Crypto ETFs kicked off the week like a bad borscht in a deli gone sour, with bitcoin funds hemorrhaging a paltry $40 million exodus, while ether’s hooligans yanked out a whopping $146 million in a fit of chilly feet-talk about sellin’ ice cream to Eskimos on the moon! 🚀❄️

Ether’s Epic $146 Million Tumble While Bitcoin’s ETFs Sneak a $40 Million Skedaddle

What promised to be a hallelujah of inflows for them fancy bitcoin exchange-traded funds on Monday, Oct. 20-think champagne and caviar-turned into a katzenjammer dirge by the buzzer, as bigwig investors cashed in their chips faster than a gambler at a rigged roulette! Sarcasm alert: Who knew profits could evaporate like my patience at a family dinner? 🎭🍾

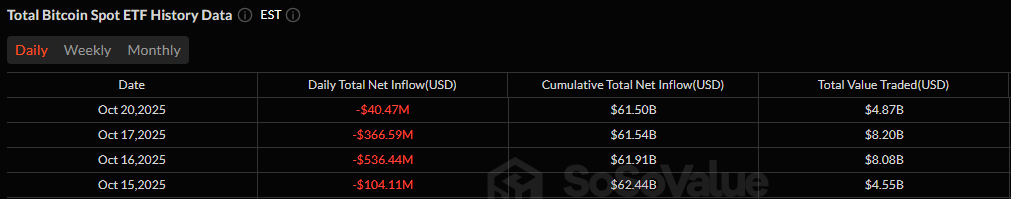

Bitcoin ETFs beelined for the exits with a combined outflow of $40.47 million, poof! Gone were the early hoorahs: Vaneck’s HODL hogged $21.16 million like a starved vulture, Bitwise’s BITB gobbled $12.05 million, Invesco’s BTCO nabbed $9.94 million, Fidelity’s FBTC scooped $9.67 million, and Grayscale’s Bitcoin Mini Trust squeezed out $7.36 million. Total inflows? Nearly $60 million-cue the drama! But then, kapow! A Godzilla-sized $100.65 million exit from Blackrock’s IBIT turned this Broadway hit into a B-movie flop. Trading was buzzing at $4.87 billion, yet net assets limped home at $149.66 billion, giggling nervously. 🤡📉

Ether ETFs? Pfft, no such luck-they belly-flopped into the red abyss with $145.68 million in redemptions, all courtesy of the heavyweight champs. Blackrock’s ETHA unleashed a monster $117.86 million exit, while Fidelity’s FETH coughed up $27.82 million-talk about gas! Trading volume clocked $2.15 billion, net assets trickled to $26.83 billion. Sarcasm: Because who doesn’t love a thrill ride on a sinking ship? 🚢🌊

This crimson Monday just prolonged the sissy tantrum from last week’s end. Still, with markets twiddling thumbs for the next big bang and these ETFs moodier than a Shakespeare tragedy, the coming days might birth either a sly pause or a full-blown Armageddon correction-stay tuned for the sequel, folks! 🎬💥

FAQ: Straight Talk with a Wink 😜

-

How did bitcoin ETFs perform to kick off the week? 🤔

Bitcoin ETFs tanked $40 million in net outflows after their fake-it-’til-you-make-it gains flopped, spearheaded by a $100 million walkout from Blackrock’s IBIT-et tu, Brutus? 🗡️ -

What kerfuffle befell ether ETFs on Oct. 20? 🌀

Ether ETFs got walloped with $146 million in faceplants, all blame on Blackrock’s ETHA and Fidelity’s FETH hogging the losses-drama queens of the crypto stage! 🎭 -

How much hubbub did crypto ETFs stir up in trading? 📈

Combined volume smashed nearly $7 billion across bitcoin and ether funds-keepin’ up appearances even as the Titanic texts, “Send snacks!” 💬🍟 -

What gibberish does this spell for market vibes? 🌫️

This wild U-turn screams icy caution slappin’ back to crypto ETFs as investors binge-watch for the next macro miracle or flop-because in investing, betting on the weather is safer! ☔🤑

Read More

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- 🤑 Crypto Scams & AI: Steinbeck’s Guide to Not Getting Rug-Pulled 🤑

- Of Course a Digital Token I Don’t Own Is Suddenly the Belle of the Ball

- Is XRP Being Silenced by Big Banks? The Shocking Truth Revealed!

- Bitcoin’s $100K Break: A Spiritual Crisis? 😱🧠💸

- Bitcoin’s Wild Surge: 3 Reasons Behind the $91K Miracle! 🚀

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- Mantle (MNT): The Blockchain That Became a Titan with USD1 & Real-World Assets 🚀

- NFTs Are Back! The Comeback You Didn’t See Coming 😂📈

- Blockheads at UGM: Beans & Blockchain Edition 🌾

2025-10-21 20:48