As traders stumble into 2026, the top crypto exchanges of 2025 continue to redefine what transparency, innovation, and security really mean-basically, what we’d all like our exes to be like: honest, secure, and always in the latest trend.

December 2025’s Top Crypto Exchanges – The Final Countdown of the Year’s Market Madness

The top crypto exchanges of December 2025 are wrapping up the year with all the fireworks they could muster. Trading volumes are still crazy high, liquidity’s finally making out with big pairs, and platforms are launching shiny new toys before the 2026 hype train leaves the station.

Inflows from the big guns-who still have money-are rising faster than my hair in winter. Thanks, clearer regulations across U.S., Europe, and Asia! Confidence is back, and investors are throwing their money at it, like throwing confetti at a parade. Platforms such as Binance, Coinbase, Bybit, and Bitget are leading the pack, offering liquidity deeper than my emotional baggage, security standards more transparent than my kitchen drawer, and tools that even your grandma could use (if she ever wanted to trade). 🧐💸

This guide spills the beans on fees, security, innovation, and global reach, giving traders a handy cheat sheet to pick the perfect playground as we say goodbye to 2025 and hello to whatever 2026 has in store.

The Top 15 Crypto Exchanges of December 2025 – The Geeky Performance Roundup

Here’s the quick and quirky rundown of the big leagues.

| Rank | Exchange | Notable Strengths |

|---|---|---|

| 1 | Binance | ~40% spot share; $698.3B July volume; BNB ATH $1,100+; Crypto-as-a-Service; 275M+ users-basically, the market’s coffee shop. |

| 2 | Bitget | $2.08T Q1 volume; Universal Exchange (UEX); 120M+ users; moved 440M BGB-basically the “everything-for-everyone” platform. |

| 3 | Coinbase | Crushed $2.9B Deribit deal; Mag7 Futures; 110M+ users; JPMorgan partner-up; Pilot project with $12K NY crypto aid-trying to buy our way out of a recession. |

| 4 | KuCoin | 41M+ users; Trust Project; MiCA license bid; AAA CER; KCS burns-making ‘tokenomics’ exciting again. |

| 5 | WhiteBIT | $2.7T yearly volume; ATH $52 WBT; Juventus collab; launching Portfolio Margin-because why not have margin with style? |

| 6 | Kraken | $411.6M Q2 revenue; Ink Layer-2 live; NinjaTrader deal; SEC lawsuit dismissed; aiming for $15B valuation-trust issues, sorted. |

| 7 | MEXC | 9.6% Q2 market share; $150B July volume; 580 listings; tokens up 35,000%-probably the best-kept secret next to your ex’s new fling. |

| 8 | LBank | 930+ tokens; ~3.1% spot share; $5B daily; memecoin EDGE platform; IPO whispers-if meme coins could talk, they’d say “LBank rocks.” |

| 9 | BitMart | 12M+ users; 120% spot growth; launched DEX; 2ms latency-fast enough to beat your ex’s apologies. |

| 10 | BTCC | $957B Q2 volume; 10M+ users; NBA star Jaren Jackson Jr.; reserves of 143%-because trusting old money’s more fun. |

| 11 | Bybit | Derivatives king; Restaking on Mantle; MNT & cmETH; ecosystem growing like my to-do list. |

