Behold, the crimson tide of CRO surges forth, a tempest of 50% in a single day! What alchemy has transformed the market’s mire into a golden field? Trump Media Group, that most enigmatic of entities, whispers of its acquisition, and the masses, ever eager to believe, dance in the glow of their own delusions. 🎩💸

Yet, as the sun blazes too brightly, so too does the market’s fever. The on-chain whispers of a soul already weary, a market teetering on the precipice of its own excess, where the specter of a pullback looms like a shadow over the revelry. ⚠️

The Ascent of CRO: A Billion-Dollar Mirage

CRO has surged nearly 50% in the past 24 hours, with much of the rally tied to reports linking Trump Media to a large-scale CRO acquisition. Ah, the folly of human ambition! A mere 19% of market cap, yet the crowd clamors for a feast of 6.42 billion. 🧠

BeInCrypto, that chronicler of chaos, reported the initial fever, but now the truth emerges: a modest $200 million and a token position that dares to dream. How the mighty have fallen, or perhaps, how the illusions have been tempered. 🧠

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. 📧

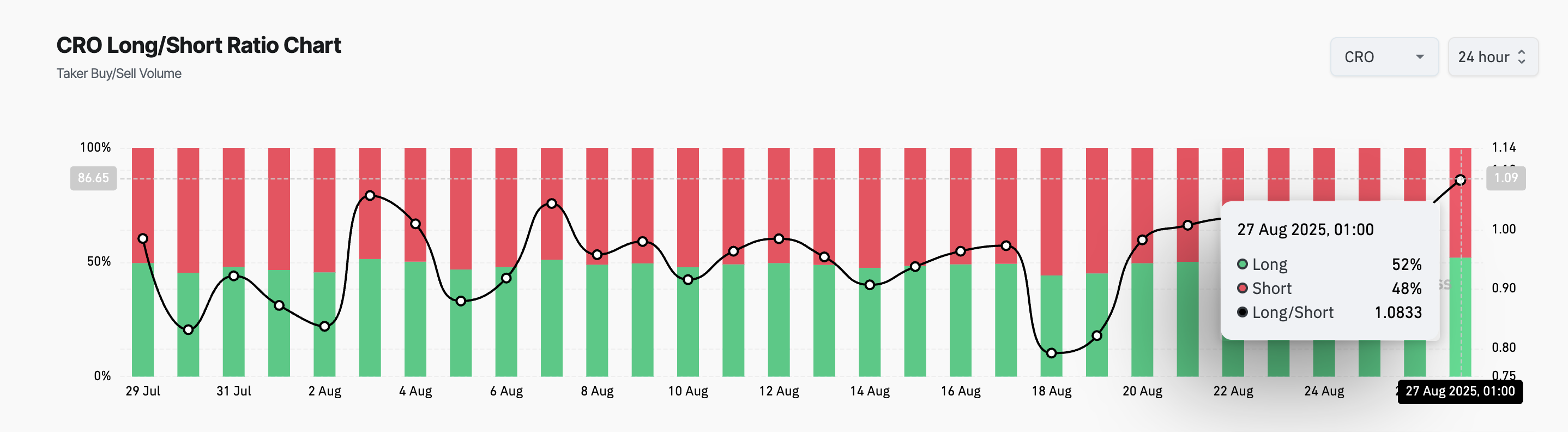

The long/short ratio measures the balance between traders betting on price increases versus those anticipating declines. A reading above 1 indicates that more traders are taking long positions, signaling strong bullish conviction, while values below one indicate a high demand for shorts. Yet, what is conviction but a mask for desperation? 🕊️

While CRO’s long/short ratio suggests confidence in its upward momentum, it also exposes the market to greater liquidation risks. If its price faces a reversal, the heavy concentration of longs could trigger many forced sell-offs, worsening market volatility. A tragedy of hubris, where the crowd’s cheers turn to howls. 😂

CRO Enters Overbought Zone

Readings from CRO’s Relative Strength Index (RSI) on the daily chart show that the altcoin has entered overbought territory, a classic indicator that it may be due for a dip. At press time, this indicator stands at 80.77. What folly, what madness, to believe that the market is anything but a reflection of our own souls, ever seeking redemption in the chaos. 🧠💥

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound. Yet, the market, like a soul in torment, awaits its reckoning. 🕊️

On the other hand, if buyers continue accumulating CRO, it could reclaim $0.23 and rally to $0.27, a high last seen in May 2022. A fleeting triumph, a mirage that vanishes with the dawn. 🌅

Read More

- You Won’t Believe How Kite Just Raised $18M To Make The Web Smarter (And Maybe Richer)

- Gold Rate Forecast

- Brent Oil Forecast

- Silver Rate Forecast

- 🕵️♂️ SEAL Unveils Phishing Buster: Scammers Tremble! 🤑

- Cronos Rises as Crypto Markets Crumble! 💸📉

- USD CNY PREDICTION

- ATOM PREDICTION. ATOM cryptocurrency

- Who Knew? Shiba Inu Falls, XRP Meets Bitcoin in Death Cross, DOGE Soars🔥

- Bitcoin Market Pain: Short-Term Holders Face Heavy Losses As Realized Profit/Loss Ratio Turns Negative

2025-08-27 13:22