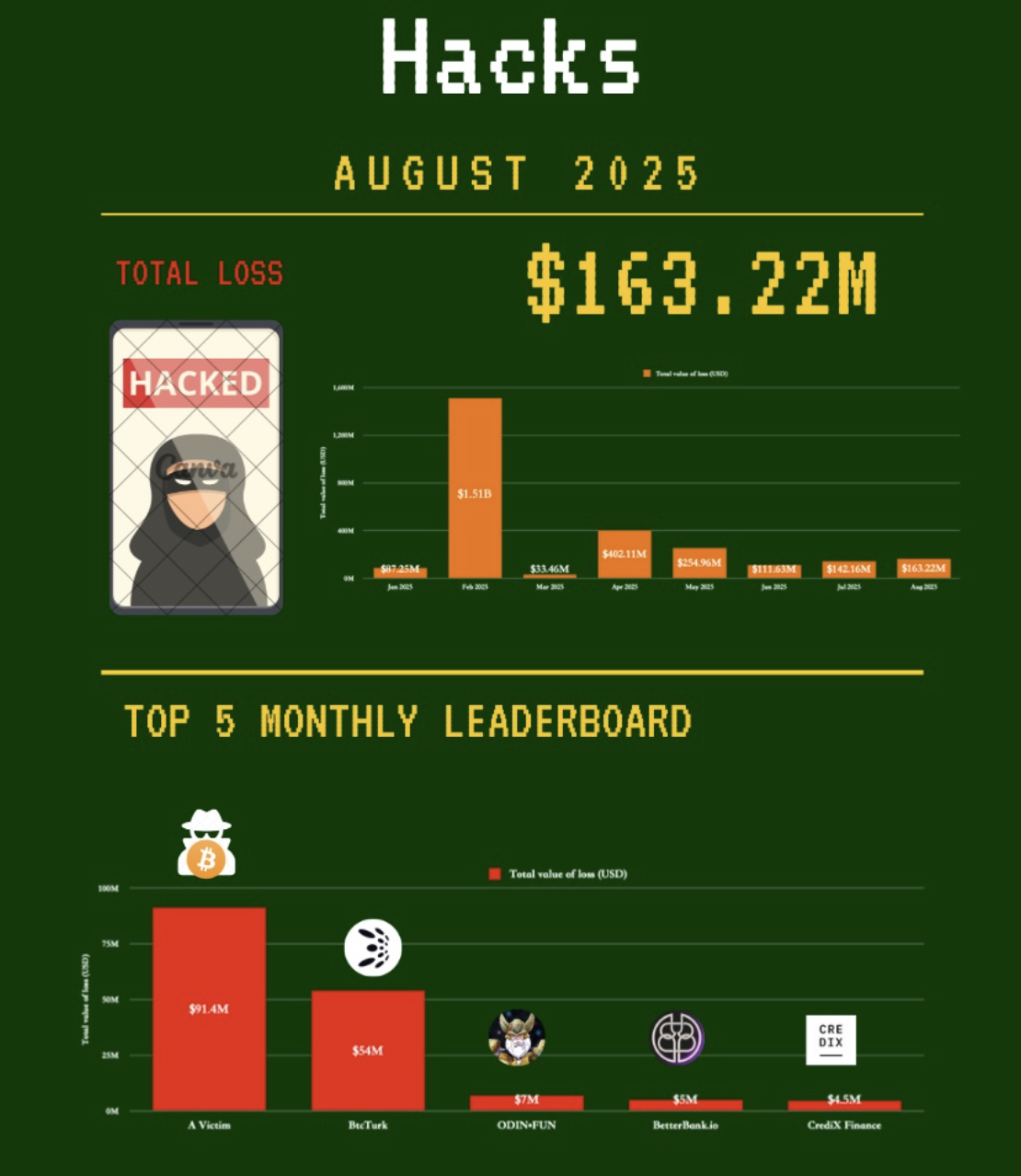

Sixteen catastrophes, each more theatrical than the last, left the crypto bazaar $163 million lighter this August-a month anxious to outdo the previous one’s casualties. In the grand calculation, July almost looks stingy.

Coins, exchanges, and even those RWA manuscripts believed themselves invulnerable, yet found themselves as defenseless as a Russian country house left unlocked during harvest.

The Spreading Wave of Hacks: Drama In Several Acts

The month of Hack August 2025-a new tradition, it seems-brought forth sixteen “striking” exploits. There we have it: $163 million spirited away, a neat 15% improvement over July, as if thieves were inspired by quarterly goals.

Exhibit one: A solitary Bitcoin holder who clearly believed in miracles and personal security lost $91.4 million thanks to a scam fancier than most Chekhovian love triangles. Turkey’s BtcTurk, presumably thinking “it could never happen here,” saw $48-54 million scuttled from hot wallets, which might have been cooled off with a dash of common sense. ODIN•FUN coughed up $7 million, BetterBank.io misplaced $5 million, and CrediXFinance vanished $4.5 million-each a little drama, each with no shortage of irony.

In these figures, one sees a ballet of human error: private keys carelessly scattered, smart contracts as fragile as tin samovars, and exchanges playing a risky game of hide-and-seek with operational security. Bravo! 👏

But the plot thickens: organized bands-perhaps smoking cigarettes under weak electric bulbs-emerged. Alleged North Korean hackers, never satisfied with mere fiction, filched $1.6 billion in crypto during the first half of 2025. Seventy percent of global losses? If only they’d taken up honest work as playwrights, the world would at least gain some new material.

These digital bandits didn’t stop at code. They moonlighted as job applicants, armed with counterfeit smiles and dubious CVs, worming their way into IT departments like a Chekhov character into a neighbor’s orchard. System access, supply chain meddling-a triumph, if your admiration leans toward the criminally inventive. 🤷♂️

What emerges is not a mere random outbreak, but a methodical, decades-long opera starring algorithms and unsuspecting humans, each unaware of being walked off the stage.

Meanwhile, August’s soap opera featured fresh attention to Real-World Asset (RWA) tokenization. Certik declared losses at $14.6 million, enough to buy several summer estates-or, more likely, pay for the headaches of bridging on-chain dreams with off-chain vulnerabilities. New weaknesses, too numerous to count, waiting for the next clever soul with too much free time and not enough principles.

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- DOGE PREDICTION. DOGE cryptocurrency

- Cronos Rises as Crypto Markets Crumble! 💸📉

2025-09-01 13:14