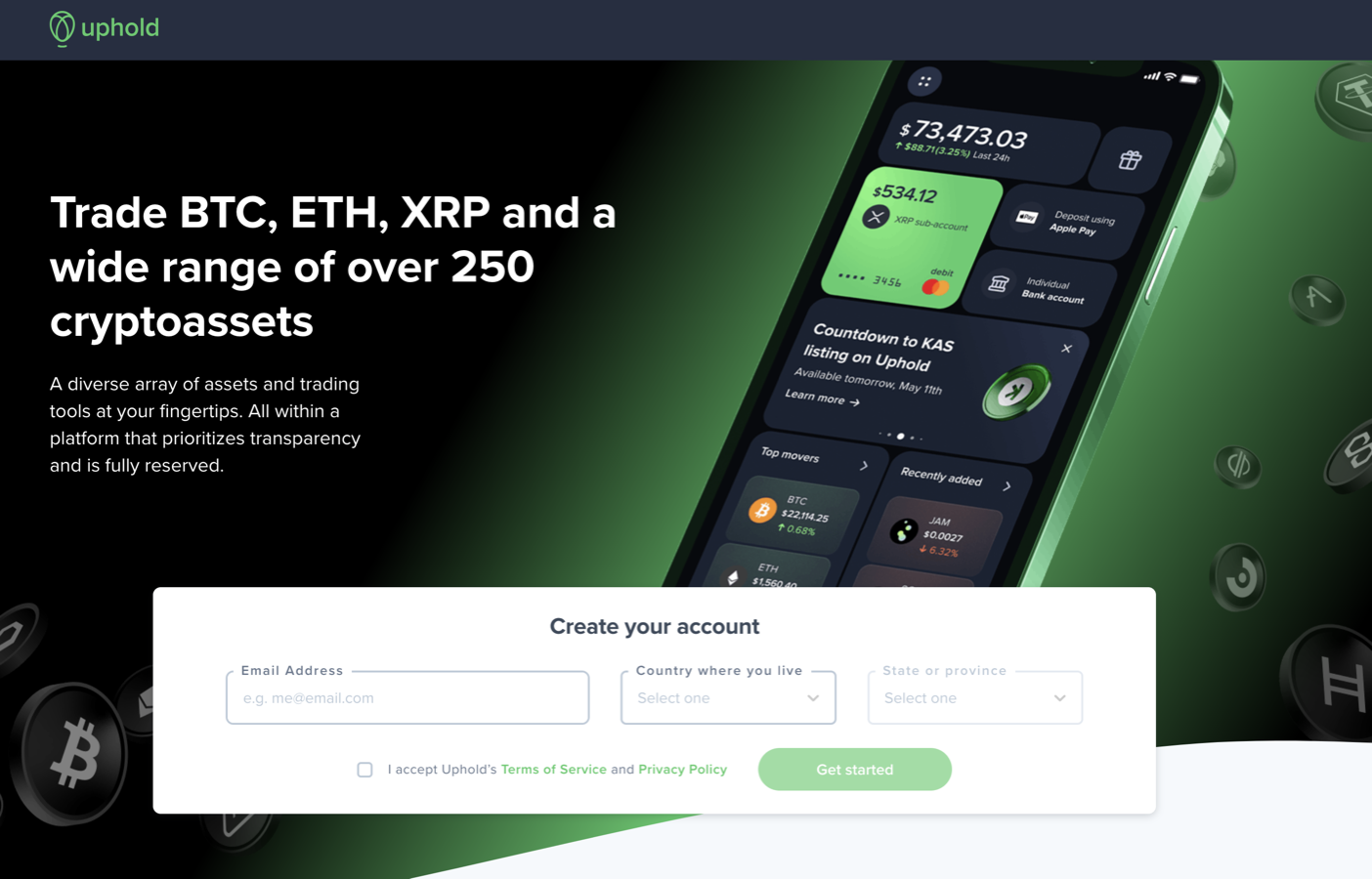

| 12 | Uphold | 10M+ users; 300+ assets; live reserves, every 30 sec; Vault for self-custody; 4.9% APY-because your money deserves a vacation too. |

