What You Must Know:

- With only Coinbase strutting its stuff in the crypto Super Bowl, it seems retail enthusiasm is packing its bags, while infrastructure development has rolled out the welcome mat.

- Capital has gracefully pirouetted away from flashy marketing budgets and into the realm of technical solutions that promise to mend the liquidity fragmentation and cross-chain woes.

- Behold LiquidChain, a Layer 3 marvel that unites Bitcoin, Ethereum, and Solana in a harmonious dance, solving that pesky siloed liquidity dilemma that has been a thorn in DeFi’s side.

- The “Deploy-Once” architecture is the golden key for developers, aiming to cut the technical overgrowth tangled around multi-chain applications.

Ah, the once-glorious era of the ‘Crypto Bowl’ lies in the grave. Instead, a profound silence blankets the event. Just a few fleeting years ago, the Super Bowl was akin to a carnival of QR codes bouncing haphazardly across screens while celebrities boldly proclaimed that ‘fortune favors the brave.’ This year, however, one could hear a pin drop amidst the crickets chirping.

Only Coinbase dared to grace the airwaves with its presence, marking a monumental shift in how our dear industry views public attention.

This retreat from the world’s most exorbitant advertising stage isn’t merely about budget cuts; nay, it represents a seismic change in market sentiment. The absence of former titans like FTX and Crypto.com depicts a hard-won journey into maturity, not unlike a teenager finally learning to clean their room.

The industry has pivoted from pouring gold coins down the well of hype to investing in the solid foundation of infrastructure. That lavish marketing spree of yesteryear? A thing of the past! We now find ourselves in a leaner landscape focused on survival, regulation, and-gasp-actual utility.

While the mainstream media might interpret this dearth of ads as a ‘retreat,’ the wise folks on-chain whisper that it’s merely a clever reallocation of resources. Capital no longer gushes into 30-second spots, but flows toward Layer 2 and Layer 3 solutions engineered to fix DeFi’s plumbing woes.

The market is telling us that the next wave of adoption shall not ride in on the coattails of celebrity endorsements; rather, it will emerge from the seamless interoperability of systems. This quest for genuine utility is luring sophisticated capital towards infrastructure gems like LiquidChain ($LIQUID), which seeks to untangle the messy web currently ensnaring user experience.

Discover more about $LIQUID here.

From Whimsical 30-Second Ads to Limitless Scalability

Narrowing crypto advertising down to a solitary Coinbase commercial may be a lagging indicator of the bear market that gripped 2022-2023, yet it serves as a harbinger for the dawning ‘utility cycle.’ Institutional players and developers no longer squabble over which exchange boasts the most charming mascot.

The friction points in our current ecosystem-the headache of moving assets between Bitcoin, Ethereum, and Solana-have become the primary bottleneck, much like a traffic jam during rush hour.

LiquidChain ($LIQUID) has arisen from this vacuum of hype as a technical solution to the liquidity fragmentation conundrum. By positioning itself as Layer 3 (L3) infrastructure, it aims to meld the liquidity of the triad of giants into a single execution environment, akin to a well-rehearsed ballet.

And why, you ask, is this important? Because current cross-chain solutions often rely on wrapped assets, which are about as secure as a paper umbrella in a monsoon. LiquidChain’s ‘Unified Liquidity Layer’ allows for single-step execution, banishing the convoluted user flows that typically scare off institutional adoption faster than a cat fleeing from a cucumber.

The market’s gaze has shifted. It’s no longer about ‘onboarding the next billion users’ through glittery commercials; it’s about ‘building the rails’ capable of supporting that very influx. A Deploy-Once Architecture, where developers craft code that accesses users across $BTC, $ETH, and $SOL simultaneously, embodies the deep-tech value proposition that flourishes when the marketing clamor fades away.

Learn more about $LIQUID here.

