The week commenced with the crypto ETFs assuming a decorous air, led by a second day of inflows to bitcoin and a renewed favour in ether and XRP, as though society had finally decided to mend its manners.

Bitcoin Extends Inflows as Ether and XRP Turn Green

A calmer tone settled over the crypto exchanges as the week began, with capital cautiously returning to bitcoin and ether after recent volatility. It was not explosive. But it was constructive, one might say, with wit rather than thunder guiding the proceedings.

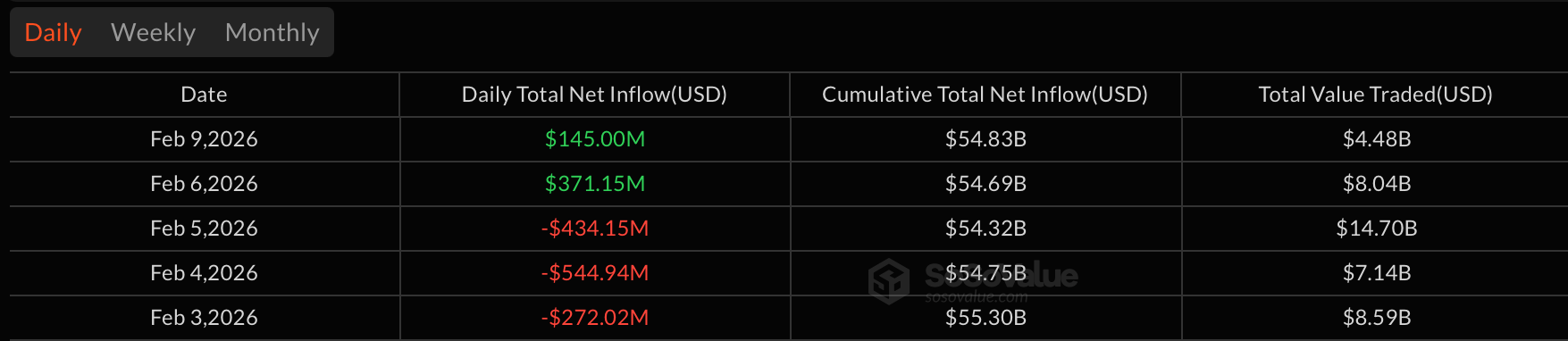

Bitcoin spot ETFs recorded $145 million in net inflows, extending their rebound to a second straight session. Grayscale’s Bitcoin Mini Trust led the charge with a commanding $130.54 million entry, signalling renewed institutional appetite-perhaps a gentleman’s agreement among fiscal magnates to favour prudence over frenzy.

ARK & 21Shares’ ARKB added $14.09 million, while Vaneck’s HODL contributed $12 million. Smaller inflows of $6.14 million into Franklin’s EZBC and $3.08 million into Fidelity’s FBTC rounded out the gains. A $20.85 million exit from Blackrock’s IBIT briefly weighed on sentiment but failed to derail the broader green close. Trading activity reached $4.47 billion, pushing total net assets up to $90.05 billion.

Ether spot ETFs also turned positive, posting a $57.05 million net inflow despite notable internal divergence. Fidelity’s FETH led all ether funds with a strong $67.32 million inflow, followed by $44.62 million into Grayscale’s Ether Mini Trust. These gains absorbed outflows of $44.99 million from Blackrock’s ETHA and $9.90 million from Bitwise’s ETHW. Total value traded came in at $1.19 billion, lifting ether ETF assets to $12.42 billion.

XRP spot ETFs quietly extended their resilience with $6.31 million in inflows. Franklin’s XRPZ attracted $3.15 million, Canary’s XRPC added $2.31 million, and Grayscale’s GXRP chipped in $846,190. Trading volume remained muted at $15.89 million, while net assets held steady at $1.04 billion.

Solana spot ETFs saw little movement, with minimal trading activity and net assets unchanged at $733.18 million, reflecting a pause in directional conviction.

Overall, Monday’s flows painted a scene of cautious re-entry rather than bold venture. Bitcoin continues to steady its ground, ether finds selective support, XRP remains quietly constructive, and solana awaits its next catalyst, perhaps with a smirk from the market-tongue in cheek.

FAQ📊

- Why did bitcoin ETFs see inflows again?

Investors appear to be selectively rebuilding exposure after last week’s heavy volatility and drawdowns, as if choosing to mend fences before dusk. - Which bitcoin ETF saw the largest inflow?

Grayscale’s Bitcoin Mini Trust led the day with over $130 million in new capital. - Why were ether ETFs green despite large outflows?

Strong inflows into Fidelity’s FETH and Grayscale’s Mini Trust outweighed selling in ETHA and ETHW, proving that virtue can outwait volatility. - Why was solana ETF activity muted?

Traders largely stayed on the sidelines, signalling uncertainty rather than outright bearishness, a very English sort of suspense.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- Gold-Backed Crypto Coins Land on Polygon – But Why? 🤔💰

- 🤑 XRP’s Billion-Dollar Love Affair: Evernorth’s Wild Ride to Crypto Glory 🌪️

- Crypto Chaos: Market Meltdown, Trade Twists & Central Bank Confusion

- UBS Tokenizes Funds: ETH’s Next Big Thing? 🤔🚀

- Strategy’s Secret Bitcoin Vault: The Hidden Truths & Why They Won’t Play Fair

- Cardano QE6? The Big “Maybe” Prediction That’s Keeping Everyone Guessing! 😲

- 🤑 Rich Dad, Poorer BTC: Kiyosaki Dumps Crypto for Scalpel & Billboards! 🏥🚀

2026-02-10 14:57