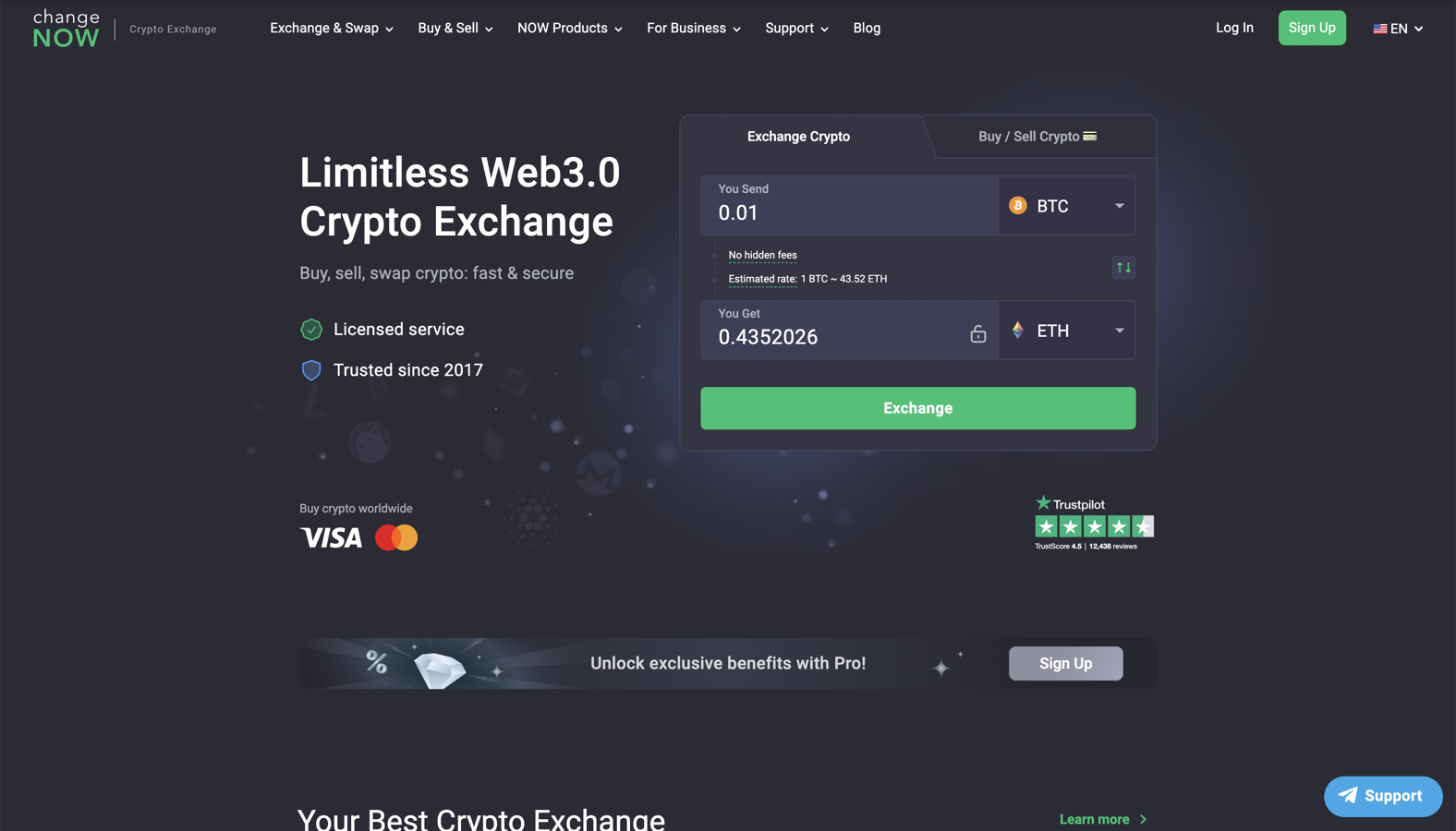

| 13 | ChangeNOW | Instant swaps; 1,400+ assets; non-custodial; B2B APIs-helping you swap like a ninja. |