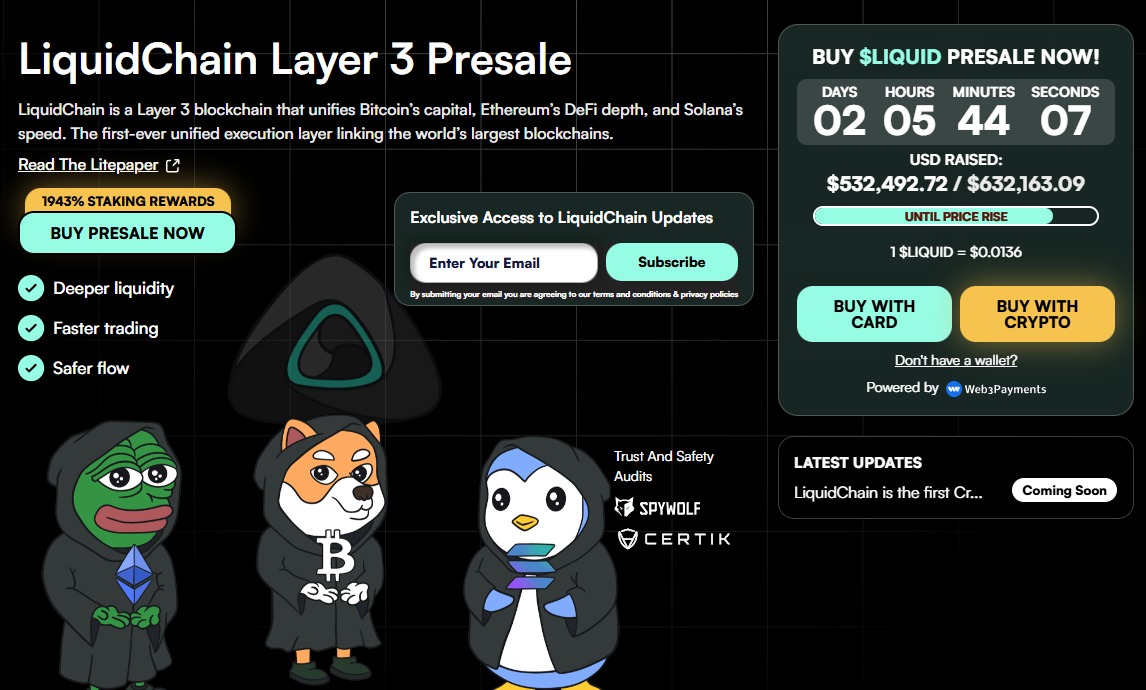

Smart Money Pursues Infrastructure as Presale Surpasses $532k

While television screens languished in a void of crypto logos, the presale market for infrastructure projects remains as vibrant as a jester at a royal court.

LiquidChain ($LIQUID) has amassed over $532K to date, with tokens currently priced at a mere $0.0136. This capital inflow, occurring amid a period of relative mainstream silence, suggests that investors are keenly targeting ‘pick-and-shovel’ plays instead of whimsical meme assets.

The project’s traction springs from its commitment to resolving the ‘Liquidity Trilemma.’ Currently, liquidity finds itself trapped: Bitcoin hoards the store of value, Ethereum commands the smart contracts, and Solana races ahead with high-frequency trading speed. LiquidChain proposes a Cross-Chain VM that crafts a verified settlement layer across this triumvirate.

For a developer, this means creating a dApp once and instantly tapping into the liquidity depths of Bitcoin and the user base of Solana without juggling three separate codebases-a task as enjoyable as herding cats!

In a marketplace where ad spending has plummeted by 90%, capital is undoubtedly casting its vote for efficiency. Presale metrics reveal an appetite for L3 solutions capable of untangling the complexities of blockchain interaction. If the Super Bowl silence imparted any lesson, it’s that the industry is done shouting. It’s too busy building.

Buy $LIQUID here.

Read More

- When Bitcoin Mining Gets Tougher Than Your Math Teacher’s Homework 🤯

- PENGU’s Waddling Surge: Pudgy Penguins Hit $2B? 😂

- 🤑 Rich Dad, Poorer BTC: Kiyosaki Dumps Crypto for Scalpel & Billboards! 🏥🚀

- Bitcoin Breaks Trendline? 94% Rate Cut Odds! 🚀

- XRP: A Most Disappointing Turn of Events! 📉

- Shiba Inu’s SHIB: To Break or Not to Break? 🎭

- Binance Sees Massive Dogecoin Whale Stir After 2 Years of Silence – Here’s What Happened!

- When Wall Street Meets Bitcoin: A Tale of ETFs and Network Woes 😂

- Dogecoin’s Rise: A Thrilling Dance Between Support and Resistance!

- XRP’s 1000% Surge: Will It Break the $2.28 Barrier? 🚀

2026-02-09 15:24