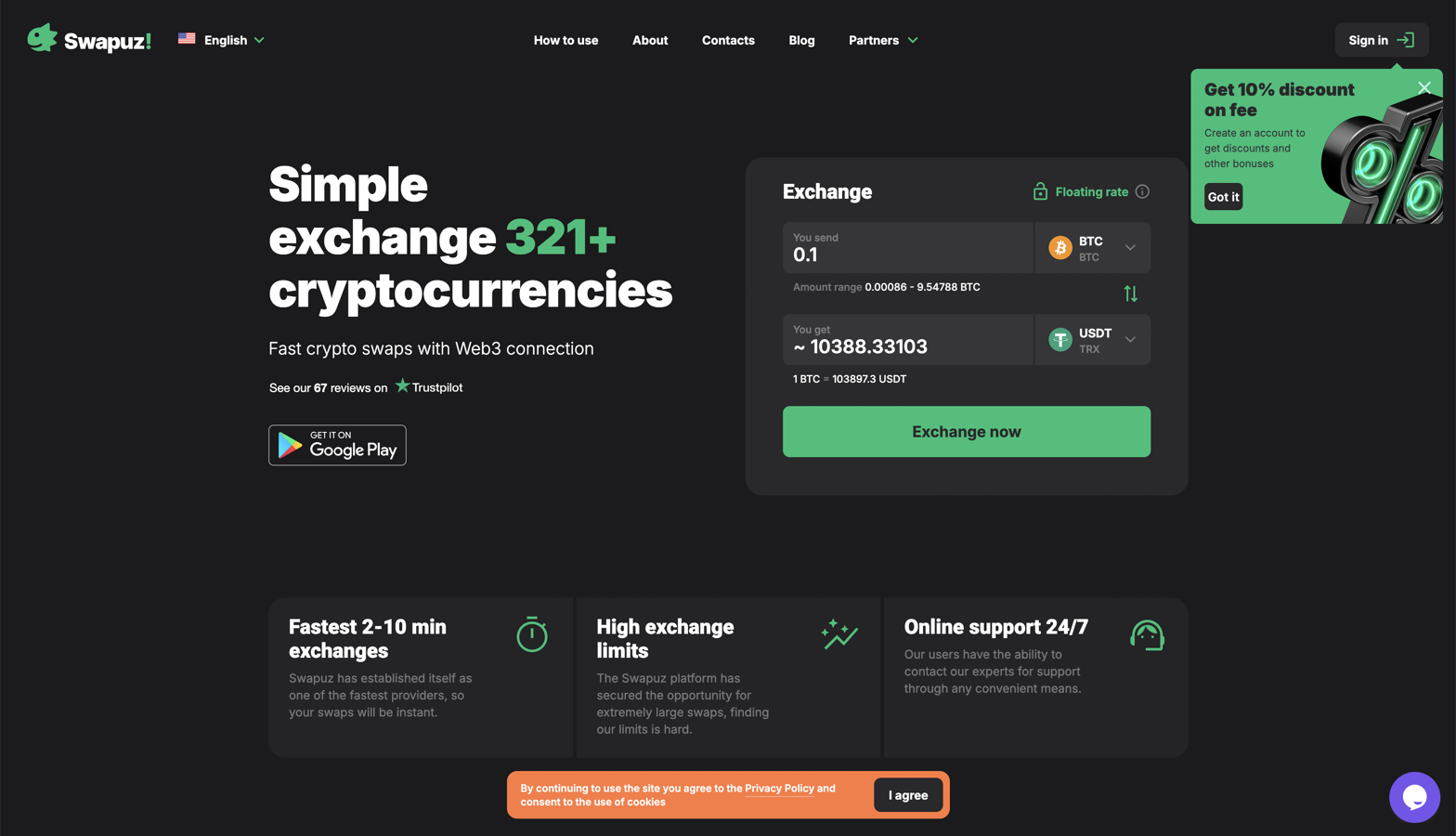

| 14 | Swapuz | 3,000+ assets; multi-channel; maintaining custody-because independence is everything. |

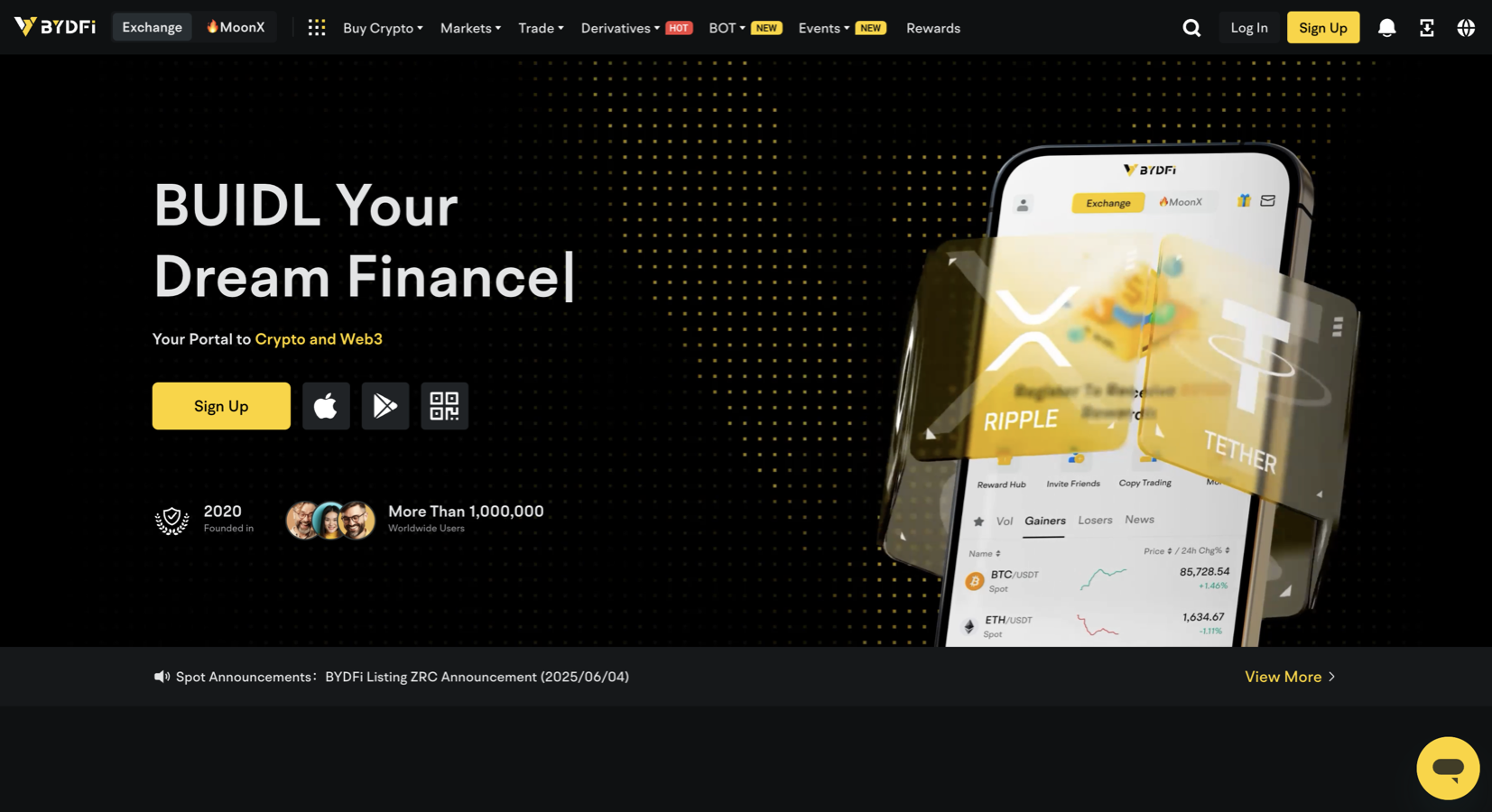

| 15 | BYDFi | Social trading; Dual-engine bling; branded partnerships; bringing hype to the masses-“BUIDL Your Dream.” |

Exchange-by-Exchange Breakdown – The Love & Loyalty

1. Binance – The Liquidity Legend & Institutional Darling

Binance still reigns supreme, holding nearly 40% of all spot trades. July saw $698.3B processed-basically, the exchange’s coffee cup is always overflowing. With over 275 million users, it’s the place where liquidity hangs out for parties in spot, futures, staking, and more. 🚀

The BNB coin hit new highs above $1,200-overcrowded, but still growing. Governments are asking Binance for advice like it’s the wise old owl of crypto. From Kazakhstan’s crypto fund to white-label services for banks, Binance is stacking strategies like Tetris blocks.

2. Bitget – The Copy-Trading & Universal Maestro

Q1 volume hit $2.08T-so much trading, even your portfolio’s face is melting. 120M+ users and a 159% quarterly jump. Its Universal Exchange unifies everything-stocks, forex, crypto, you name it-so traders don’t have to jump through hoops anymore.

Its BGB tokens went through a burn, like a diet plan but for crypto. Now acting as gas and governance tokens for the Morph chain, BGB’s utility just got the glow-up it needed.

3. Coinbase – The U.S. On-Ramp & Institutional Bridge

Crushing the US market, Coinbase acquired Deribit for $2.9B, turning it into the all-in-one wonder shop for crypto derivatives. They also launched hybrid products blending stocks and crypto-so now your “Duck and Cover” strategy might just work.

Its survey says 75% of big investors plan to pour more into crypto in 2025. Plus, JPMorgan and Coinbase are now practically best friends, making crypto payments as easy as pie.

4. KuCoin – The Listing Lab & Token Trust Accelerator

Serving 41 million users, KuCoin’s “Trust Project” aims to make everything secure-because trust isn’t just for your friend’s new puppy. Token burns happen every month to keep the economy healthy. They’re also working to get licensed in Europe and Thailand-because if you’re going to play with fire, do it legally.

Plus, tons of new tokens are dropping daily-like high-velocity fireworks-and AI bots that make more trades than a caffeinated squirrel.

5. WhiteBIT – For Institutions & Momentum in Tokens

Europe’s darling, WhiteBIT, launched Portfolio Margin-because hedge funds love a good margin. Their token, WBT, soared above $52, especially after partnering with Juventus-the only thing faster than their growth is Ronaldo’s goal record.

Hosting events at FC Barcelona Museum, they’re all about blending high society with high-tech, signaling they mean business-literally, $2.7 trillion traded this year.

6. Kraken – The Fortress of Trust & DeFi Explorer

This security champ launched Ink Layer-2 early in August-faster, cheaper, smarter trading. Its NinjaTrader acquisition expands horizons, and with a valuation aiming for $15B, Kraken’s future looks as solid as its security protocols. They even dodged an SEC lawsuit-talk about plot twists.

It’s evolving into a DeFi gateway, making traditional traders jealous with its layered approach that bridges old and new.

7. MEXC – The Altcoin Adventurer & Spike Specialist

From just 7.2% in Q2, MEXC shot up to 9.6% of the market-like a rocket fueled by meme coins. Listing 580 tokens, some hitting 35,920%, it’s the hype train you never saw coming. If you’re into early catches, this is your spot.

It’s also working on cross-chain links and ZK tech-basically, the crypto version of “fast, anonymous, and secure” from a spy movie.

8. LBank – Meme Marvel & Token Hunter

As of September, LBank commands roughly 3.1% of the market, processing nearly $5B daily-because meme coins aren’t just a phase, they’re a lifestyle. Listing hundreds of tokens daily, it’s the jet-fuel of altcoins, launching peeps like PEPE2025/USDT.

Rumors of a US IPO are swirling-probably to make even more meme magic happen.

9. BitMart – The Innovator’s Playground

With over 12M users and a new DEX, BitMart is the hybrid hero of 2025. Its tech is fast-faster than your Wi-Fi during a raid-with new assets and AI tools that make trading feel like an race car drive.

Launching new features and softening the futures game-bit by bit, it’s making itself indispensable.

10. BTCC – The Legacy Legend

Since 2011, BTCC has boldly stepped into the future with over 10M users and $957B processed. With Jaren Jackson Jr. dunking into their brand, and their reserve ratio of 143%, they’re the old-timers you trust-like that vintage leather jacket that never goes out of style.

Resurrecting their legacy, they’re aiming for a big return-trust, volume, and all that jazz.

11. Bybit – The Derivatives Dynamo & Layer-2 Wizardry

Bybit keeps winning with derivatives and now is experimenting with restaking-think of it as a crypto spa day for your assets. They teamed up with Mantle to make MNT-powered magic, with new trading pairs and perks that make your portfolio sing.

Even after past hiccups, Bybit’s back with a vengeance-more reliable than your grandma’s cookie jar.

12. Uphold – The Hybrid Hero & Self-Custody Star

Uphold’s all about multi-asset magic, serving over 10M users-with a “trade anything, anywhere” motto. Their vault offers self-custody deluxe; think of it as your crypto safe with a butler.

Interest accounts with up to 4.9% APY? Yes, please. Because your crypto deserves a bit of R&R, too.

13. ChangeNOW – Fast Swaps & The Invisible Engine

The ninja of non-custodial swaps-no accounts, no fuss, just fast, full control. Supporting 1,400+ assets, it’s the go-to for instant trading-perfect for that “I need this now” moment.

Making moves into B2B infrastructure, they’re building the backbone behind your favorite apps-without ever asking “who’s holding your money?”

14. Swapuz – Multi-Channel Non-Custodial Maestro

Supporting over 3,000 assets, Swapuz is like the Swiss Army knife of trading-speedy, secure, and full of features. It routes trades through the best pathways so you’re not left holding the bag (or losing money). It keeps assets in your control, which is the real crypto power move.

With cryptography, audits, and multi-sig wallets, it’s tougher to hack than your grandma’s secret cookie recipe.

15. BYDFi – Social Trading & the Blockchain Broadway

Blending social, automated, and dual engines, BYDFi is the cool kid that’s got both swagger and brains. Their MoonX platform helps you trade memes, trends, and maybe even your cat’s TikTok fame. Partnered with sports brands and launching a card-you might as well call it crypto’s All-Star team.

They’re making noise at events, from Dubai to Korea, all while pushing listings like a DJ spinning hits-fast and loud.

Crypto Trends of 2025: The Future Looks Juicier Than a Mango🤤

- Regulatory convergence: Like synchronized swimming, but with laws-making sure everyone’s playing fair without drowning.

- Institutional adoption: Big corporations diving into crypto, making it as normal as Starbucks on every corner.

- Derivatives dominance: Futures, options, and hybrid products-because who doesn’t love a little leverage?

- Exchange tokens: BNB, BGB, and WBT aren’t just symbols, they’re becoming the new black-spreading utility like glitter at a kids’ party.

- M&A activity: Big fish eating smaller fish, and a lot of new brains in the ecosystem-like evolution, but for crypto.

- Security & transparency: Reserves, self-custody, and safer swaps-basically, your crypto’s skin in the game.

Final Aha! Moments as 2025 Bows Out

Exchanges aren’t just places to buy and sell-they’re becoming the backbone of global crypto life. As December waves goodbye, the bull market’s got new tricks up its sleeve. Binance, Coinbase, Bybit, and friends are racing ahead, turning innovation into the new normal.

This year’s non-custodial champions like ChangeNOW and Swapuz remind us that privacy + speed + control = crypto’s winning combo. If you’re a newbie, check out how exchanges work-because understanding the game is key.

Heads up: The best exchanges of 2025 are shaping what your crypto future will look like in 2026. Choose wisely-it’s like dating, but for your digital assets.

FAQ: The 2025 Crypto Confessions

Lowest fees? Binance, Bitget, MEXC, and BitMart-they’re giving discounts like Oprah gives free cars. 🏎️

Trade without KYC? Sure-if you’re only trading tiny amounts, because big brother’s watching. But don’t worry, regulations tighten faster than your jeans after holiday feasts.

Safest exchange? Kraken and Coinbase-they’re the Fort Knox of crypto. But BNB and ChangeNOW are playing it smarter with transparency and non-custody tricks.

Best for beginners? BYDFi, Uphold, Coinbase-like training wheels, but for crypto.

Altcoins? MEXC, KuCoin, LBank-they’re like Willy Wonka’s chocolate factory-tons of options and surprises around every corner.

Futures? Bybit, Binance, and Bitget-derivatives so deep, you might drown happily.

Proof of Reserves? Critical-look for 143% from BTCC or 100%+ from Kraken and Uphold. Trust but verify, like grandma’s recipes.

Hidden fees? Watch out for withdrawal costs, funding rates, and sometimes just the ‘mysterious’ inactivity fees-because who doesn’t love surprises?

More Coffee, Less Confusion: Read On

- What is Bitcoin?

- What are Altcoins?

- What is a CEX?

- What is a DEX?

- How Crypto Exchanges Work

- Pick Your Wallet

- Download the Wallet

Stay Smarter, Stay Ahead!

- Bonus lists & giveaways

- Weekly hot picks & insider tips

- Crypto Casino Radar to catch the latest promos

- iGaming Alpha-the inside scoop on exclusive deals

Sign Up & Be the Crypto Boss

Business & Partnership Deets

Got ideas or collaborations? Shoot us an email at affiliates@bitcoin.com-we love talking shop with the future millionaires and the crypto curious alike!

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- XRP to Moon or Bust? 🤡 Chart Nerds & Wishful Thinking Collide 🚀

- Bankman-Fried\’s Wild Excuse

- Mantle (MNT): The Blockchain That Became a Titan with USD1 & Real-World Assets 🚀

- The Great AI Mirage: Stargate’s Shady Collapse & Power Struggles 🤖🔥

- 🤑 GAIN Token: Bull Trap or Divine Rebound? 🤑

- Trump Coin ETF: Canaries Singing on Wall Street? 🏦💸

2025-12-05 16:23